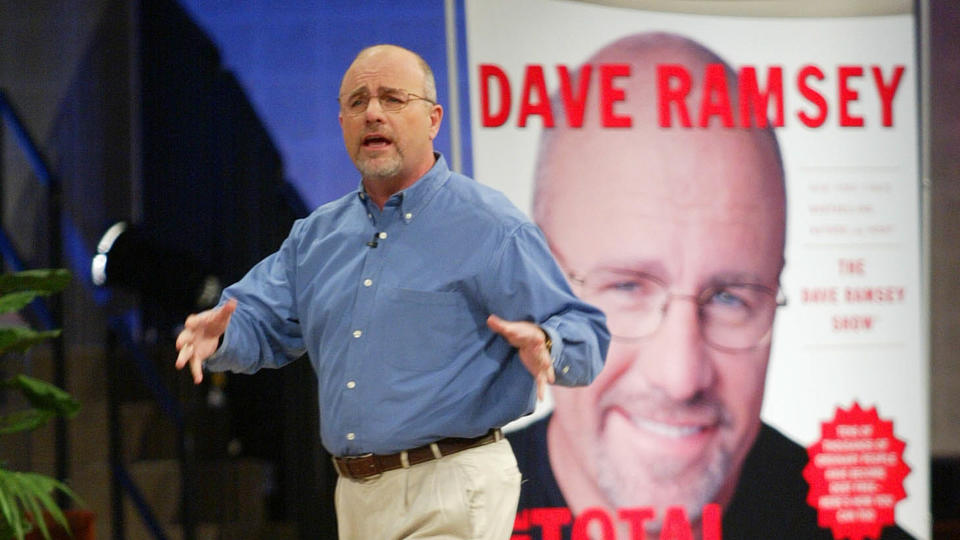

Dave Ramsey has long gone from riches to rags and back again once again, and as a result of it all he’s formulated a approach of utilizing typical feeling to control revenue responsibly. He’s shared these measures to money well being through books like his bestselling “The Total Income Makeover” and on his nationally syndicated radio system, “The Dave Ramsey Present.” Ramsey has aided millions of folks get back command in excess of their cash and make higher economical achievements and peace.

See: Superstars Who Are Even Richer Than You Feel

Investing: 3 Issues You Ought to Do When Your Financial savings Arrive at $50,000

Just one of Ramsey’s best recommendations to the GOBankingRates viewers is: “Tell your income what to do instead of wanting to know wherever it went. Men and women know what they need to do with their revenue, but they just really do not do it. Be proactive with your cash — do a spending budget, get rid of debt and help save.”

This tips echoes a lot of what Dave Ramsey has taught during the yrs. These highlights of Ramsey’s most effective dollars tips are a excellent way to get you enthusiastic to boost your personal funds this month and as a result of 2023.

1. Make a Revenue System

“The trick in most people’s life is that they don’t even recognize wherever they want to go,” Ramsey claimed on his web page. “They really do not even know if they’re getting there. Down South, we simply call that ditty-bopping along — ditty-bopping by life.” Acquiring by way of existence without having a care in the earth and anticipating others to care for you is no excellent feat. He extra:

“That’s referred to as being a kid. Grown ups devise a approach and abide by it. Little ones do what feels fantastic.”

Getting proactive with your dollars takes operate, but it’s what you must be expecting out of you. Start by generating a economical approach. Figure out what you want for your finances and make the improvements that will get you and your dollars on the ideal track.

Take Our Poll: Are You Organizing To Get or Provide a Home This Year?

2. Come across the Braveness To Adjust

At the time you outline what you want and have an strategy of how to get there, it is time to start off generating changes. But alter can be agonizing, claimed Ramsey, and that suffering deters a lot of men and women from at any time tackling their finances ahead of points get out of control. For most people today, he claimed:

“Not until eventually the discomfort of the very same is bigger than the pain of alter will you embrace modify.”

You have to start undertaking in another way if you want a various end result, Ramsey claimed. “Twelve-steppers say if you continue on to do the similar thing above and over all over again and anticipate a unique consequence, that’s the definition of madness. You have to modify the path.”

3. Regulate Your Dollars

After you have a plan, you can place it into motion. As you get regulate of your income, you are going to make certain it is going exactly where it desires to. On this, Ramsey mentioned:

“You ought to achieve manage more than your cash or the lack of it will endlessly command you.”

He prompt a couple of resources that can make running your dollars less difficult, like the dollars-envelope budgeting system and his funds-tracking software EveryDollar. Try some new cash management methods and uncover one thing that functions for you.

4. Give Each and every Dollar a Identify

A huge part of correctly handling dollars is, as Ramsey put it, providing each individual dollar a name. When you build a price range, “Every dollar has an assignment,” whether it is feeding or housing your family members, spending off personal debt or guarding you from life’s unknowns.

“You’re producing each individual dollar behave. Giving each and every dollar a name right before the thirty day period starts.”

5. Act Your Wage

An vital part of sticking to a spending plan is holding your way of living in check out, or as Ramsey place it on Twitter:

“Key to winning with money. Live on significantly less than you make! Act your wage. Stop paying like you are in Congress.”

In a customer-pushed modern society, it can be as well tempting to search at what all people has and consider you ought to be shelling out more so you can have it much too — even if you just cannot actually pay for it. “‘Stuff’ is fine,” Ramsey mentioned. “Get some, but if the finding of ‘stuff’ is your total objective you will never ever be seriously happy.” Instead of hoping to catch up to your expending, maintain your paying out inside of your profits and only invest in what you can manage.

6. Frugal Currently, Wealthy Tomorrow

“We’ve dropped our minds in this tradition, we truly have,” Ramsey said on his radio demonstrate. “And all of it is simply because men and women have been bought stuff, and offered things and marketed things, and they’ve got this entitlement thing” that can make them invest on items they simply cannot find the money for. Ramsey teaches his followers to resist the urge to devote. Creating frugal options is what will develop genuine prosperity that lasts:

“If you will live like no a single else, later you can dwell and give like no a single else.”

7. Perform Challenging To Get Absolutely free of Credit card debt

There’s a myth that only the loaded are debt-free of charge, mentioned Ramsey. But the reality is:

“Anyone can grow to be personal debt-free of charge. True financial debt reduction is simple typical feeling and tricky perform.”

Debt has develop into a provided for a lot of Individuals, but it can trigger some of the worst economical tension. “We all make blunders, but the question is irrespective of whether you are inclined to take responsibility for your faults,” he additional.

To get out of debt, Ramsey prompt his “debt snowball” system: Make only the least payments on all money owed, then put more revenue toward the credit card debt with the smallest balance. “When you shell out off that smallest debt, it offers you a results, and you feel you can make it,” Ramsey stated. “Then, when you spend off the subsequent personal debt, you recognize this is heading to do the job, and you fork out off the upcoming debt.”

8. Do not Borrow or Cost

Ramsey advised that you halt borrowing income or charging buys to a credit score card. It would make it too effortless to overspend further than what you can find the money for. He even routinely suggests actions like chopping up credit history cards. On living beyond your suggests, he stated:

“When people today attempt to borrow their way into a place in lifetime or an possession of things in lifestyle that they really just can’t pay for, then they struggle the rest of their lives paying payments on things.”

Dave Ramsey’s evaluate for whether or not you can pay for something is easy: If you can say, “‘I wrote a check and paid out for it,” then you can afford it. “That’s the definition,” Ramsey claimed. “If you just can’t spend for it in cash, in full, on the spot, funds on the barrel head, you just can’t afford it — whatever it is, your auto, your apparel, your groceries.”

9. Save For the Unanticipated

When you do not have cash in the lender, you’re uncovered to the worst of economical mishaps and hardships. Even slight bills can turn out to be big setbacks and guide to problems like financial debt:

“Ever observe when you are broke every thing is an crisis?”

The way to deal with these hazards is to build stability with an emergency fund. Ramsey recommended preserving an unexpected emergency fund in two distinctive phases of his 7 Toddler Ways. First is to get a buffer saved of $1,000, which can assist protect the each day unanticipated bills that occur with everyday living. Later on (following having to pay off credit card debt), Ramsey recommends saving an emergency fund that’s equivalent to a number of months’ really worth of expenditures to enable go over much more major emergencies like a work reduction.

“Weirdest point took place when I acquired an emergency fund of a few to six months of expenditures: I quit getting as quite a few emergencies,” Ramsey mentioned on Twitter.

10. Make investments In the Long run

Investing is an essential aspect of a effective revenue program, and it’s an crucial component to fiscal safety. Ramsey prompt working with fiscal principles like budgeting and debt payoff right before investing, but all that is so you can create wealth with out something keeping you again. Investing is how you can use your dollars to generate additional prosperity and prosperity, and plan for the future:

“When you are investing, you are residing your life extra in the foreseeable future and in the present.”

Ramsey presents some useful techniques for all those setting up to devote. Initially, you want to get started contributing to a pre-tax savings system and a tax-cost-free discounts approach. He also recommended placing some investments in “mutual cash that have a successful keep track of history.” Ramsey explained using the services of a financial advisor can also support you completely comprehend your options, but make positive you’re nonetheless using responsibility of your decisions. “Don’t spend in something except you can conveniently reveal how the investment decision will work to another person else,” he explained.

A lot more From GOBankingRates

This write-up at first appeared on GOBankingRates.com: 10 Very best Funds Guidelines of All Time From Dave Ramsey