1 February 2022

- Credit rating requirements tightened somewhat for corporations and remained unchanged for housing loans

- Banking institutions go on to hold all round benign see of company credit history threats, owing generally to good evaluation of financial outlook

- Strong boost in loan demand from customers by companies, driven by higher performing capital needs stemming from source bottlenecks, as properly as by financing for for a longer period-phrase expense

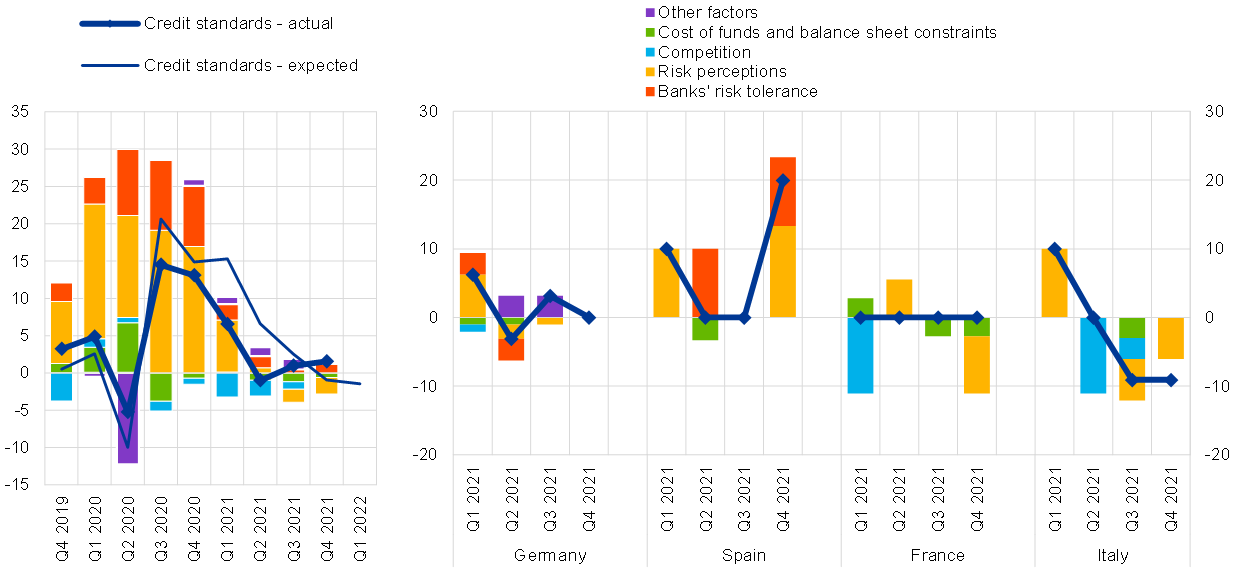

In accordance to the January 2022 euro area bank lending study (BLS), credit score specifications – i.e. banks’ internal suggestions or bank loan acceptance conditions – for financial loans or credit score lines to enterprises tightened extremely a little bit (internet proportion of banking companies standing at 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, see Chart 1) in the fourth quarter of 2021. Concerning loans to homes for dwelling order, euro area banking companies described unchanged credit history standards (web proportion of {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}), whilst credit benchmarks for purchaser credit score and other lending to households eased moderately (web percentage of -4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}). Banking companies had a typically benign watch of firms’ and households’ credit hazards primarily based on an overall optimistic assessment of the financial outlook, regardless of the recent pandemic situation and the dampening effects of offer bottlenecks. In the initial quarter of 2022, financial institutions assume credit history requirements to continue to be broadly unchanged for loans to firms, to tighten moderately for housing financial loans and to simplicity additional for client credit history.

Banks’ total conditions and circumstances – i.e. the true terms and situations agreed in bank loan contracts –were broadly unchanged for loans to corporations and loans to homes in the fourth quarter of 2021. For margins on normal loans, banks ongoing to report a narrowing in internet conditions for loans to firms and loans to households for dwelling invest in, whilst margins on riskier loans widened for these personal loan types. For client credit score and other lending to homes, both of those margins on ordinary and riskier financial loans remained broadly unchanged.

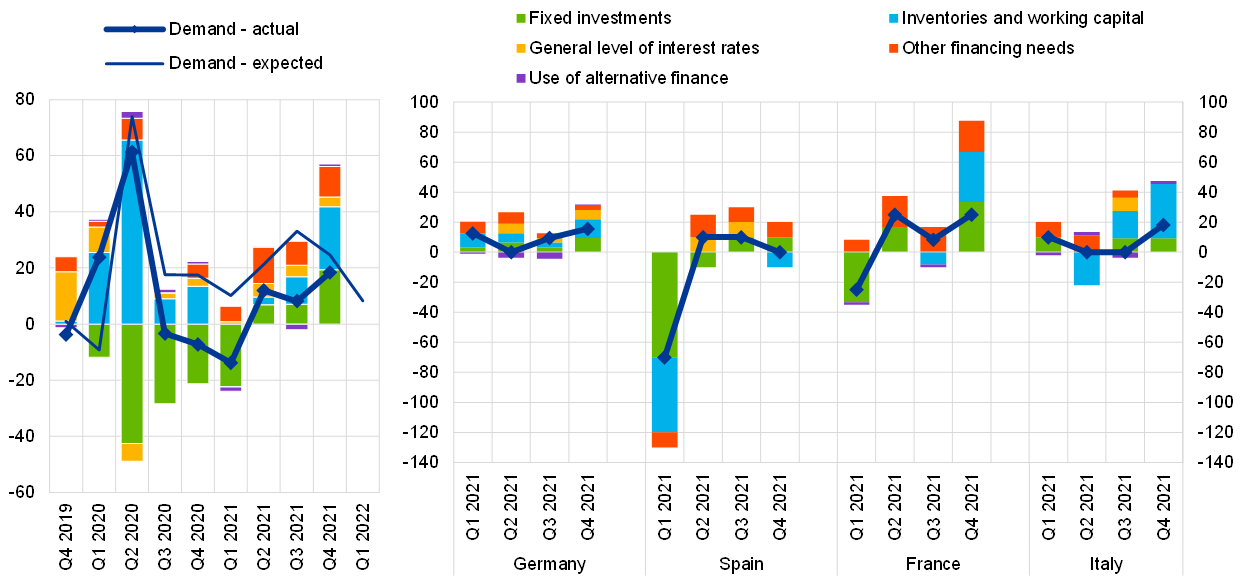

Banking companies described, on equilibrium, a significant boost in firms’ demand for financial loans or drawing of credit lines in the fourth quarter of 2021 (see Chart 2), pushed by a stronger favourable contribution of firms’

funding demands for both of those functioning money and set investment in contrast with the previous quarter. In addition, banking institutions continued to report a positive impact on bank loan demand from other funding wants, which contain M&A exercise and credit card debt refinancing and restructuring. Demand from customers for housing loans and for purchaser credit rating and other lending to homes greater in web phrases in the fourth quarter of 2021. Client self-confidence and the very low common degree of curiosity costs continued to help the need for financial loans to homes across bank loan categories. In addition, housing industry prospective customers experienced a optimistic influence on the desire for housing financial loans, whilst expending on durables experienced a smaller damaging influence on client credit score. In the to start with quarter of 2022, financial institutions anticipate net desire to keep on to enhance for loans to firms and homes.

In accordance to the banking institutions surveyed, access to retail funding continued to boost in the fourth quarter of 2021. In addition, banking companies described that supervisory and regulatory steps had a beneficial effect on their capital place in 2021. At the similar time, euro area banks’ non-carrying out bank loan (NPL) ratios experienced a smaller net tightening impact on credit score criteria for loans to enterprises and for client credit, whilst the impact continued to be neutral on credit score requirements for financial loans to households for house acquire in the next half of 2021. Throughout the principal financial sectors, euro place banks indicated moderately tightened or broadly unchanged credit standards for new financial loans to enterprises. Ultimately, euro area banking institutions claimed that COVID-19 related governing administration guarantees ongoing to help banks’ credit expectations for loans to corporations in the 2nd 50 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of 2021. Need for loans with COVID-19 similar authorities ensures declined on balance, though it greater for loans with no these assures.

The euro location lender lending survey, which is conducted four situations a 12 months, was made by the Eurosystem in order to enhance its knowledge of bank lending conduct in the euro location. The success noted in the January 2022 study relate to adjustments observed in the fourth quarter of 2021 and anticipated changes in the initial quarter of 2022, except if normally indicated. The January 2022 study spherical was executed involving 13 December 2021 and 11 January 2022. A overall of 152 banks were being surveyed in this round, with a reaction level of 100{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

For media queries, make sure you call Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes

- A report on this study spherical is accessible on the ECB’s web-site. A duplicate of the questionnaire, a glossary of BLS conditions and a BLS person guideline with details on the BLS series keys can be uncovered on the same internet web site.

- The euro space and nationwide knowledge sequence are accessible on the ECB’s website via the Statistical Details Warehouse. Countrywide final results, as printed by the respective national central banks, can be acquired by way of the ECB’s web-site.

- For more in-depth information on the lender lending study, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro spot bank lending survey”, Occasional Paper Series, No 179, ECB, 2016.

Chart 1

Modifications in credit rating benchmarks for loans or credit strains to enterprises, and contributing elements

(net percentages of banking companies reporting a tightening of credit history benchmarks, and contributing elements)

Supply: ECB (BLS). Notes: Internet percentages are outlined as the distinction concerning the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banking institutions responding “eased somewhat” and “eased considerably”. The net percentages for the “other factors” refer to even further components which had been stated by banking companies as getting contributed to modifications in credit requirements.

Chart 2

Improvements in demand for loans or credit rating traces to enterprises, and contributing components

(web percentages of banks reporting an maximize in desire, and contributing components)

Source: ECB (BLS). Notes: Internet percentages for the concerns on need for financial loans are outlined as the change concerning the sum of the percentages of banking companies responding “increased considerably” and “increased somewhat” and the sum of the percentages of banking companies responding “decreased somewhat” and “decreased considerably”.