Australian banking institutions may well raise additional cash to repay COVID-19-era loans from the authorities following they served drive a nearly 3-fold thirty day period-more than-month jump in combination financial debt elevated by lenders Asia-Pacific in January.

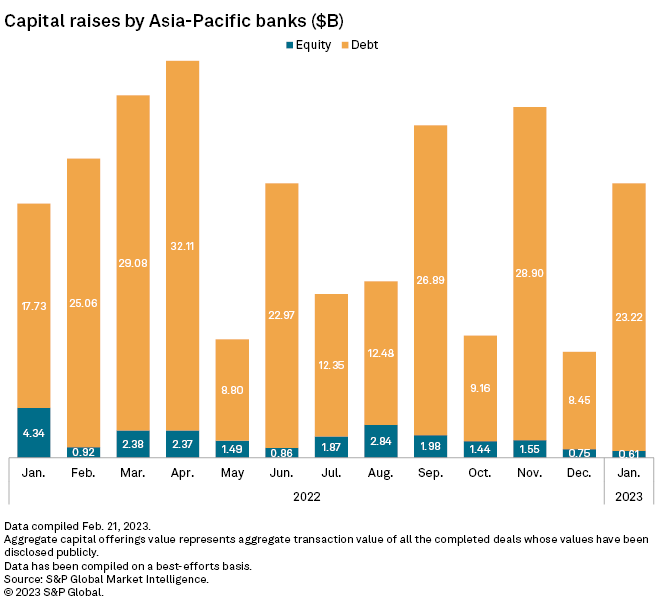

Mixture credit card debt elevated by banks in the location rose to US$23.22 billion in January from US$8.45 billion in December 2022 and US$17.73 billion in January 2022, in accordance to knowledge compiled by S&P Worldwide Market place Intelligence. A number of billion-dollar credit card debt income by Australian banks and Sumitomo Mitsui Financial Team Inc.’s US$5.80 billion total reduction-absorbing ability observe issuance drove the full. The mixture figures incorporate bonds, senior credit card debt and favored securities.

Banks’ fairness elevating routines ended up subdued in January, as price hikes and geopolitical tensions go on to cloud the expansion outlook. In total, just 4 Southeast Asian financial institutions tapped equity funds marketplaces in January, elevating about US$606.7 million.

Australian banking institutions lifted much more than US$7.5 billion by way of personal debt security profits in January as they prepared to repay cheap pandemic loans furnished by the country’s central lender, the data exhibits. Nationwide Australia Financial institution Ltd., Westpac Banking Corp., ANZ Team Holdings Ltd. and Commonwealth Bank of Australia are anticipated to increase far more than A$120 billion in 2023 as they have to have to repay their share of about A$200 billion of a few-12 months financial loans prolonged to lenders by the Australian central financial institution by means of the pandemic-related Time period Funding Facility, The Australian Economic Review documented Jan. 5. The four banking companies acquired a complete of A$132.88 billion of loans by way of the facility, in accordance to central financial institution info.

“We anticipate the Australian banks to carry on to situation money securities in 2023,” mentioned Marvin Kwong, director and portfolio manager of set income for Asia at M&G Investments. “Provide is anticipated to keep on being manageable, supplied that the financial institutions have already constructed up capital buffers continually more than the previous handful of decades.”

The Term Funding Facility was established up by the Reserve Bank of Australia to offer minimal-price a few-year funding to financial institutions as component of a policy response to the COVID-19 pandemic. The facility shut to new drawdowns June 30, 2021, at which time A$188 billion of funding was remarkable, according to the central lender. The facility will go on to assistance reduced borrowing charges till mid-2024.

Billion-dollar issuances

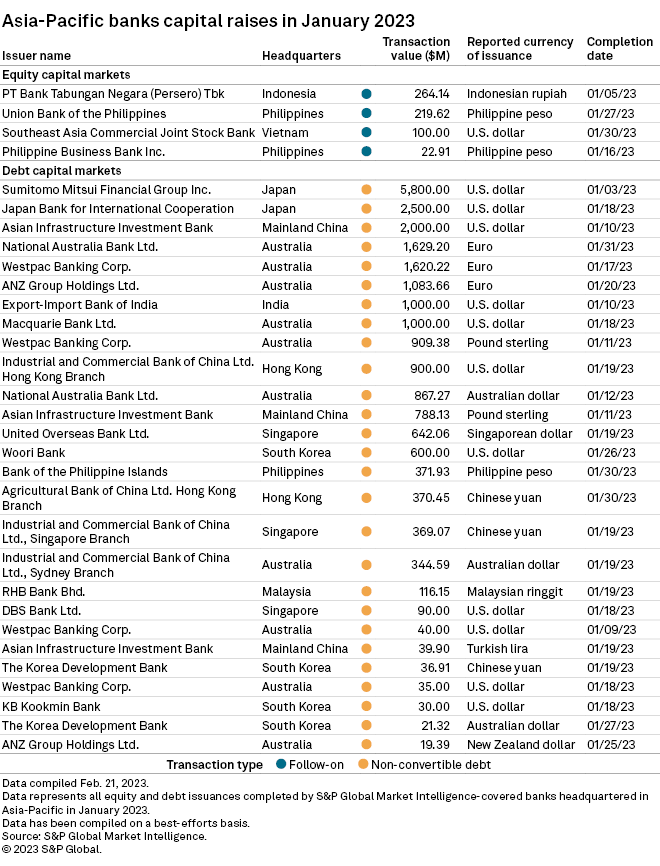

In January, Asia-Pacific lenders done more than fifty percent a dozen billion-greenback personal debt issuances, all denominated in overseas currencies. Sumitomo Mitsui Financial’s US$5.80 billion U.S.-dollar-denominated nonconvertible challenge was the largest offering in January, adopted by Japan Lender for Intercontinental Cooperation’s US$2.50 billion and Asian Infrastructure Expenditure Bank’s US$2 billion issuance.

Three euro-denominated offerings had been done by National Australia Lender, Westpac and ANZ Group, when Export-Import Financial institution of India and Macquarie Financial institution Ltd. also joined the pack with U.S. dollar issuances.

The enhance in Asian banks’ issuance of international-forex bonds “could be thanks to quite a few elements, such as the volatility of premiums inside of some of the banks’ property marketplaces, front-loading of issuances in order to phase up lending in other markets, as perfectly as some steadiness as noticed in the U.S. prices industry in January,” M&G’s Kwong said.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3VP5Q4SNYZO2ZLOS7OFBMEIUUE.jpg)