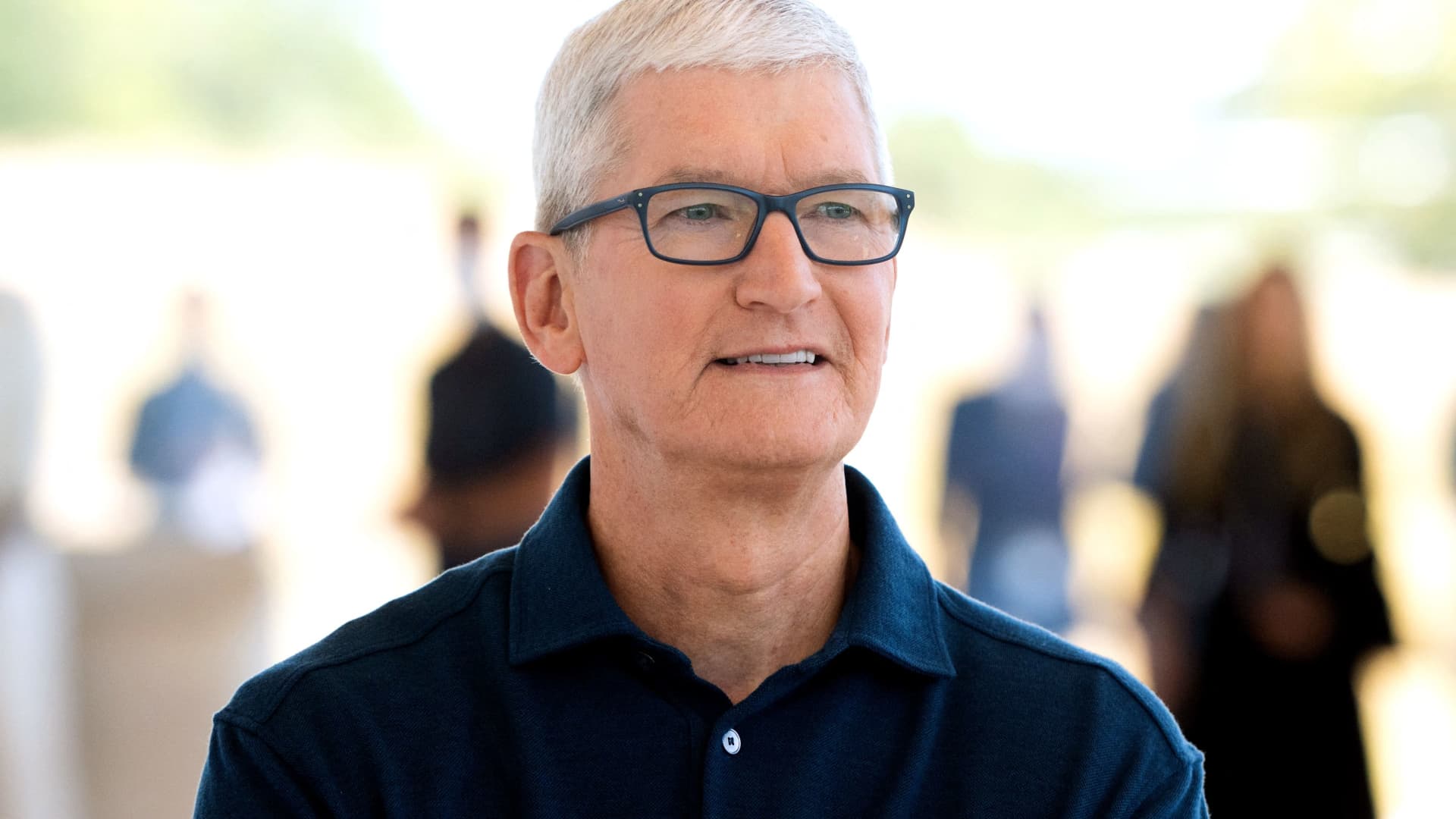

Apple CEO Tim Prepare dinner poses for a portrait future to a line of new MacBook Airs as he enters the Steve Careers Theater throughout the Apple Throughout the world Builders Convention (WWDC) at the Apple Park campus in Cupertino, California on June 6, 2022.

Chris Tuite | AFP | Getty Visuals

A wholly owned subsidiary of Apple will examine person credit score and lengthen shorter-time period financial loans to consumers for Apple Fork out Later, the tech giant reported.

The new bank loan support, which will contend versus very similar choices from Affirm and PayPal, was declared throughout Apple’s developer meeting on Monday. Afterwards this calendar year, when the firm’s new iOS 16 Iphone computer software is introduced, customers will be able to get items with Apple Spend and shell out the equilibrium off in four equal payments about six months as a purchase now, pay back later on (BNPL) service.

Apple has partnered with Mastercard, which interacts with the distributors and delivers a white label BNPL item known as Installments, which Apple is employing. Apple Card issuer Goldman Sachs also is concerned as the complex issuer of the loans and is the formal BIN sponsor, the business explained. But Apple is not working with Goldman’s credit history selections or its harmony sheet for issuing the loans.

The at the rear of-the-scene structure of Apple’s new financial loan services, and the point that it is handling loan selections, credit checks and lending showcases the Apple iphone giant’s method to convey the framework and infrastructure for its economic providers in-house as considerably as possible.

Apple has increasingly broken into the fintech market, by way of its Wallet application and money companies that are centered on making its Iphone additional useful and beneficial to end users, who will be inclined to proceed to obtain Apple components, which continues to be the firm’s main resource of sales.

The financial loans from Apple Shell out Later are unlikely to be product to Apple in the limited time period, while suggesting the company could use its prodigious stability sheet to offer far more economic services in the upcoming. Apple noted $378.55 billion in profits in 2021.

Apple Pay back Later

Courtesy: Apple Inc.

Apple will run a comfortable credit score check to assure that borrowers are able of paying out again the loans, which will very likely be capped at close to $1,000, the business mentioned. If Apple Pay back Later loans are not repaid, then Apple will no lengthier extend those customers credit score. But the company explained it will not report the missed payments to credit score bureaus.

Apple will initially start Pay Later in the United States. Apple Card, its other credit rating name, is at the moment only obtainable in the U.S.

/financial-advisor-having-a-meeting-with-clients-1063753064-d9de431611904a8389e37b04441f4b1c.jpg)