This calendar year has been a awful one for financial engineering (fintech) firms. The market went by a key hype cycle about the final few a long time, and now buyers are dealing with an unsurprising hangover in their portfolios.

Upstart Holdings (UPST -.98{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}) and Block (SQ -1.89{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}) are fintech shares that traders cherished in 2021 and have been down a lot more than 70{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in excess of the earlier 12 months. In point, Upstart is down 91{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, this means that if you invested $100 in the inventory a calendar year in the past, you’d have considerably less than $10 left nowadays. Ouch.

But for long-expression investors, these shorter-phrase rate drops can deliver likely acquiring possibilities. So, which of these fintech stocks is the better acquire these days? Upstart or Block? Let us examine.

1. Upstart: The prolonged-phrase opportunity stays intact

Upstart is an synthetic intelligence (AI) lending system that helps financial institutions cost financial loans for individuals. It is seeking to swap classic credit history scores as a result of far better modeling and pricing for loans. The stock went public in late 2020 and began expanding like a weed in 2021. For reference, in the second quarter of 2021, earnings grew a whopping 1,018{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} year around 12 months as additional folks seemed for inexpensive customer financial loans by way of Upstart’s banking associates. With minimal variable charges, Upstart started out to make potent income, with an running margin of 18.7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in Q2 2021.

Because Upstart is typically just an intermediary for other creditors, it makes funds by earning a little cost on all financial loans that are priced by means of its platform. This indicates that large bank loan quantity equals much more income, all else staying equivalent. A company design like this functions great through an financial growth, but can appear unattractive if the planet heads into a recession, which is likely occurring currently. Previous quarter, the 3rd quarter of 2022, Upstart’s price income lowered 15{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} 12 months above year to $179 million. The corporation is also not lucrative anymore, putting up an working reduction of $58.1 million previous quarter.

Upstart is plainly tied to the credit rating cycle, which is why the inventory has been down so significantly in 2022. Traders are also anxious that Upstart’s pricing AI hasn’t been analyzed during a economic downturn and may start out underperforming conventional credit rating scores. You can find no proof this has transpired nonetheless, to be apparent, but that won’t suggest it is not going to occur about the upcoming 12 months or so, which will be a huge exam for the firm.

But there are indicators that Upstart’s enterprise will commence rising yet again after the economic climate normalizes. Its financial institution and credit score union associates continually climb larger, hitting 83 very last quarter in contrast to just 31 a year back. The new automotive product or service carries on to achieve adoption and is now acquiring used at 702 sellers throughout the state, up from 291 a 12 months back. These partnerships need to carry in far more loan quantity for Upstart.

It is tough to worth Upstart stock due to the fact the company is not financially rewarding any more. But with a marketplace cap of just $1.5 billion ideal now, the inventory could glance cheap a handful of yrs from now if it arrives out of this economic downturn unscathed.

2. Block: So, do you like cryptocurrencies?

You might know Block better by its previous 2D name, Square. The business, started out by Twitter founder Jack Dorsey, served revolutionize payment processing by inventing the white credit rating card reader that could be connected to a cell phone or pill. Since then, it has expanded to turn out to be a strong payment and application company for smaller firms and has also created out a enormous economical providers software for customers named Money Application. The Square organization is a constant grower, hitting 29{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} 12 months-about-calendar year gross revenue expansion over the past a few many years. It introduced in $783 million in gross revenue very last quarter.

Income Application has been the spotlight of Block’s enterprise in excess of the past several several years, with gross revenue escalating 84{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} 12 months about yr for the past a few years, hitting $774 million in gross profit final quarter. The app experienced 49 million regular transacting buyers in Q3, with much more and much more persons beginning to use its associated debit card: the Income Card. Over the lengthy phrase, Block is on the lookout to make the Cash Application more like a financial institution account, which could be quite valuable from a profit perspective and even further push gross earnings development.

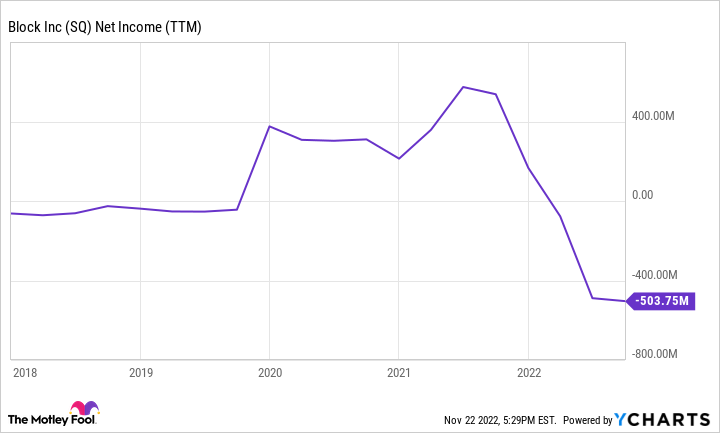

Seeking at just the Income Application and its legacy Square payments small business, Block is undertaking really very well at the instant. The difficulty arrives with its forays into other enterprises. These involve the unwell-fated acquisition of obtain-now-spend-later on organization Afterpay for $29 billion, an acquisition of cash-losing music streaming small business Tidal, and enormous investments into the cryptocurrency business with its Spiral and “TBD” segment (certainly, that is the actual identify of the business device). Management also made the decision to get Bitcoin for Block’s harmony sheet, which isn’t going to glance like a good go at the minute. With all these funds-getting rid of segments exterior the core Sq. and Cash Application organizations, Block has gone from creating a revenue to losing a ton of revenue. More than the last 12 months, it made a web decline of about $500 million.

SQ Internet Money (TTM) information by YCharts.

Which is the greater obtain?

Neither corporation is in a fantastic scenario at the moment, and I don’t imagine I’d invest in either inventory at today’s prices. But If I had to pick out one, I’d acquire shares of Upstart, specified its lessen current market cap and big opportunity to disrupt the lending marketplace. Block’s administration group appears to be far too distracted by significant-threat cryptocurrency products and solutions and repairing its inadequately prepared acquisitions.

Brett Schafer has no place in any of the stocks outlined. The Motley Fool has positions in and endorses Bitcoin, Block, Inc., and Upstart Holdings, Inc. The Motley Fool has a disclosure plan.