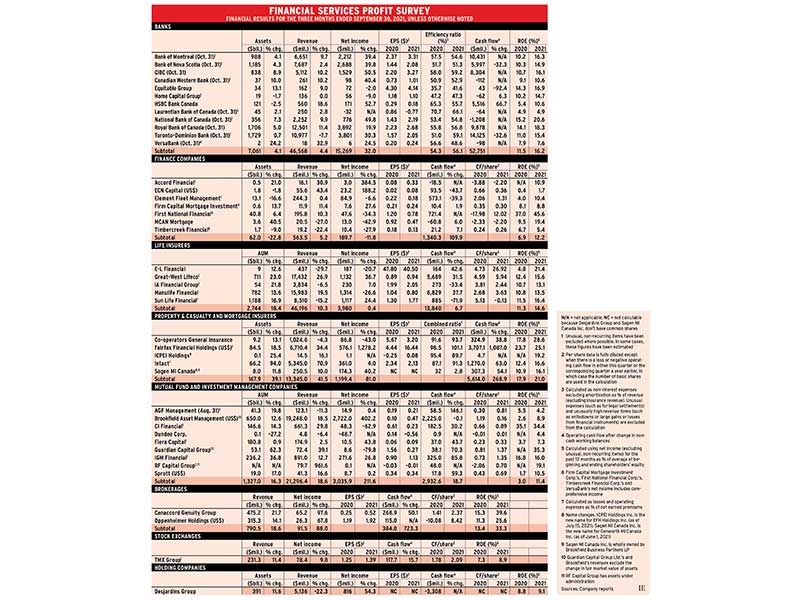

In the quarters ended between Aug. 31 and Oct. 31, 2021, 26 of the companies reported higher year-over-year earnings; one firm, RF Capital Group Inc., posted positive net income compared to a loss a year earlier; 12 companies reported lower year-over-year net income; and two reported losses.

The average earnings increase was 35.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, but that figure was buoyed by a huge increase in net income for Brookfield Asset Management Inc. (BAM), as well as the fact that most banks didn’t need to increase their loan-loss provisions (LLPs). In fact, in the quarter ended Oct. 31, the banks reduced LLPs by $261 million overall, following a drop of $455 million in the previous quarter.

Normally, the banks add between $1.5 billion and $2.5 billion of LLPs each quarter, so the declines in LLPs pushed up bank earnings and the average net income increase for the companies in the survey as a whole. Had the quarter’s LLPs been $2 billion, the year-over-year increase in net income for the banks would have been 14.7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} instead of 32{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, and the overall increase would have been 24.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

BAM, the biggest company in the survey by revenue, posted revenue this quarter of $19.2 billion. Its earnings are volatile because of constant changes in the fair value of its investments and the uneven flow of the acquisitions and dispositions that are part of its business model. In this quarter, BAM reported gains in both fair value and net dispositions, totalling $1.8 billion. Combined with higher earnings from operations, the company reported a $2.2-billion increase in net income from a year earlier.

Excluding BAM and the banks, the average gain in profits for the other 29 companies was only 12.7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

Six of the increases in quarterly dividends were declared by banks, which, along with insurers, had been prohibited by the Office of the Superintendent of Financial Institutions from issuing dividends during most of the pandemic. Bank of Montreal’s quarterly dividend rose to $1.33 from $1.06; CIBC’s rose to $1.61 from $1.46; Canadian Western Bank’s rose to 30¢ from 29¢; National Bank of Canada’s rose to 87¢ from 71¢, Royal Bank of Canada’s rose to $1.20 from $1.08 and Toronto-Dominion Bank’s rose to 89¢ from 79¢.

Other dividend increases included Element Fleet Manage–ment Corp.’s to 7.75¢ from 6.5¢; Manulife Financial Corp.’s to $33¢ from 28¢; Sun Life Financial Inc.’s to 66¢ from 55¢; Intact Financial Corp.’s to 91¢ from 83¢; and Fiera Capital Corp.’s to 21.5¢ from 21¢.

In addition, Great-West Lifeco Inc. paid a special dividend of 5.2¢ in December; so did First National Financial Corp., of $1.25. Both payments were in addition to the companies’ normal dividends. ECN Capital Corp.’s third quarter report stated the company intends to pay a special dividend of $7.50 after the sale of two businesses, a deal that closed on Dec. 23.

Equitable Group Inc. did a two-for-one stock split on Oct. 15 and adjusted its quarterly dividend accordingly, to 18.5¢ per share from 37¢.

Here’s a closer look at the sectors:

Banks

Nine banks reported higher earnings. Equitable and Home Capital Group Inc. had lower net income and Laurentian Bank of Canada reported a loss.

Laurentian booked a $77.9-million after-tax impairment charge in its personal banking division. Laurentian’s 2021 annual report stated this “reflects the recent decline in assets and deposit volumes,” which, along with prevailing economic conditions, “made it challenging to retain existing customers and acquire net new ones.”

Equitable’s and Home Capital’s net income declines were single-digit percentages and not worrisome.

All the Big Six banks reported substantial earnings increases, ranging from RBC’s 19.9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to CIBC’s 50.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. Among the six, only Bank of Nova Scotia and CIBC increased their LLPs, but only by $168 million and $78 million, respectively.

Finance companies

Accord Financial Corp., ECN Capital and Firm Capital Mortgage Investment Corp. reported higher year-over-year net income while Element, First National, MCAN Mortgage Corp. and Timbercreek Financial Corp. reported lower earnings than a year ago.

Accord’s huge 384.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} increase in earnings reflects the broader economic recovery. The company buys other firms’ accounts receivable and was negatively affected by lockdowns. Accord’s financial report noted that its Canadian small business division and U.S. media finance divisions did particularly well in the quarter ended Sept. 30, 2021.

ECN’s 188.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} rise in net income reflects much stronger increases in revenue than expenses (43.4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} versus 17.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, respectively), plus a jump in earnings for businesses being sold (to US$13.6 million from US$7.4 million).

Element services vehicle fleets, for which demand has been muted by the pandemic; First National reported a big decline in deferred placement fees; and both MCAN and Timbercreek reported sizable drops in revenue.

Life insurers

E-L Financial Corp. and Manulife reported lower earnings, while Great-West Lifeco, iA Financial Group Inc. and Sun Life reported higher net income. E-L’s drop was because of much lower increases in the fair value of investments in this quarter, at $9.5 million compared with $215.9 million a year earlier.

As for Manulife, despite an overall net income drop of 26.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, the firm reported an increase of 10{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in core earnings on a constant exchange-rate basis. Net income was higher in Canada and for the company’s global wealth and asset management divisions, and down in the U.S. and Asia.

Property & casualty and mortgage insurers

Fairfax Financial Holdings Ltd., Intact and Sagen MI Canada Inc. reported higher earnings year-over-year.

Fairfax’s gain was huge because net income a year earlier was very weak. The company’s earnings are volatile because, unlike most insurers, it invests in equities and private companies.

The other companies focus on insurance operations. Both Co-operators General Insurance Co. and Intact had lower underwriting profits, but Intact managed a 4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} gain when excluding charges related to the acquisition of U.K.-based RSA Insurance Group Ltd.

Mutual fund and investment management firms

Five companies reported increased earnings, RF reported positive year-over-year net income, two firms reported year-over-year declines and Dundee Corp. reported a loss. Dundee mainly invests in mining companies, which are not faring well.

CI Financial Corp.’s net income dropped by 62.9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} thanks to $50.3 million in foreign-exchange losses and a $61.4-million drop in the fair value of acquisition liabilities.

Guardian Capital Group Ltd. reported the biggest drop in percentage terms, down by 79.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} due to a drop in the fair value of investments of $8.1 million versus a gain of $35.7 million a year earlier.

CI reported positive net sales ($800 million), as did AGF Manage-ment Ltd. ($288 million) and IGM Financial Inc. ($1.9 billion).

Brokerages

Both Canaccord Genuity Group Inc. and Oppenheimer Holdings Inc. reported big earnings gains, reflecting the pickup in advisory activities.

Exchanges

TMX Group Ltd.’s net income rose by 9.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, reflecting a 11.4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} increase in revenue.

Holding companies

Desjardins Group reported a 54.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} earnings gain that was driven by the company’s property & casualty insurance arm, where earnings rose by 86.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to $289 million.

Click image for full-size chart

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RIWF57GAMZOXHIAHSKH52W4AIE.jpg)