Global Market for Biometrics for Banking and Financial Services

Dublin, March 30, 2022 (GLOBE NEWSWIRE) — The “Biometrics for Banking and Financial Services – Global Market Trajectory & Analytics” report has been added to ResearchAndMarkets.com’s offering.

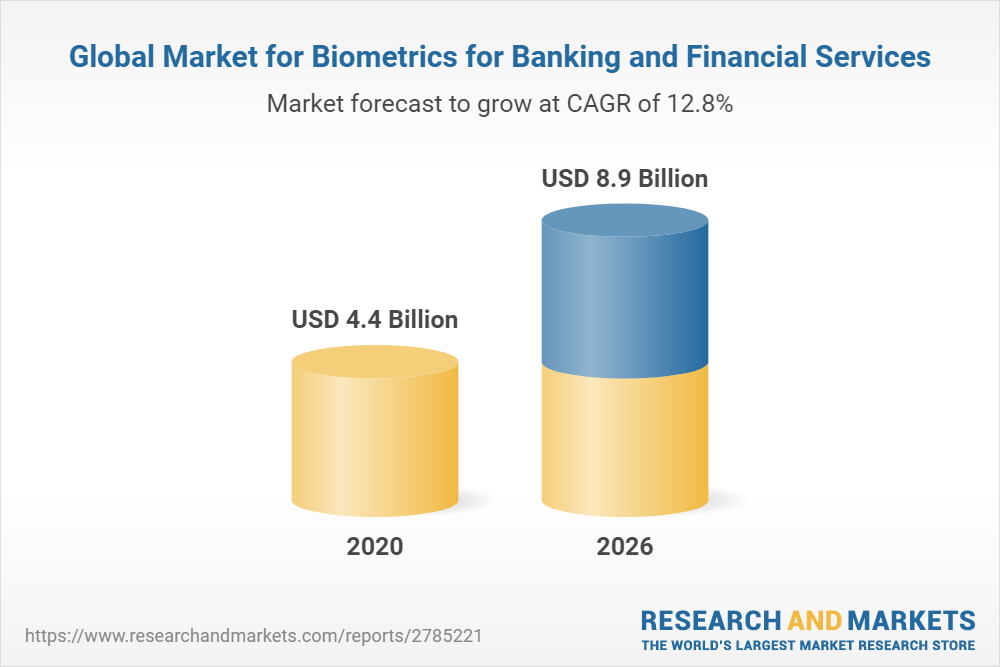

Global Biometrics for Banking and Financial Services Market to Reach $8.9 Billion by 2026

The global market for Biometrics for Banking and Financial Services estimated at US$4.4 Billion in the year 2020, is projected to reach a revised size of US$8.9 Billion by 2026, growing at a CAGR of 12.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} over the analysis period.

The turn of next decade is expected to be more challenging for banks and financial institutions as security breaches become more sophisticated with technology advancements. Money laundering has become more widespread representing about 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}-5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of global GDP.

One of the measures being actively pursued by banks is biometrics, since the technology assists in the creation of secure banking environment by reducing instances of identity fraud, establishing audit trail of transactions, and protecting financial data. The shift towards biometrics is also being driven by the inability of traditional security measures such as PINs, passwords and tokens to effectively offer protection, particularly against the growing sophistication of intruder attacks.

The growing realization among banking customers about inadequacies of PINs and passwords in offering protection against sophisticated bank frauds and online threats is leading to high demand for strong security solutions such as those involving biometrics.

Further, steady increase in the number of password hacks in recent times reflects inadequate security associated with the use of passwords as access method. Driven by the growing need to offer protection against the rising instances of fraudulent transactions and identity thefts along with the ever-widening scale of frauds, banks are opting to invest into strong authentication measures.

Fingerprint Biometrics, one of the segments analyzed in the report, is projected to grow at a 13.4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} CAGR to reach US$6.2 Billion by the end of the analysis period. After a thorough analysis of the business implications of the pandemic and its induced economic crisis, growth in the Face Biometrics segment is readjusted to a revised 11.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} CAGR for the next 7-year period. This segment currently accounts for a 22.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} share of the global Biometrics for Banking and Financial Services market.

The U.S. Market is Estimated at $1 Billion in 2021, While China is Forecast to Reach $1.8 Billion by 2026

The Biometrics for Banking and Financial Services market in the U.S. is estimated at US$1 Billion in the year 2021. The country currently accounts for a 22.84{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} share in the global market. China, the world second largest economy, is forecast to reach an estimated market size of US$1.8 Billion in the year 2026 trailing a CAGR of 17.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} through the analysis period.

Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 7.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} and 9.9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 10.9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} CAGR while Rest of European market (as defined in the study) will reach US$2.2 Billion by the close of the analysis period.

Global market for biometrics in BFSI sector continues to grow at a robust rate driven by the increasing focus of BFSI companies on offering highest security to customer transactions through use of biometrics-based authentication measures. The use of biometrics technology has the potential to reduce instances of fraud attributed to identity duplication.

As consumer preferences change and new payment methods are introduced, banks are being compelled to move towards digital transformation of payments and cards operations. Technology advancements are also leading to an increase in number of forgeries and frauds, whereby the need for solution that cannot be replicated is gaining prominence in the banking and financial services industry.

In the financial sector, the rise in fraudulent access to account due to increasing use of mobile and online banking services is enhancing the importance of access and identity management; governance of information security; and information security roadmap as important security initiatives implemented for financial organizations. However, growing complexity of threats and the lack of adequate budgets are challenging effective implementation of such security programs.

Face Biometrics Segment to Reach $1.9 Billion by 2026

Face Biometrics utilizes unique facial characteristics to recognize and identify individuals. Face recognition is the most successful form of human surveillance and it includes the measurement of eyes, nose, mouth, and other facial features. Commercialization of face recognition systems increased owing to an upsurge in the usage of multimedia video technology.

This technology is generally used for applications such as surveillance, screening, criminal and law enforcement that include kiosks and booking stations. It could be also used in passport issuance applications, driver`s licensing and registration of voters. Global market for Face Biometrics is estimated at US$996.6 Million in 2020, and is projected to reach US$1.9 Billion by 2026 reflecting a compounded annual growth rate of 11.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} over the analysis period.

Key Topics Covered:

I. METHODOLOGY

II. EXECUTIVE SUMMARY

1. MARKET OVERVIEW

-

Impact of COVID-19 Pandemic and a Looming Global Recession

-

Rising Focus on Identity Amidst the Pandemic Drives Changes in Biometrics Field

-

Contactless Biometric Technologies to Make Gains Amidst COVID-19 Outbreak

-

An Introduction to Biometrics Technology

-

Types of Biometrics Technologies

-

Biometrics: A Growing Solution to Address Financial Fraud and Security Breaches

-

Growing Role of Biometrics in Banking and Financial Institutions

-

Application of Biometrics Technology in Financial Services Sector

-

Global Market Prospects & Outlook

-

Fingerprint Scan Technology Leads, Vein Recognition Gains Traction

-

Developing Economies Spearhead Adoption of Biometrics in BFSI Industry

-

Competition

-

Recent Market Activity

2. FOCUS ON SELECT PLAYERS (Total 63 Featured)

-

AllTrust Networks

-

Cyber-SIGN, Inc.

-

Fujitsu Frontech North America, Inc.

-

HID Global Corporation

-

IDEMIA

-

Ingenico Group SA

-

Nuance Communications, Inc.

-

Precise Biometrics AB

-

Thales Group

-

Verint VoiceVault

3. MARKET TRENDS & DRIVERS

-

Digitization of Banking Services and Need for Stricter Identification Protocols to Prevent Security Breaches Drives Market

-

Unreliability and Vulnerability of Traditional Authentication Methods Fuels Adoption of Biometrics Solutions

-

Biometric Technology Vs Conventional ID Authentication Methods

-

Biometrics Enable Banks to Improve Customer Engagement Levels

-

Growing Adoption of Mobile Banking Spurs Opportunities for Biometrics

-

Increasing Availability of Biometrics-Enabled Smartphones Transforms Mobile Banking Services

-

Expanding Social Network Footprint of Financial Organizations: Opportunities for Biometrics Technology

-

Biometric Payment Cards Propel Biometrics Adoption in BFSI Sector

-

Biometrics Technology Facilitates Financial Inclusion of Unbanked Population

-

Biometrics-based Authentication at ATMs on the Rise

-

Future Financial Transactions to be Password-less, Contact-less and Friction-less

-

Amidst Digital Transformation of Banking Operations, Behavioral Biometrics Witnesses Growth

-

Keystroke Dynamics Authentication Overcomes Challenges Related to Conventional Authentication Methods

-

Multi-Modal Biometrics Gain Momentum

-

Biometric Multi-Factor Authentication: Providing Greater Security to Transactions

-

Digital Onboarding Initiatives of Banks Present Favorable Outlook for Biometrics Technologies

-

Voice Biometrics Continues to Gain Growth

-

Contactless Iris Biometrics Technology Poised for Strong Growth

-

Facial Recognition Growing in Popularity

-

Banks See More Deployment of Vein Recognition Biometrics

-

Dual Biometrics Finds Acceptance among Banks

-

Identity Verification: A Major Growth Area for Biometrics Use in Banks

-

Access Control: A Potential Application Area

-

Fintech Banking Addresses Drawbacks of Conventional Banking

-

On-Cloud Biometrics Gain Popularity

-

Innovations in Biometrics for Banking and Financial Services Sector: A Review

-

Select Innovations in Banking Biometrics Space

-

Partnerships: Order of the day for BFSI

-

Regulatory Mandates Promote Adoption Biometrics Technology in Banking Sector

-

Challenges Facing Banks in Implementing Biometric Security Systems

4. GLOBAL MARKET PERSPECTIVE

III. REGIONAL MARKET ANALYSIS

IV. COMPETITION

For more information about this report visit https://www.researchandmarkets.com/r/xxa9oy

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900