The net-zero emissions commitments from Wall Street’s banking giants was a significant move towards keeping world wide warming in look at, but in the pretty much two years due to the fact every single of the U.S. majors committed to web-zero, their progress continues to be gradual.

Which is a demand sophisticated in a report out Wednesday from extended-proven environmental advocacy team The Sierra Club.

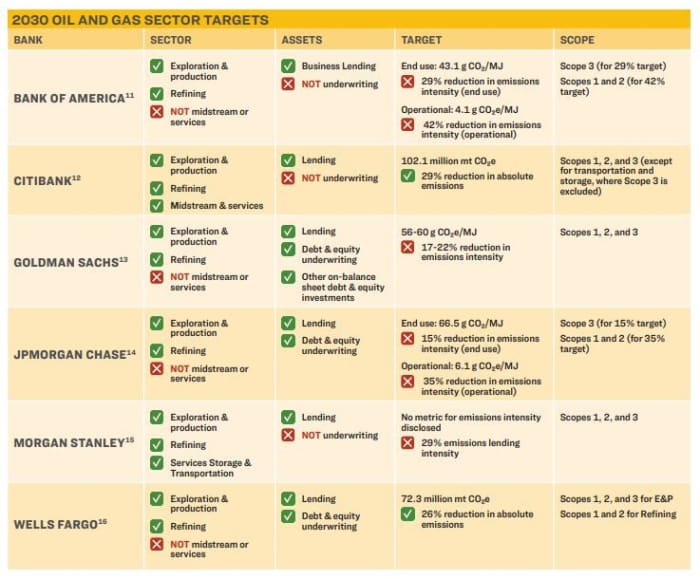

The report examines the banks’ interim 2030 targets to lower greenhouse fuel (GHG) emissions not just at their own functions but in how they finance the power sector and other industrial segments of the financial state. The 2030 test-in is meant to show progress on the way to web-zero emissions by 2050, like for the oil and gasoline

CL00,

and electrical power era

VPU,

sectors.

“Big U.S. banking companies have fallen considerably at the rear of the finest techniques of their world friends, placing only weak targets and insurance policies riddled with loopholes that allow for billions of bucks in new fossil fuels tasks each and every year,” said Adele Shraiman, campaign agent for the Sierra Club’s Fossil-Free of charge Finance campaign. “If banking companies want to stay up to their net-zero pledges, they require to commit to actual emissions reductions and conclude funding for providers expanding fossil fuels.”

The Sierra report hits as the Net Zero Banking Alliance (NZBA), of which the big U.S. names have joined, is envisioned to release an update at the United Nations’ important weather change meeting future 7 days, the COP 27, which runs from Nov. 6 to Nov. 18, in Egypt.

The financial institutions in aim are JPMorgan Chase

JPM,

Citigroup

C,

Wells Fargo

WFC,

Lender of America

BAC,

Morgan Stanley

MS,

and Goldman Sachs

GS,

They have provided providing a quarter of the $4.6 trillion in worldwide fossil gas financing in the earlier 6 a long time alone.

The Sierra Club

JPMorgan Chase CEO Jamie Dimon resoundingly confident lawmakers earlier this calendar year that his lender has no intention of halting the funding of growth in the oil patch. Dimon, who appeared with other leading banking executives on Capitol Hill in September, was requested by Rep. Rashida Tlaib, the Democrat of Michigan, to give a “yes” or “no” reaction to a handful of inquiries. That included whether JPMorgan has a plan versus funding new oil and fuel products and solutions.

“Absolutely not and that would be the street to hell for America,” explained Dimon, whose financial institution is the most significant U.S. company of loans and other funds to the electrical power sector.

The Sierra report implies there are appreciable loopholes in banks’ exclusion guidelines for drilling in the Arctic. In late 2020, Bank of The us was the final to sign up for other U.S. banking majors in refusing to finance oil and gas exploration in the pristine portion of Alaska that then President Trump had opened to drilling for the initial time at any time.

Policy also varies, the report says, when it arrives to funding coal initiatives. Coal stays the major fossil gas polluter, but China and India’s slow move away from the gasoline and even a resurgence of its use in pieces of Europe amid the Russia-sparked electrical power disaster has aggravated climate-watchers.

The report’s findings also emphasize the need to have for mandatory similar disclosures of company local climate commitments, which was feedback that a lot of buyers and advocacy teams gave to the Securities and Exchange Fee on its proposed local weather risk disclosure rule.

Read through: SEC’s landmark local climate-change ruling could demand corporations account for pollution they really don’t instantly produce

The Sierra Club also values the banking sector disclosing far more transparent information. “Of the team, only Wells Fargo has explicitly mentioned that it does not involve offsets in its 2030 targets,” the environmental advocates say.

Financial institution CEOs may possibly be in a tough place. They listen to from some lawmakers of endeavours to remove “woke capitalism” from banking agendas to focus on development and income exceptional of other priorities. But they also know that traders and regulators are turning up the force to a lot more aggressively fund the changeover to renewable electrical power. If Republicans choose the Dwelling in the midterms but Democrats keep the Senate, as some polls suggest, the major executives of significant financial companies could encounter local climate-modify whiplash.

Lender of America CEO Brian Moynihan has been requested about the stress on banks to only cut the polluters unfastened.

“Simply expressing we’re not likely to keep X or Y in our portfolio does not suggest X or Y does not hold going on. Receiving X or Y to get greener on their metal output each yr, or commitments produced by the oil and fuel sector — not only their functions, but with carbon capture and storage and items that offset their emissions — their modify is in fact the great improve,” he explained to Politico.

“The binary conclusion of make investments-not invest, lend-not lend, do small business with or not do enterprise with — that doesn’t modify the behavior of these companies,” he explained. “You want these businesses to declare internet-zero, set a approach on the desk. Then society would like to maintain them accountable.”

The world’s preeminent local weather scientists and strength industry experts have pressured that in buy to access world climate targets, all sectors have to promptly and drastically minimize greenhouse gas emissions. In all, the U.S. economic system need to slash emissions by all around 45{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} percent by 2030 to retain development on observe for the 2050 marker and to give to give the globe a true chance to maintain the temperature increase under 1.5°C.

According to the Global Electricity Agency (IEA), in get for the entire world to restrict warming to 1.5°C (2.7°F) by 2050, there ought to be no supplemental expenditure in new fossil gas offer.

This finding is significant, Sierra Club says, since it means new fossil gas enhancement is basically incompatible with assembly worldwide local climate ambitions and

with the ambitions set by the banking companies on their own.

“Surpassing this threshold is perilous not only for Earth’s weather, ecosystems, and communities, it will also jeopardize the world wide economic system, with present emission trajectories estimating at the very least 10 percent of full international economic worth could be dropped by 2050,” Sierra Club stated in its release.