Consumers plan to devote $998 this holiday break browsing year, in accordance to a Countrywide Retail Federation (NRF) survey. This is how you can defeat higher selling prices amid transport delays and employee shortages to get benefit of holiday break revenue. (iStock)

The getaway season is a joyous time of calendar year, but it can also be a time of added fiscal strain for numerous customers. People prepare on paying out $998 on typical this 12 months purchasing vacation items, foodstuff, decor and other expenses, according to a new survey executed by the Countrywide Retail Federation (NRF).

With supply chain problems and stock shortages threatening to travel up rates on buyer goods and even groceries, celebrating the holiday seasons could be even a lot more high priced than envisioned. The good news is that major suppliers are getting measures to suppress the deficiency of inventory and enhance product availability, according to NRF President and CEO Matthew Shay.

“The retail marketplace is doing the job diligently with ports, labor, shippers and transportation suppliers as well as government officers to conquer supply chain worries and make positive people have entry to the presents they want to give and, just as significant, receive,” Shay claimed.

Nevertheless, it truly is significant to be diligent with your getaway shopping price range to keep away from moving into the New Year weighed down by getaway personal debt.

Hold looking at for vacation paying out suggestions, like how to consolidate credit card debt when the holiday year has ended. Go to Credible to examine charges on a variety of economical goods, together with personal debt consolidation financial loans, without the need of impacting your credit rating rating.

Vacation Consumers System TO Expend Far more Income IN 2021 Right after 2 Many years OF Decrease

3 vacation shopping recommendations to hold shelling out in verify

It is really attainable to purchase the fantastic present for every person on your Xmas listing without having emptying your wallet. Use these strategies to continue to keep your holiday paying less than regulate so you can enjoy this distinctive time of calendar year without added money tension:

Read through far more about each and every purchasing method in the sections beneath.

REVOLVING Credit rating BALANCES Reach PRE-PANDEMIC Concentrations

1. Make a reward-providing finances

It is easy to reduce sight of your paying out throughout the vacations. Which is why it’s so vital to develop a finances prior to you start shopping, according to Lindsey Bell, main markets and funds strategist at Ally Lender.

“The most effective way to curb impulse getting and last-moment investing is to generate a gift-giving list ahead of time and earmark a spending budget sum for every person,” Bell reported. “Considering that no prepare is great, set aside some money in a buffer fund for the perfect present that falls just exterior your price range.”

Possessing a system for vacation browsing can enable continue to keep you accountable and decrease economical worry, she additional.

Items are not the only holiday getaway expenditure, nevertheless. You should really also account for other typical holiday-associated charges, reported Joe Buhrmann, senior economical preparing guide at eMoney Advisor.

“Really do not forget to include things like things these as decorations, ingredients for foods and baking, and postage to mail packages in your holiday break price range,” Buhrmann claimed. “Also, if you will be touring, do not overlook about gas, accommodations and aircraft tickets to check out loved ones.”

70{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} OF Us citizens GO More than Price range All through THE Holiday seasons, Survey FINDS

2. Continue to keep track of your expending

Creating a funds is only useful if you can keep keep track of of your development. There are plenty of free budgeting apps that join to your financial institution accounts to routinely keep track of your investing. Some of these applications even supply force notifications so you can get an automatic inform if you happen to be near to conference your shelling out restrict.

“Monitoring investing is now as straightforward as clicking a mouse or opening an app,” Bell said.

Budgeting applications aren’t for all people, even though. If the tech is as well too much to handle for you, take into account using out a lump sum of income to hold you from overspending.

“It can be straightforward to overspend if you are using plastic,” Buhrmann stated. “Spending cash could drive you to be a minor much more resourceful when you are purchasing and discover extra meaningful and personalized gifts.”

3 Ways INFLATION IS IMPACTING YOUR WALLET, AND HOW TO Combat Mounting Selling prices

3. Employ credit rating card rewards

Rewards credit playing cards enable you gain cashback on everyday purchases and even airline miles that you can redeem for getaway travel. If you might be preparing on keeping put this vacation season, you could be ready to provide your bonus factors to buy gifts for your cherished kinds.

“See if you have any credit card reward factors from resort stays,” Buhrmann explained. “Are there airline points that you’ll by no means use or accumulate ample of to obtain a totally free flight? Several of these can be cashed in for merchandise or present playing cards to enable with getaway paying out.”

Take a look at Credible to assess rewards cards that can support you afford to pay for vacation expenses this yr. It really is cost-free to browse features to come across the right credit history card for you.

Americans RANK Personal debt PAYOFF AS Maximum Money Precedence, Study Demonstrates

How to consolidate debt after getaway overspending

It’s simple for even the most thrifty consumers to overspend in the Christmas spirit. But placing vacation bills on a credit rating card can be an highly-priced funding solution if you will not pay back off your credit card debt in a timely fashion.

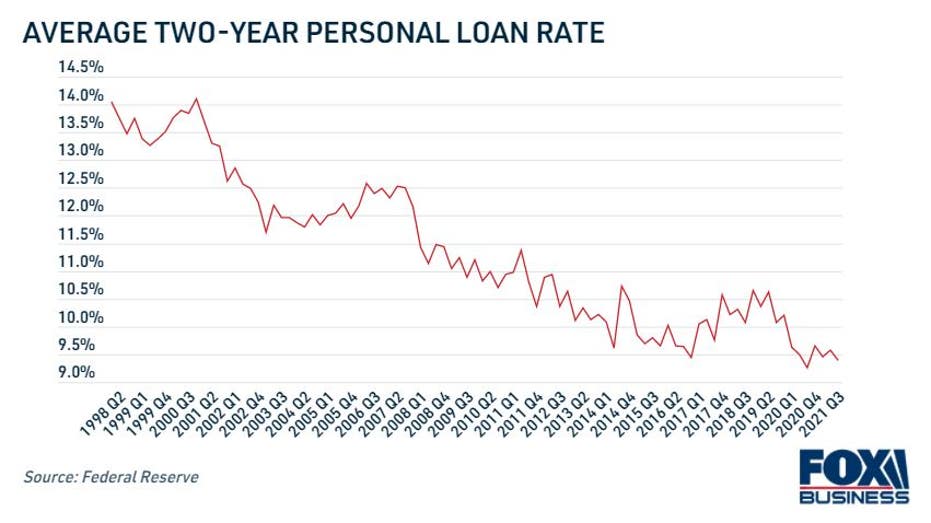

Credit card curiosity charges are near all-time highs, in accordance to the Federal Reserve, achieving 17.13{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} for all accounts assessed curiosity in Q3 2021. This suggests that your unpaid credit rating card balances more than the holidays can be more costly than at any time.

If you have racked up credit rating card credit card debt this holiday getaway time, look at paying out it off at a lower fascination rate with a debt consolidation personal loan. This is a kind of personalized bank loan that you pay off in set monthly payments above a set interval of months.

In contrast to credit history card prices, private personal loan prices are in close proximity to file lows. The average fee on a two-year own loan was 9.39{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in Q3 2021, the Fed experiences.

If you might be looking at applying a particular financial loan to consolidate holiday break debt, it is vital to examine gives from several creditors to make sure you happen to be finding the most affordable charge doable for your predicament. You can locate your believed rate on Credible and use a individual personal loan calculator to see your potential cost savings.

HOW TO Preserve Revenue ON YOUR Personalized Bank loan — AND Pay out OFF YOUR Debt More quickly

Have a finance-related query, but do not know who to question? E mail The Credible Funds Skilled at moneyexpert@credible.com and your problem may possibly be answered by Credible in our Revenue Professional column.