While compact organizations are in a position to receive forgiveness on their Paycheck Safety System (PPP) loans, only about 50 percent of borrowers have sought reduction, even though financial loans of $150,000 or less only have to have a 1-web site software.

The reasons small firms are delaying loan forgiveness vary. For some, rumors of impending wholesale forgiveness by the federal govt are to blame. For other individuals, it can be procrastination. But with the initial payment on numerous PPP loans coming thanks, modest business entrepreneurs have to have to act soon.

What is PPP personal loan forgiveness?

The Paycheck Security System was developed at the top of the pandemic to support compact firms endure. Congress empowered the Little Small business Administration to difficulty hundreds of billions of pounds in small-curiosity smaller enterprise loans. Since then, virtually $800 billion has been unveiled to 8.5 million tiny businesses. The PPP loans are forgivable as prolonged as the borrower works by using the dollars for experienced expenses, including holding staff members on their payroll. It also can be applied for particular operating bills and other small business fees associated with the pandemic.

Debtors are welcome to look for financial loan forgiveness as before long as the proceeds have been made use of. They can utilize any time up to the loan’s maturity date, which is 10 months just after the financial loan was issued. For instance, corporations who took out PPP financial loans in January need to start repaying in November if they haven’t been authorised for personal loan forgiveness.

“You have up until eventually the personal loan matures if you are requesting forgiveness, but there is no incentive to hold out,” Alan Haut, the U.S. Little Business Administration’s district director for North Dakota, explained to enterprise.com. “You may have to commence earning payments if you use soon after the deferment interval.”

How do you apply for PPP mortgage forgiveness?

Dependent on how a great deal you borrowed, making use of for PPP bank loan forgiveness can be a make a difference of minutes or might require more effort and hard work. Possibly way, listed here are the ways to comply with:

Phase 1: Contact your lender.

The to start with move in receiving PPP mortgage forgiveness is to get hold of your loan provider instantly. The lender has a duty to support debtors get their financial loan forgiven. The SBA has streamlined the system by launching the PPP Direct Forgiveness Portal, which makes it possible for debtors to automatically submit their forgiveness software to the financial institution.

You will find a big caveat with this new instrument. The loan company has to signal up for the SBA’s portal, which not all lenders have completed. As of the conclude of September 1,400 PPP lenders, or far more than 50 percent, have opted into the Immediate Forgiveness Portal. That signifies about 50 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of lenders have not opted in, so getting in contact with your lender should really usually be the initial step.

“You have to get hold of your loan company and make confident they opted in,” Haut stated. “A lot of lenders have an on the net system of their possess that is rapid and straightforward. Beginning with the loan company is the best selection.”

If your financial institution is portion of the Direct Forgiveness Portal and does not have an on line portal of its have, use the SBA resource.

Move 2: Decide if you are eligible for bank loan forgiveness.

To get your PPP loan forgiven, you must satisfy distinct requirements. The dimension of the mortgage will establish how much proof you want to offer. The eligibility prerequisites are as follows:

- At the very least 60{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of the mortgage complete was made use of to cover payroll expenditures and charges.

- The remainder of the bank loan was used on home finance loan interest or rent, utility charges, running prices, property hurt prompted by the pandemic, materials, and individual protecting machines (PPE).

- Employers tried to retain work ranges and pay back that had been in line with concentrations prior to the pandemic.

If you verify off these bins, you can transfer on to the following stage.

Move 3: Figure out which application is proper for you.

To get forgiveness for your PPP loan, full an SBA Type 3508. There are 3 versions of the application, centered on the dimension of the bank loan and the range of workforce on payroll. Each application calls for fundamental business enterprise details, which includes identify and tackle, tax ID range, and call data. You’ll will need to indicate irrespective of whether this is your To start with Attract or Second Attract PPP bank loan and enter the personal loan amount of money and terms.

The key difference between the types is the range of calculations you are essential to perform.

SBA Sort 3508EZ

Use Variety 3508EZ if your business enterprise has no staff members and can fulfill 1 of the following requirements:

- You are self-employed with no workforce.

- You did not lessen staff salaries by far more than 25{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

- Employees’ hours stayed the similar.

This 3-webpage application involves the calculation kind, signature sort and an optional demographic data form. It necessitates you to record how the PPP loan was expended and to calculate your personal loan forgiveness total.

Source: U.S. Modest Business enterprise Administration

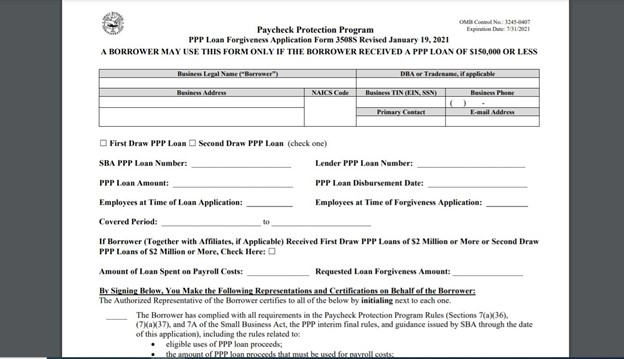

SBA Form 3508S

Sort 3508S is the most simple PPP financial loan forgiveness software to finish. It is only eligible for debtors with loans of $150,000 or a lot less. This two-web site software demands no documentation and few calculations. When you use Type 3508S, no documentation is needed if it is your 1st PPP loan. For Second Attract PPP financial loans, debtors have to verify that their income fell at the very least 25{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

Supply: U.S. Modest Business enterprise Administration

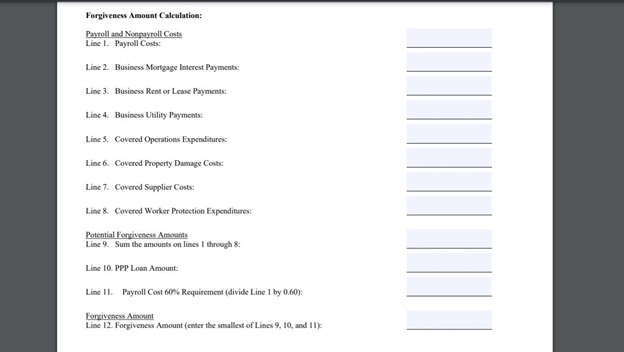

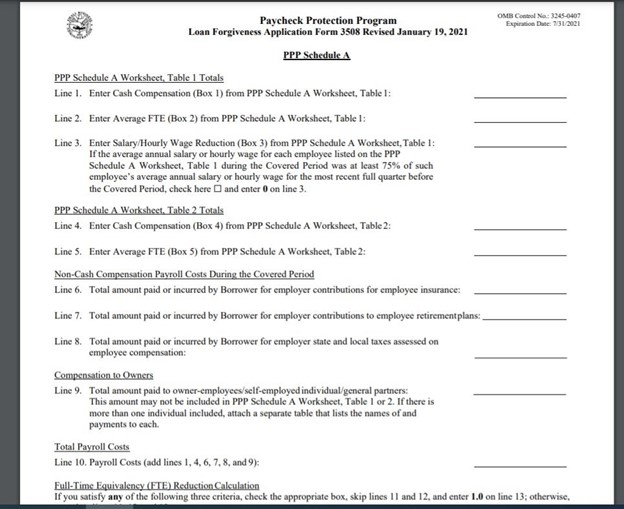

SBA Variety 3508

Type 3508 is the most complex of the 3 apps. It is for modest small business borrowers who usually are not suitable to complete the 3508EZ or 3508S kinds. The forgiveness software is 5 web pages extended and involves the most calculations. It includes a calculation page, signature kind, Schedule A, Agenda A worksheet and the optional demographic information form.

Source: U.S. Compact Organization Administration

Stage 4: Will not hold out much too prolonged to apply.

If you use the income from your PPP mortgage for its meant capabilities, you are confirmed to receive loan forgiveness from your lender. But if you wait around much too long to use, you could be forced to start off repaying the mortgage.

“Small organization proprietors require to know they only have 10 months to procrastinate,” explained Brock Blake, CEO of online loan market Lendio. “When it is really 10 months from when you got the loan, it is the working day of reckoning. You have to begin producing payments after that.”