Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

If you have fair credit and would like to take out a personal loan, you do have options. Find out what they are. (iStock)

People turn to personal loans for a number of reasons, including the predictable monthly payments and interest rates that are typically lower than credit card interest rates. Of course, the best personal loan interest rates are usually reserved for people with the best credit scores.

If your credit is only fair, you may have fewer personal loan options, or you may only qualify for interest rates that aren’t much better than your credit card APR. Still, it is possible to get a personal loan with fair credit, and to take some steps to ensure you receive the lowest rate available to you.

With Credible, you can compare personal loan lenders and check rates within minutes, without affecting your credit.

What does it mean to have fair credit?

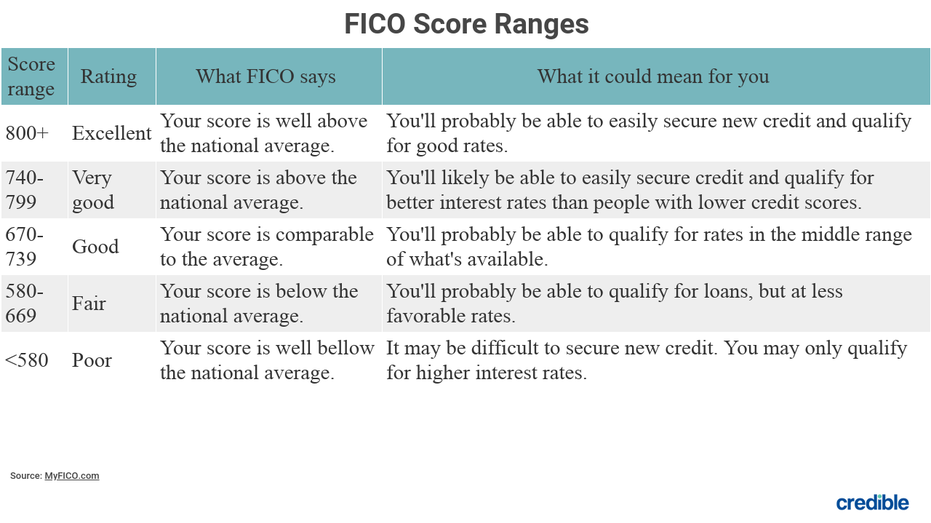

Factors like your payment history, credit usage, length of credit history, new credit and types of credit accounts all play a role in your credit score. A FICO score between 580 and 669 is usually considered to be fair.

If you have fair credit, lenders will consider you a “subprime borrower,” which means your credit score is lower than they’d like it to be. Since lenders will view you as a riskier borrower than those with good or excellent credit, you might have a harder time getting a loan.

How to get approved for a personal loan with fair credit

To get approved for a personal loan with fair credit, try these steps:

- Shop around. Not all personal loans are created equal. That’s why it’s important to do your research and compare interest rates, repayment terms and fees from multiple lenders.

- Prequalify. Many lenders will allow you to prequalify or check potential rates and terms without hurting your credit score. All you have to do is fill out a short form with some basic information.

- Add a cosigner. If you have fair credit, a cosigner with good or excellent credit can help you get approved for a personal loan that you might not qualify for on your own. A cosigner could be your spouse, parent or friend, and they’ll be responsible for repaying your loan if you default.

- Apply. Once you decide on a lender, fill out the application. Keep in mind that you’ll probably need to provide documents like your driver’s license, W-2s and pay stubs.

How much does a personal loan for fair credit cost?

The cost of a personal loan for fair credit will depend on several factors, including your loan amount, interest rate and loan term.

Let’s say you take out a $5,000 personal loan with a three-year term at a 24.57{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} interest rate. You’ll end up paying $198 monthly and $2,116 in interest over the life of your loan. By comparison, if your credit was good enough to qualify for a better interest rate of 11.27{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, the same loan amount and repayment term would cost you just $164 per month, and your total interest costs would be just $916.

Now imagine you choose a $15,000 personal loan with the same three-year term and 24.57{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} interest rate. You’ll be responsible for $593 each month and $6,348 in total interest charges. At 11.27{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, the same loan would cost you $493 per month, and $2,748 in total interest.

If you move forward with a larger $50,000 personal loan that also comes with a 24.57{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} interest rate and three-year term, your monthly payment will be $1,977 and your total interest will cost you $21,159. At 11.27{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, your monthly payment would fall to $1,643, and your total interest costs would be $9,160.

How to improve your fair credit score

You can take numerous steps to improve your fair credit score, including:

- Stay on top of your payments. Since payment history is one of the most important factors in calculating your credit score, don’t miss any loan or credit card payments. It’s a good idea to enroll in automatic payments or set up calendar reminders.

- Reduce your credit utilization. Your credit utilization ratio refers to the amount of credit you’ve used compared with how much available credit you have. The lower your credit utilization, the better, so try to pay down your debt if possible or ask for an increase in your credit lines.

- Don’t apply for too many accounts at once. Too many hard credit inquiries at one time can ding your credit score. Only apply for what you really need, and submit prequalification forms when possible to find out your chances of approval, as prequalification won’t affect your credit.

What are some personal loan fees?

Fees are another way lenders can get revenue from a loan. Some personal loan lenders charge fees, while others don’t. Here are some personal loan fees you might encounter:

- Application fees — Lenders may charge this fee to process your loan application.

- Origination fees — To underwrite your loan, lenders may charge this fee, which is usually a percentage of the loan amount. It can be as low as 1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} or as high as 10{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

- Late fees — If you make late payments on your personal loan, your lender may charge a late payment fee.

- Returned payment fees — If your bank bounces a payment for insufficient funds, your lender may charge you a returned payment fee.

- Prepayment penalty — When you pay off a loan early, the lender makes less in interest than it would have if you paid throughout the loan term. The lender may charge a prepayment penalty to recoup some of that loss.

Personal loan lenders for borrowers with fair credit

Not all personal loan companies will lend to people with fair credit. But the following 14 Credible partner lenders all have minimum credit score requirements of 669 or lower.

Avant

If you need money quickly, Avant may be a good option, as the lender can deposit the funds as soon as the next business day.

Minimum credit score: 550

Loan terms: Two to five years

Loan amounts: $2,000 to $35,000

Best Egg

Best Egg may be a smart choice if you have fair credit, as the lender considers your “digital footprint” in addition to more than 1,500 “proprietary credit attributes.”

Minimum credit score: 600

Loan terms: Two to five years

Loan amount: $2,000 to $50,000

Discover

Discover may be a smart choice if your credit is on the higher side of fair.

Minimum credit score: 660

Loan terms: Three to seven years

Loan amount: $2,500 to $35,000

LendingClub

If you need a personal loan and have had trouble getting approved with other lenders, LendingClub’s peer-to-peer platform is worth considering.

Minimum credit score: 600

Loan terms: Three or five years

Loan amount: $1,000 to $40,000

LendingPoint

A personal loan from LendingPoint might make sense if you don’t have a stellar credit score.

Minimum credit score: 580

Loan terms: Two to four years

Loan amount: $2,000 to $36,500

LightStream

LightStream should be on your radar if your credit is on the high side of fair and you want to borrow a large amount.

Minimum credit score: 660

Loan terms: Two to 12 years for home improvement loans, two to seven years for all other loan purposes

Loan amount: $5,000 to $100,000

Marcus

If you like the idea of a custom payment plan to fit your budget, a Marcus personal loan may be a good fit.

Minimum credit score: 660

Loan terms: Three to six years

Loan amount: $3,500 to $40,000

OneMain Financial

OneMain Financial should be on your radar if you don’t have the best credit and can carry a higher interest rate.

Minimum credit score: None

Loan terms: Two to five years

Loan amount: $1,500 to $20,000

Payoff

A Payoff personal loan may be a good option if you have a debt-to-income ratio of 50{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} or less and have three years of good credit history.

Minimum credit score: 600

Loan terms: Two to five years

Loan amount: $5,000 to $40,000

Prosper

If your credit is on the higher side of fair, Prosper’s peer-to-peer marketplace can be a solid pick.

Minimum credit score: 640

Loan terms: Three or five years

Loan amount: $2,000 to $40,000

Universal Credit

If you want to improve your credit score, consider a personal loan from Universal Credit so you can take advantage of free credit score monitoring and other tools.

Minimum credit score: 560

Loan terms: Three to five years

Loan amount: $1,000 to $50,000

Upgrade

Upgrade’s personal loans can be a smart choice if you have fair credit, want to borrow a small amount of money, and can’t wait long for the funds.

Minimum credit score: 560

Loan terms: Two to seven years

Loan amount: $1,000 to $50,000

Upstart

If you have credit that’s on the lower side of fair, Upstart considers factors other than credit score, including your education and work history.

Minimum credit score: 580

Loan terms: Three to five years

Loan amount: $1,000 to $50,000

You can compare personal loan rates from these lenders on Credible.

Alternatives to fair credit personal loans

If you decide that a fair credit personal loan isn’t for you, you might want to explore these alternative options.

- Personal line of credit — A personal line of credit works much like a credit card in that you can borrow as much or as little as you’d like up to a set credit limit. You only pay interest on the amount you borrow. If you’re not sure exactly how much money you need to borrow, a personal line of credit can be a good option.

- Home equity loan — A home equity loan is a lump sum of money you borrow against the equity in your home (your home value minus what you owe on your mortgage). Home equity loans usually offer lower interest rates and possibly some tax deductions, too. But keep in mind that if you’re unable to repay the loan, your home could be at risk.

- Peer-to-peer lending — With peer-to-peer lending, you take out a loan from a person or group of people, instead of a financial institution like a bank. If you’ve had trouble getting approved for a loan from a traditional lender, peer-to-peer lending may be worth trying.

- Credit card — A credit card allows you to make purchases up to a set credit limit and pay them back later. If you’d like to cover everyday expenses and potentially earn rewards like cash back and travel points, it may help you out. But credit cards typically have interest rates that are much higher than personal loan interest rates.

- 401(k) loan — A 401(k) loan lets you borrow money against your 401(k) retirement account and pay it back with interest over time. It might be worthwhile if you’ve funded your 401(k) and are facing an emergency situation like a job loss. But keep in mind that you’ll have to repay the loan. Failing to do so could subject you to significant tax consequences.