The most basic way to invest in shares is to invest in trade traded resources. But you can do a lot much better than that by obtaining very good good quality corporations for interesting price ranges. For example, the 1st Company Financial Solutions, Inc. (NASDAQ:FBIZ) share price tag is up 51{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in the previous 5 decades, a bit above the sector return. It is really also good to see that the stock is up 11{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in a year.

So let’s examine and see if the for a longer period time period performance of the enterprise has been in line with the underlying business’ development.

Test out our most up-to-date evaluation for First Company Money Expert services

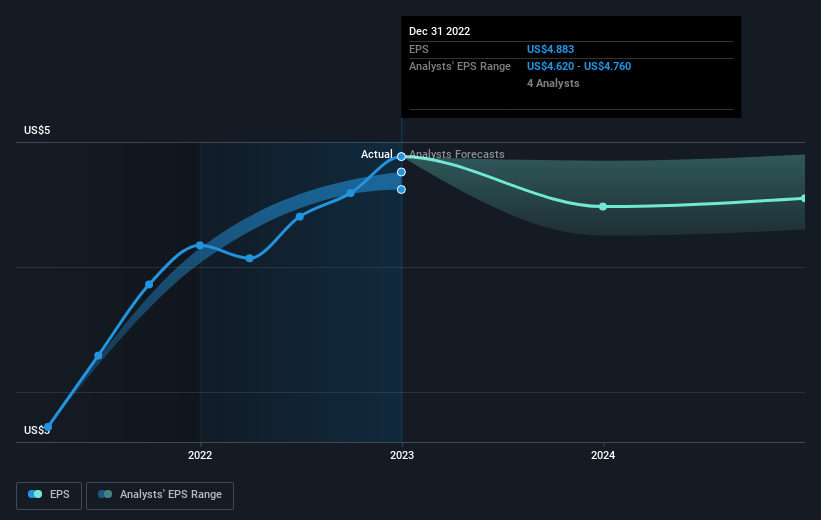

To paraphrase Benjamin Graham: More than the small time period the sector is a voting equipment, but in excess of the lengthy term it truly is a weighing equipment. One particular imperfect but basic way to look at how the industry notion of a business has shifted is to compare the alter in the earnings for each share (EPS) with the share price tag motion.

More than fifty percent a 10 years, Initially Enterprise Economic Services managed to expand its earnings for each share at 29{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} a calendar year. This EPS progress is larger than the 9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} average yearly maximize in the share cost. So a single could conclude that the broader industry has turn into additional careful towards the inventory. The fairly low P/E ratio of 7.71 also suggests sector apprehension.

You can see down below how EPS has improved over time (find the precise values by clicking on the graphic).

We think about it constructive that insiders have manufactured substantial purchases in the very last yr. Getting stated that, most folks take into consideration earnings and income growth traits to be a extra significant guideline to the company. Just before obtaining or offering a inventory, we always suggest a shut assessment of historic expansion trends, readily available listed here..

What About Dividends?

It is significant to look at the whole shareholder return, as nicely as the share price return, for any offered inventory. The TSR is a return calculation that accounts for the value of dollars dividends (assuming that any dividend been given was reinvested) and the calculated price of any discounted capital raisings and spin-offs. Arguably, the TSR provides a extra detailed photograph of the return generated by a inventory. In the situation of First Company Money Providers, it has a TSR of 73{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} for the last 5 decades. That exceeds its share cost return that we previously described. The dividends paid by the firm have thusly boosted the overall shareholder return.

A Different Viewpoint

It truly is awesome to see that Initial Business Money Expert services shareholders have gained a complete shareholder return of 14{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} about the very last 12 months. Of study course, that features the dividend. That get is much better than the yearly TSR over five decades, which is 12{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. Hence it appears like sentiment all around the corporation has been beneficial recently. Someone with an optimistic standpoint could watch the recent improvement in TSR as indicating that the enterprise itself is acquiring superior with time. It’s normally attention-grabbing to monitor share price tag general performance in excess of the extended expression. But to understand Initial Small business Economic Services much better, we have to have to contemplate quite a few other variables. Take pitfalls, for example – To start with Enterprise Economic Solutions has 2 warning indications (and 1 which is important) we believe you should know about.

If you like to acquire shares alongside administration, then you could just appreciate this no cost list of providers. (Trace: insiders have been shopping for them).

Remember to observe, the sector returns quoted in this post replicate the current market weighted ordinary returns of shares that at the moment trade on US exchanges.

Have feed-back on this post? Anxious about the content? Get in contact with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This report by Just Wall St is typical in mother nature. We offer commentary dependent on historical information and analyst forecasts only working with an impartial methodology and our articles or blog posts are not supposed to be financial guidance. It does not constitute a recommendation to acquire or market any inventory, and does not consider account of your targets, or your financial problem. We aim to bring you extended-time period centered assessment pushed by fundamental data. Be aware that our analysis may well not variable in the latest price-delicate enterprise bulletins or qualitative substance. Simply Wall St has no placement in any shares pointed out.

Sign up for A Paid out User Exploration Session

You’ll obtain a US$30 Amazon Reward card for 1 hour of your time although serving to us establish improved investing equipment for the particular person buyers like on your own. Indicator up in this article

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WUHMM5UZLRIXJMMRBZLQN424AY.jpg)