With international remittances set to arrive at $5.4 trillion by 2030, in accordance to a specialized UN company, African fintech darling M-Pesa wants to get a piece of the pie. The Kenyan fintech behemoth is ramping up an bold expansion drive to woo markets in the world North.

According to the UN specialised company, International Fund for Agricultural Advancement (IFAD), in the 2021/22 forecast interval, remittance circulation ($605 billion) was additional than triple the complete amount of official worldwide enhancement support ($178.6 billion).

With forecasts demonstrating worldwide dollars transfer markets will cross the trillion dollar mark as shortly as up coming year, gamers in this place are now eager to ring-fence their slice of the pie.

Amazon and M-Pesa

In accordance to Aly-Khan Satchu, Economist and CEO of the investment advisory organization Prosperous Management Ltd, M-Pesa is proficiently goaling a two-way move with a a short while ago declared partnership with Amazon.

“With respect to inward remittances, I imagine M-Pesa has to glimpse at charges if it is to capture a sizeable market place share and a a lot more advanced domestic platform which offers a suite of investment decision opportunities for inward remittances. Safaricom has the platform and issue-to-stage edge and the scale to make this all arrive jointly,” he explained.

The move into new marketplaces is a pure and needed development for M-Pesa, which has presently established a robust track file of innovation and growth in Africa.

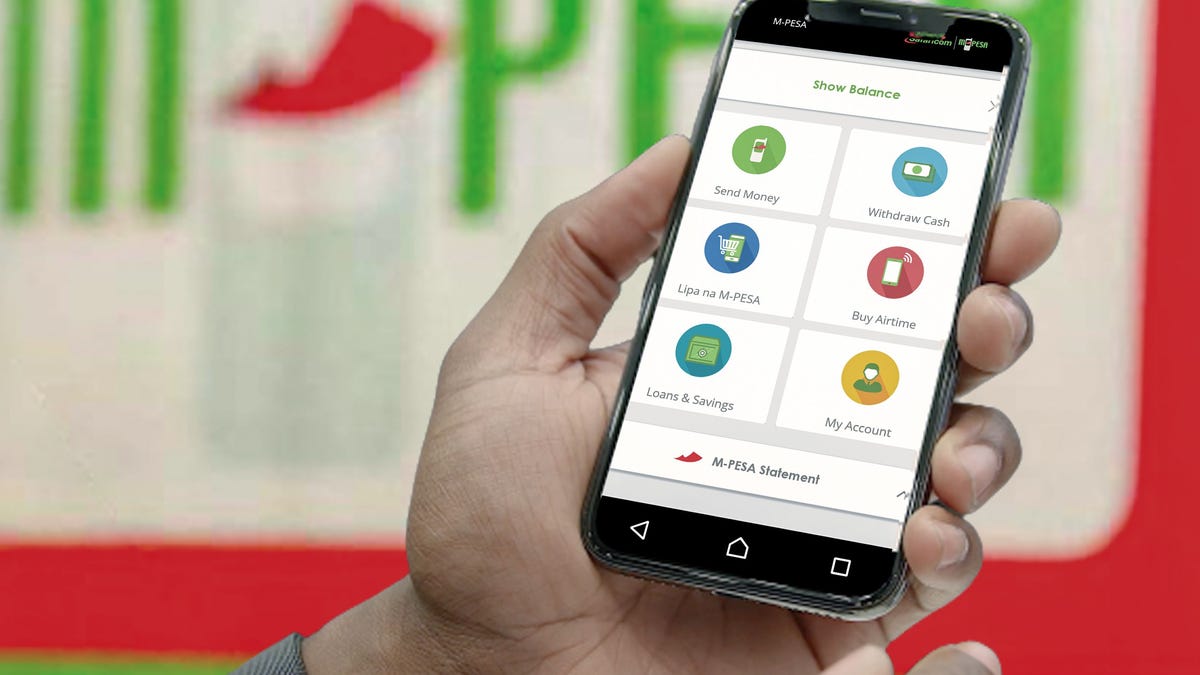

M-Pesa and fiscal inclusion

The platform has produced monetary products and services available to tens of millions of individuals who beforehand lacked accessibility to classic banking providers and has transformed how persons in Africa take care of their revenue.

Internationally, having said that, it will want to first wrestle the worthwhile market dominated by regular players these types of as Western Union and MoneyGram and banks in new nations around the world.

Now, the virtual banking program run by telecommunications large Safaricom has limited partnerships with Western Union, Cash Gram, Globe Remit, and Remitly, the cell-initial service provider of remittances and money services for immigrants.

Splitting from Safaricom

Plans are now afoot for M-Pesa to split from Safaricom, its large telecommunications babysitter, letting it to operate as a standalone money provider.

“I assume the overall Safaricom share rate is now a drag on the M-Pesa valuation and that a spin-off will generate price for shareholders, entice a new course of global shareholders and enable for effective funds allocation into M-Pesa,” explained Satchu.

A divorce from Safaricom would give M-Pesa more headroom to pursue intercontinental ambitions as a fintech assistance and could enable it to record on new inventory markets, broaden its fintech assistance supplying globally and solidify its placement as a top player in the fast rising intercontinental cash transfer marketplace.

Just one tactic for world growth could be centered about partnerships with area banks and cell operators, who will enable to give the system in new markets.

Global partnerships

Early in February, Nala, a Tanzanian fintech startup, and M-Pesa inked a offer to expand its Global Cash Transfer (IMT) services to the European Union (EU).

Tellingly, final 12 months, Safaricom and Visa introduced the ‘M-Pesa GlobalPay’ virtual card that permits clients to use M-Pesa to shop at additional than 100 million merchants across 200 nations for the initial time.

At the very same time, M-Pesa needs to be the platform of alternative for Africans in the diaspora, sending billions back again household. Very last calendar year, Africans dwelling abroad despatched $54 billion back again household.

This technique will enable the support to make on its present skills and relationships though leveraging the understanding and resources of regional partners to be certain a sleek roll-out.

Having said that, the European market represents a diverse challenge entirely. With very developed fiscal units and stringent restrictions, M-Pesa will need to have to commit closely in study, progress, and promoting to win around clients and convince regulators of the worth of its products and services.

Adapting to world-wide markets

Just one of the keys to M-Pesa’s achievement will be its ability to adapt to the exclusive demands and specifications of every market place.

For instance, in Europe, where a lot of nations around the world have well-set up banking techniques and higher concentrations of money literacy, M-Pesa will need to have to emphasize the usefulness, security, and pace of its solutions.

In addition, the firm will need to comply with sophisticated rules, facts defense rules, and anti-money laundering demands to operate in the area.

Another critical issue in M-Pesa enlargement into Europe will be its capacity to make sturdy partnerships with nearby banking companies and stakeholders.

This will aid the corporation gain a improved knowing of community marketplaces, triumph over any regulatory hurdles, and build a network of dependable and faithful clients.

Despite these challenges, M-Pesa’s possible to revolutionize European monetary products and services could be immense, specifically the payments companies.

M-Pesa could trip on the have faith in of Vodafone and Vodacom, Safaricom’s world wide shareholders to penetrate stubborn European marketplaces. But it will face pushback from banking institutions.

With its progressive engineering, in depth community, and established observe report of achievement, the enterprise is poised to make a significant effect in the location and improve how individuals imagine about cash and fiscal providers.

One particular way that M-Pesa could also travel its growth into new markets is by double-listing on international inventory exchanges.

By heading community, the corporation could raise capital and attain access to new financial investment possibilities, which could support it to develop its operations and develop into new marketplaces.

In addition, listing on a major stock trade could raise M-Pesa’s visibility and trustworthiness, building it much easier for the corporation to draw in new clients and establish its brand.

All round, an expansion by M-Pesa into new marketplaces can be a activity-changer for the organization and the financial services industry as a full.

By leveraging its partnerships with worldwide funds transfer products and services and perhaps listing on worldwide stock exchanges, M-Pesa could reach new heights and revolutionize money products and services around the globe.

The original version of this write-up was released by chicken-Africa no filter.