Pay Dirt is Slate’s money advice column. Have a question? Send it to Lillian, Athena, and Elizabeth here. (It’s anonymous!)

Dear Pay Dirt,

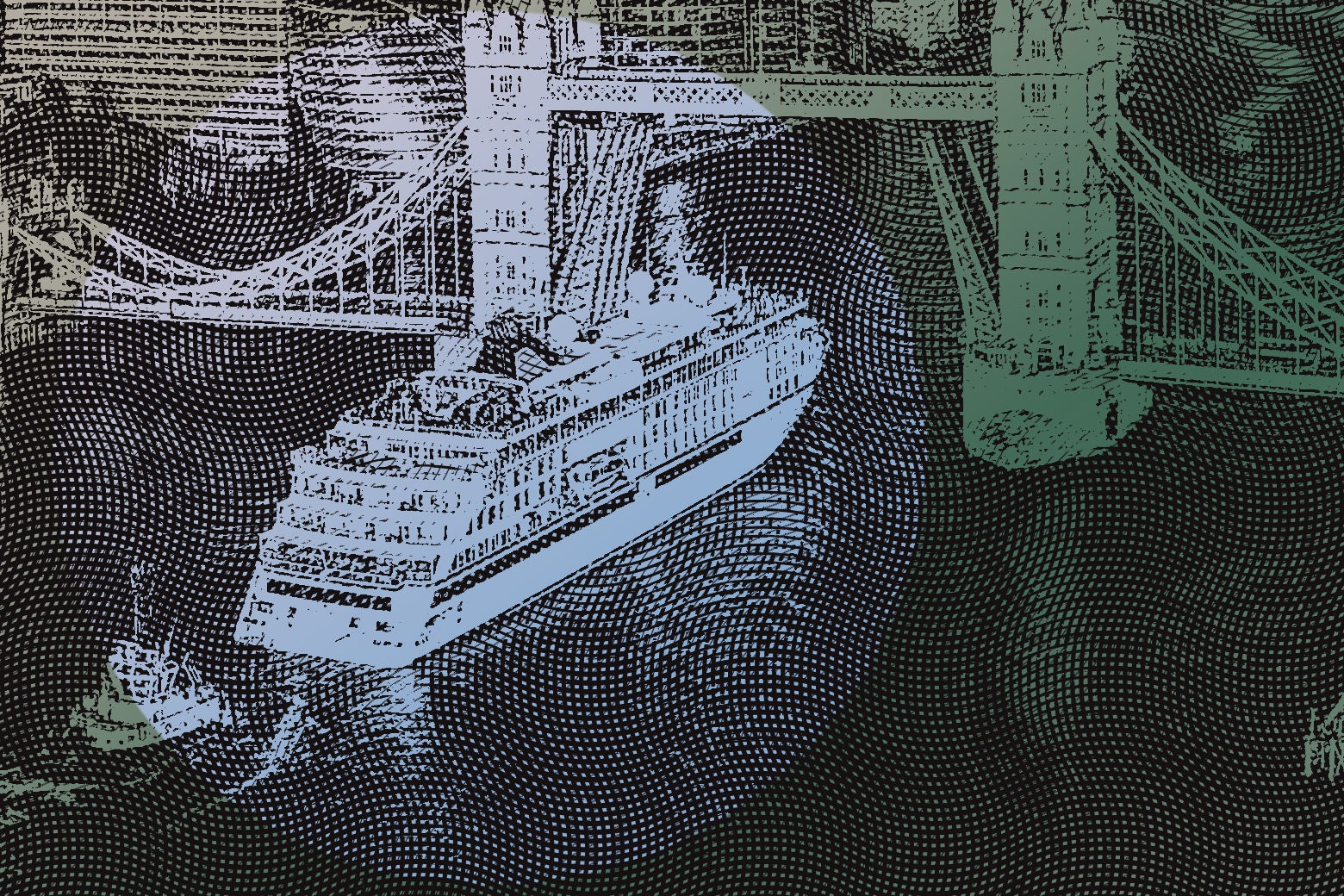

My parents will be having their fiftieth wedding anniversary this year. They never got to go on their honeymoon due to family troubles and have always wanted to travel, but never got further than Canada. Four years ago, I proposed my siblings and I send them on an all-expenses paid European cruise for the big anniversary. I don’t make the most money out of the family, but my job pays well and expenses are low.

My two disabled brothers were all in. My sister was not. She called the idea “ludicrous” and a “waste of money.” She wasn’t going in with the rest of us. Fair enough, but with the anniversary coming up she changed her tune. My brothers are getting our parents’ new luggage and paying for excursions on the trip. I am paying the rest.

I told my sister if she wanted to reimburse me half the cost of the trip, she could join in. She told me that I was being greedy and ridiculous. She was a stay-at-home mom and didn’t have thousands of dollars just laying around. I got really annoyed at this. My sister’s husband is a lawyer. They have a huge house, go on fancy vacations every year, drive brand-new cars, and her kids go to private schools. If I can manage to save a few hundred a month to give our parents the trip of a lifetime, I think my sister could trim the financial fat somehow.

I told her she has four years to think up another gift and suggested she take our parents out to dinner. She told me no dinner could compete with a European cruise and I was trying to upstage her. I told her she had my offer and could take it or leave it. My brothers are annoyed by our sister but think she will make a scene at the anniversary party. I don’t want that to happen but I don’t think I am wrong for laying this boundary. What do I do?

—Tripping Up

Dear Tripping Up,

If I were playing devil’s advocate, I’d wonder if her husband is in the hole with student loans (he still could be), and that’s why she has a hard time parting with the money. But… it sounds like she’s living a pretty good life, complete with fancy vacations she prioritizes for herself. You and your brothers have done a lot over the past four years to make this gift happen, while she remained silent. Actions speak louder than words and she needs to learn that the hard way.

Her feeling like you’re trying to “outshine her” has nothing to do with you and everything to do with her. She’s worried about how she’ll look to your parents, but guess what? That’s for her to deal with. It’s not your problem to solve. When she calls again, explain to her that you’re done talking about this and that your offer still stands. If she starts to be rude, tell her to have a nice day and hang up.

As to her making a possible scene at the party? That’s double embarrassing for her. If your parents ask for the details, you can share that your sister knew for the past few years and then let them assess the situation for themselves.

Dear Pay Dirt,

For the past three years I have been making it my job to put money in my kids’ (ages 3 and 5) piggy banks. For example, we celebrate both Christmas and Hanukkah and for Hanukkah, I put $10 a night in their piggy bank rather than give them more toys (which they already have more than enough of). After three years, they each have about $400 in their piggy banks and now I want to do something smart with that money so that when they are teenagers they can have that money to put toward something special (a car, a meaningful trip, etc.). I’m hoping this can be the start of a longer conversation on savings with them as they mature. I’m looking into simple savings accounts at my local bank but I was wondering if you had other suggestions. I’m not interested in putting it into a 529 as I see this as being their “fun” money for the future.

—The Pigs Are Full

Dear Pigs Are Full,

What fun ages! There are a lot of online platforms and apps that can help you teach your children about money while allowing them the flexibility to spend wisely. One of the platforms that I love and recommend you look into when your children are older is Greenlight. The fun, interactive app doubles as their checking and savings account—with access to a real, physical debit card, too. It tracks their spending while sending you alerts to help you monitor where their money is going. It’s got a slew of other helpful features so it’s something to keep in mind.

Since they are still young, this platform probably isn’t the right fit yet. In the meantime, I’d open a child’s savings account with a great annual percentage yield (APY) and continue to make deposits or withdrawals from there—a process you can rope them into once they’re older. You can also make a savings account chart for their room on a dry-erase board. You can create a total amount they’re reaching for (say $1,000) and then have them color it in (or erase) every time they either save or spend, say on a toy, so they can see how their money works in real-time.

Want more Pay Dirt every week? Sign up for Slate Plus now.

Dear Pay Dirt,

My husband (a 53-year-old man) refuses to believe that the stock market can be a good investment. He thinks it is a scam. Getting him to contribute to his Simple IRA and Roth every year is a fight and he says all of the time that he just wants to pull all his money out, pay the taxes, and invest in something else (real estate? actual gold and silver?) I (44) completely disagree. I have a business degree and worked for a variable annuity company for several years before I left to help him start our construction business. He has worked in construction since high school. He is very smart but hasn’t taken the time to learn anything about investing. I agree that diversifying your investments is a good thing but we don’t have the money to buy investment property or houses. Even if we did, I would still want to make our full contributions to retirement accounts every year. How can I reassure him that, over time, the stock market can give you a good return?

—No Stock In the Market

Dear No Stock,

I don’t blame your husband for being scared, although it sounds like a source of contention (understandably!). The stock market has been rough lately, and at age 53, he’s already seen this play out a few times. You and I both know that when investing, you have to be willing to play the long game to make out like a bandit, with an exception here and there.

Since he wants a diverse portfolio but has a low-risk tolerance, I’d consider suggesting he invest in saving bonds, which the U.S. Department of Treasury backs. You’re automatically guaranteed interest (the current interest rate for I-Bonds is 6.89 percent if purchased by April 30th, 2023) and can cash out the bond after only a year. After watching the I-Bond reliably grow, he may be more tempted to move on to other investment opportunities, such as index funds or mutual funds. And it may grow his confidence in the whole process, too.

Dear Pay Dirt,

I’ve always been unenthusiastic about debt. Right now I have only two accounts: my and my husband’s mortgage (which we’ve had for 14 years) and one credit card that I use for most of my expenses and auto-pay every month. My credit score is good (744 on one service, 800 on another). My husband is ending our marriage and we are selling the house, and I don’t plan to buy another in the near term. How do I keep my good credit score up if I’m going to have fewer accounts?

—Solo Score

Dear Solo Score,

I’m so sorry about your divorce. But I am happy that you are looking out for yourself and your finances.

After your mortgage is paid off, your lender will report that your loan is now closed and paid in full to the three major credit bureaus. Your paid-off mortgage will then be on your credit for up to 10 years. Despite having one less account on your credit report, the paid-off mortgage should act as a bonus and show up positively on your credit history. But you’re right, your score will take a small hit because you’ll no longer have an installment loan open and will be left with just a credit card. Lenders prefer when you have a mix of accounts open. I wouldn’t worry too much about it, though, that dip should only be temporary and will eventually climb back up.

But if you want to work on building out your score, you can always open another credit card for additional expenses. The more credit you have available to you, the less of a utilization rate you’ll have, and that can help. Also, if you are looking to make a bigger purchase, like furniture, a computer, or another big-ticket item, you can consider financing it with an installment loan. This will help show lenders you have a mix of debt, which is what your mortgage was providing. Good luck!

—Athena

Classic Prudie

My mother-in-law lived with us briefly a few months back. She was living with us because she had gotten back on drugs after five years of sobriety and almost died from stomach ulcers. We gave her a place to stay because she swore it was a one-time mistake caused by the man she was seeing at the time. She told all of us she was done with this man, who was letting her bleed to death on the bathroom floor. A couple weeks ago, she received a large insurance settlement for a car accident.