NEWYou can now listen to Fox News articles!

When President Biden has floated the plan of canceling “some” pupil financial loan credit card debt — an strategy both equally GOP and Democrat lawmakers alike are alarmed by, stating it would price the federal government also much money and increase to inflation — some faculty graduates with weighty credit card debt loans usually are not waiting all-around for somebody or one thing to bail them out.

They’re pushing ahead, undertaking what’s correct — and figuring out a way to shell out off their have personal debt.

And for just one Rutgers University graduate, that associated a novel plan.

New Jersey indigenous Pathik Oza graduated in 2018 with a B.A. from Rutgers College — he examined psychology and biology — with $70,000 in pupil financial loans, he explained to Fox News Digital in an interview.

OHIO Couple, Mom and dad OF TWO, GET Enormous Scholar Bank loan Personal debt Guiding THEM

And while Oza commenced pursuing an additional degree ahead of his prepare to attend health care college, he also located a passion for rehoming utilized and discarded guides.

“I was going for walks all-around just one working day during the summertime, and I saw guides lying there, and I believed there would be an opportunity,” he claimed.

O3 Publications founder Pathik Oza of North Brunswick, N.J., for the duration of a new Zoom interview with Fox Information Digital about having to pay down his scholar credit card debt. “I just began this volunteer get the job done in which I would obtain undesired publications,” he stated.

(Fox News Electronic)

“Why would books be thrown away? They could be redistributed to somebody who may perhaps have to have them. So I just commenced this volunteer do the job where I would acquire undesirable books,” he told Fox News Electronic.

What started as a type gesture and a chance to give back to area libraries, universities, shelters and children’s hospitals turned into a sparkling new company possibility.

An raising range of requests for textbooks and a higher need for his companies became anything far also massive for just Oza and his Toyota RAV4 to handle.

Pathik Oza designed the choice to flip reselling guides into a worthwhile organization.

So Oza produced the determination to convert reselling textbooks into a organization. He began off by opening an Amazon account.

He named his business enterprise O3 Guides.

FLORIDA-Dependent Mother PAYS OFF $40K IN College student Debt Soon after Residing ‘PAYCHECK TO PAYCHECK’

“The profit would hold coming in, and it retained expanding,” he claimed. “[In about] a month or so, I had about 1,000 to 2,000 books in Amazon warehouses. So it was fairly great to see the growth in the organization.”

Oza continued to develop by launching a web site and opening an Etsy shop, which “blew up” when the globe was locked down through the coronavirus pandemic.

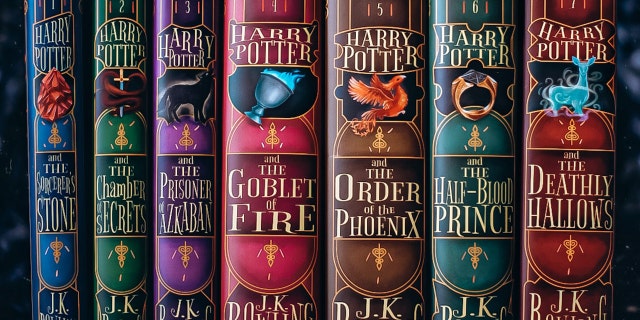

O3 Books’ authentic dust jacket styles for J.K. Rowling’s “Harry Potter” e-book series are proven below. (Pathik Oza/O3 Publications)

He also uncovered that there was specifically higher demand for his décor guide sets and redesigned dust jackets he moved in that direction to assistance spruce up the backgrounds of do the job-from-home Zoom conferences.

By the stop of 2020, Oza experienced built $115,000 from his side business — which protected his student loans in entire, and then some.

Oza discovered “a large amount about finances,” he mentioned, by having to pay off his financial loans and by fueling his own little organization at the exact time.

Oza explained he uncovered “a whole lot about funds” by spending off his loans and by fueling his very own company at the identical time.

OHIO Author Paid out OFF $48K IN Scholar Financial loans IN 14 MONTHS: IT WAS ‘AN ADVENTURE’

Nowadays, the 25-calendar year-previous reported he would experience “extra snug” using on unique varieties of borrowing in the long run primarily based on the financial information he’s accrued.

The results of O3 Books is now having to pay for Oza’s 2nd diploma in complete, reducing the load of needing to choose out an additional bank loan.

Pathik Oza of N.J. begun O3 Publications — and employed the money he made from his new small business to totally shell out off his scholar mortgage personal debt.

(Pathik Oza)

The tiny business enterprise owner has considering that switched profession paths.

He is been pursuing a degree in computer science, though the believed of hefty med school financial loans potentially in his upcoming gave him an further increase to take care of personal debt he currently experienced.

“I felt it was urgent to spend those off,” he explained.

HOW TO Decide WHICH University student Financial loans TO Fork out OFF Initial

For other learners with financial debt who are hunting for a way to fork out down their financial loans, Oza claimed weighing the possibility of starting off a modest company is a superior strategy. He primarily recommended taking advantage of online marketplaces like Amazon and Etsy.

“Any enthusiasm you’ve started off, there’s unquestionably a industry for it,” he explained.

“You only need a tiny part [of the population] to [help] generate revenue in sales. As prolonged as you have 1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of the prospects, you have a entire-fledged organization,” he added. “There’s generally a marketplace for one thing.”

Growing his possess business enterprise has specified Oza a enhance in phrases of fiscal literacy, so he also recommended that conserving and investing one’s income is normally the “finest choice.”

ROWE: Thought OF CANCELING Student Personal loan Personal debt ‘MAKES ME CRAZY’

“Make absolutely sure to fully grasp funds and how you can greatest allocate your cash flow,” he said. “Financial loans are a burden no one particular wishes — but you will get rid of them.”

O3 Textbooks founder Pathik Oza shared strategies for other learners with debt to spend down their financial loans. “Social media has opened up quite a few options to market your capabilities and permit you to produce a facet or perhaps full-time profits,” he said.

(Pathik Oza)

Oza hopes just one working day to leave O3 Textbooks with his mothers and fathers — as a continuous outlet for supplemental revenue. In other words, he would like it to keep in the relatives.

“This is an remarkable facet profits I’ll keep for good,” he reported. “I crafted a brand name all-around it. I created a community around it. So, it is something I can not allow go.”

“There is a current market for your talent and there are several platforms you can use to showcase your ability.”

Oza also shared supplemental guidelines for any person needing added profits or hard cash to shell out down their scholar personal debt.

“I would suggest finding a aspect-time task — and if you do not have that much time, then use all those obtainable several hours to make cash with a ability you have,” he said.

Click on Below TO Signal UP FOR OUR Life style Newsletter

“It could be just about anything like advertising and marketing, artwork, web style, application improvement or training … There is a market for your talent and there are numerous platforms you can use to showcase your talent.”

“For example,” he additional, “Instagram is an excellent area for artists to showcase their artwork … The very best component about this is you can do the job when you are obtainable.”

Click Below TO GET THE FOX News Application

Claimed Oza, “Social media has opened up several prospects to current market your skills and allow for you to develop a facet or likely total-time money from a passion or talent you have. Yet again, if your circumstance lets you to do this, attempt to lower your investing costs as a lot as feasible.”