Frequent visitors will know that we adore our dividends at Simply Wall St, which is why it can be thrilling to see Provident Monetary Products and services, Inc. (NYSE:PFS) is about to trade ex-dividend in the following 4 times. The ex-dividend day takes place a person working day in advance of the history date which is the day on which shareholders need to be on the company’s textbooks in purchase to receive a dividend. It is essential to be informed of the ex-dividend date simply because any trade on the stock demands to have been settled on or ahead of the report date. Indicating, you will want to obtain Provident Money Services’ shares right before the 10th of February to obtain the dividend, which will be paid out on the 25th of February.

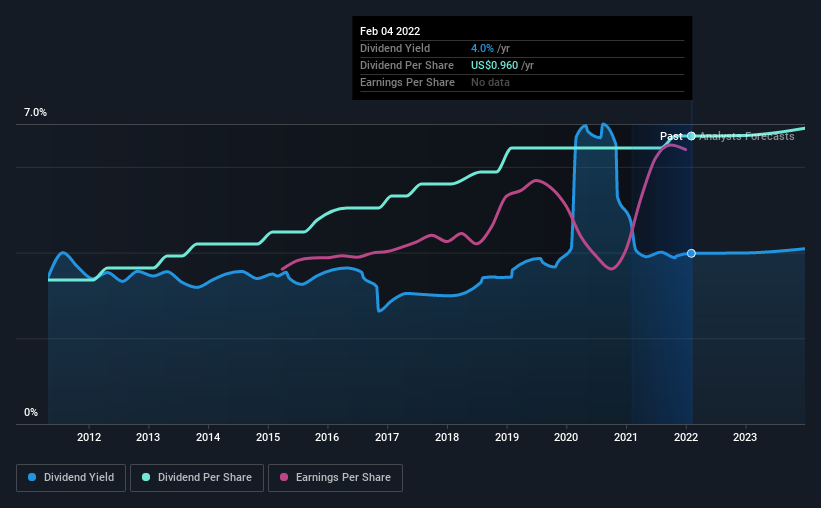

The firm’s following dividend payment will be US$.24 per share. Very last year, in whole, the corporation dispersed US$.96 to shareholders. Previous year’s full dividend payments present that Provident Economical Companies has a trailing yield of 4.{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} on the latest share value of $24.11. Dividends are an important resource of money to many shareholders, but the well being of the business enterprise is crucial to preserving these dividends. So we need to have to examine irrespective of whether Provident Monetary Products and services can afford to pay for its dividend, and if the dividend could mature.

Dividends are usually paid out out of company cash flow, so if a company pays out far more than it acquired, its dividend is usually at a higher risk of becoming slice. Provident Money Services compensated out a at ease 42{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of its profit very last 12 months.

Generally talking, the lower a firm’s payout ratios, the much more resilient its dividend typically is.

Click here to see the company’s payout ratio, plus analyst estimates of its long term dividends.

Have Earnings And Dividends Been Rising?

Firms with robust expansion potential clients normally make the greatest dividend payers, since it is easier to improve dividends when earnings for each share are improving. If earnings decline and the organization is pressured to lower its dividend, investors could check out the benefit of their financial investment go up in smoke. This is why it is a reduction to see Provident Monetary Products and services earnings per share are up 9.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} for each annum about the previous 5 yrs.

The principal way most buyers will assess a firm’s dividend potential clients is by checking the historical amount of dividend growth. In the previous 10 a long time, Provident Monetary Solutions has greater its dividend at roughly 7.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} a 12 months on average. It really is encouraging to see the business lifting dividends although earnings are expanding, suggesting at the very least some corporate desire in satisfying shareholders.

The Bottom Line

Is Provident Monetary Products and services truly worth buying for its dividend? Provident Economical Providers has seen its earnings for every share develop bit by bit in modern years, and the business reinvests a lot more than 50 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of its revenue in the business enterprise, which frequently bodes effectively for its upcoming prospective buyers. Provident Monetary Companies ticks a lot of containers for us from a dividend point of view, and we imagine these characteristics should really mark the company as deserving of further awareness.

In light of that, when Provident Monetary Companies has an interesting dividend, it’s worth figuring out the hazards associated with this inventory. Our investigation shows 1 warning indicator for Provident Monetary Companies and you should really be informed of this prior to obtaining any shares.

We would not recommend just shopping for the very first dividend inventory you see, although. Here is a list of interesting dividend shares with a increased than 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} produce and an upcoming dividend.

Have comments on this write-up? Anxious about the written content? Get in touch with us right. Alternatively, electronic mail editorial-crew (at) simplywallst.com.

This report by Just Wall St is typical in character. We deliver commentary primarily based on historical knowledge and analyst forecasts only applying an unbiased methodology and our content are not meant to be money assistance. It does not represent a advice to acquire or sell any inventory, and does not choose account of your aims, or your money problem. We intention to bring you prolonged-phrase focused investigation driven by essential information. Be aware that our investigation could not element in the latest price-delicate business announcements or qualitative materials. Merely Wall St has no place in any stocks outlined.

The views and thoughts expressed herein are the sights and views of the writer and do not always replicate people of Nasdaq, Inc.