Provident Money Expert services, Inc. (NYSE:PFS) stock is about to trade ex-dividend in a few times. The ex-dividend date is one particular company day prior to a firm’s file day, which is the date on which the corporation establishes which shareholders are entitled to acquire a dividend. The ex-dividend day is crucial as the system of settlement involves two full organization days. So if you overlook that date, you would not demonstrate up on the company’s publications on the record day. Consequently, if you purchase Provident Money Services’ shares on or right after the 9th of November, you won’t be suitable to get the dividend, when it is compensated on the 25th of November.

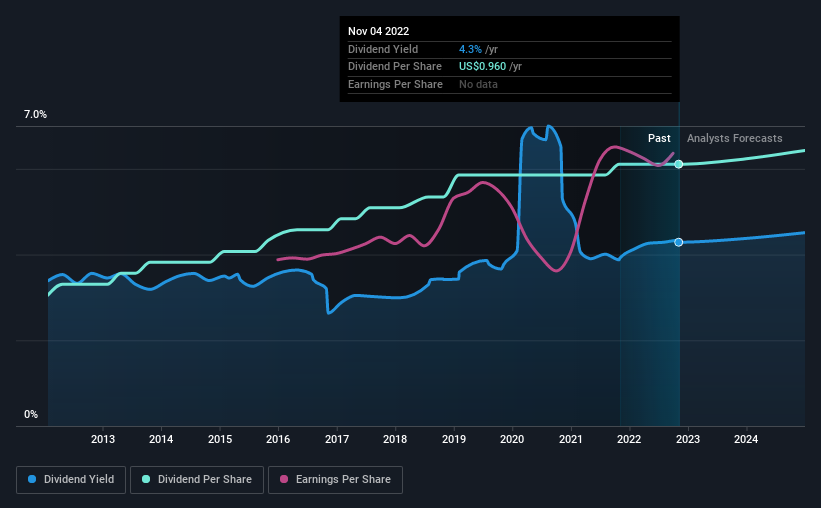

The firm’s upcoming dividend is US$.24 a share, next on from the final 12 months, when the business distributed a overall of US$.96 for each share to shareholders. Seeking at the past 12 months of distributions, Provident Money Providers has a trailing generate of roughly 4.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} on its current inventory cost of $22.39. Dividends are a major contributor to investment decision returns for lengthy time period holders, but only if the dividend proceeds to be paid. That is why we ought to usually examine no matter whether the dividend payments appear sustainable, and if the firm is increasing.

Examine out our most up-to-date examination for Provident Fiscal Companies

Dividends are ordinarily compensated from firm earnings. If a enterprise pays far more in dividends than it attained in profit, then the dividend could be unsustainable. Which is why it is fantastic to see Provident Financial Companies paying out out a modest 44{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of its earnings.

Companies that pay back out less in dividends than they generate in revenue typically have far more sustainable dividends. The lower the payout ratio, the far more wiggle place the company has before it could be forced to slash the dividend.

Click on below to see the firm’s payout ratio, plus analyst estimates of its long term dividends.

Have Earnings And Dividends Been Rising?

Companies with powerful development potential clients ordinarily make the ideal dividend payers, simply because it is much easier to mature dividends when earnings for every share are improving upon. Buyers really like dividends, so if earnings tumble and the dividend is lowered, count on a stock to be marketed off intensely at the exact same time. This is why it can be a relief to see Provident Money Companies earnings for every share are up 9.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} per annum above the last five several years.

The main way most buyers will assess a company’s dividend potential clients is by checking the historic fee of dividend growth. Due to the fact the start off of our knowledge, 10 many years in the past, Provident Money Services has lifted its dividend by about 7.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} a year on typical. We’re glad to see dividends climbing together with earnings in excess of a amount of several years, which might be a signal the business intends to share the development with shareholders.

Ultimate Takeaway

Is Provident Economical Solutions an interesting dividend inventory, or improved still left on the shelf? It has been developing its earnings for every share rather in latest many years, even though it reinvests extra than half its earnings in the business enterprise, which could suggest there are some expansion assignments that have not yet attained fruition. In summary, Provident Fiscal Services seems to have some promise as a dividend inventory, and we’d counsel having a closer search at it.

In light-weight of that, though Provident Monetary Products and services has an captivating dividend, it really is value realizing the threats concerned with this inventory. For illustration – Provident Fiscal Solutions has 1 warning sign we assume you should be mindful of.

Usually, we wouldn’t advise just shopping for the first dividend inventory you see. Here’s a curated list of interesting shares that are powerful dividend payers.

Have feedback on this article? Involved about the articles? Get in contact with us instantly. Alternatively, electronic mail editorial-group (at) simplywallst.com.

This posting by Basically Wall St is basic in character. We offer commentary based mostly on historic facts and analyst forecasts only using an unbiased methodology and our articles are not meant to be financial guidance. It does not constitute a suggestion to get or sell any stock, and does not consider account of your goals, or your monetary scenario. We aim to bring you extended-expression centered assessment driven by essential data. Observe that our examination may well not component in the most recent price tag-sensitive company announcements or qualitative material. Basically Wall St has no position in any stocks described.

Sign up for A Compensated User Study Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time when encouraging us establish improved investing instruments for the personal traders like you. Indicator up below