Provident Economic Expert services, Inc. (NYSE:PFS) has declared that it will pay back a dividend of US$.24 per share on the 27th of May. The dividend generate is 4.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} based on this payment, which is a minimal bit minimal as opposed to the other providers in the industry.

Examine out our most recent evaluation for Provident Fiscal Providers

Provident Money Services’ Dividend Is Nicely Protected By Earnings

Whilst yield is significant, one more element to contemplate about a firm’s dividend is whether or not the recent payout ranges are feasible. The previous dividend was very quickly protected by Provident Money Services’ earnings. This implies that a ton of the earnings are currently being reinvested into the organization, with the goal of fueling advancement.

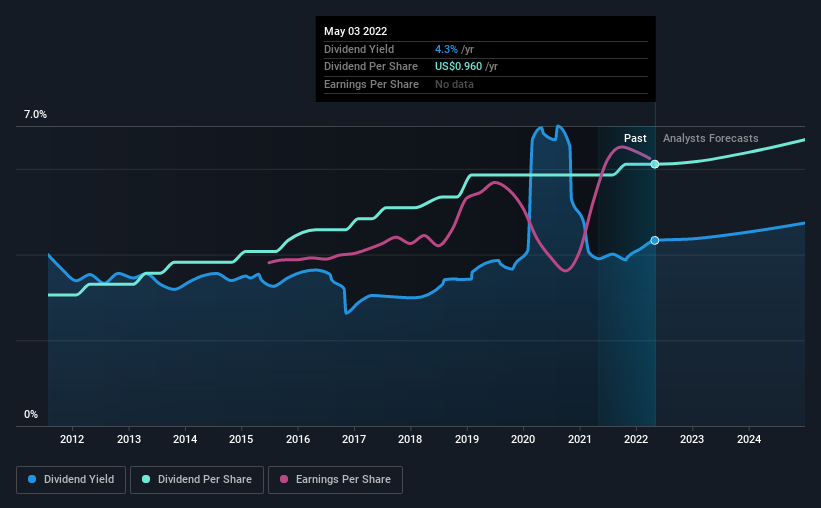

The subsequent year is established to see EPS expand by 4.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. Assuming the dividend proceeds along new tendencies, we believe the payout ratio could be 44{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} by up coming calendar year, which is in a very sustainable selection.

Provident Economic Services Has A Good Track Record

The organization has a sustained file of shelling out dividends with pretty tiny fluctuation. The first once-a-year payment during the previous 10 decades was US$.48 in 2012, and the most current fiscal calendar year payment was US$.96. This is effective out to be a compound once-a-year growth amount (CAGR) of roughly 7.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} a year in excess of that time. The growth of the dividend has been really trusted, so we assume this can present investors some nice supplemental earnings in their portfolio.

We Could See Provident Monetary Services’ Dividend Developing

Investors who have held shares in the company for the earlier handful of years will be satisfied with the dividend earnings they have obtained. Provident Fiscal Products and services has impressed us by growing EPS at 9.{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} for every yr over the earlier 5 decades. Earnings are on the uptrend, and it is only paying a small portion of individuals earnings to shareholders.

Provident Money Solutions Appears Like A Great Dividend Inventory

General, we assume that this is a excellent earnings financial investment, and we feel that maintaining the dividend this 12 months could have been a conservative selection. Earnings are effortlessly masking distributions, and the organization is making lots of cash. Using this all into consideration, this looks like it could be a superior dividend chance.

Buyers frequently are inclined to favour businesses with a steady, steady dividend plan as opposed to people functioning an irregular one. However, investors require to look at a host of other elements, apart from dividend payments, when analysing a enterprise. Having the discussion a little bit further more, we have determined 1 warning signal for Provident Monetary Providers that traders need to be aware of relocating forward. Is Provident Economical Providers not fairly the option you were being hunting for? Why not look at out our selection of top rated dividend shares.

Have opinions on this report? Worried about the information? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply just Wall St is normal in nature. We offer commentary centered on historic facts and analyst forecasts only using an impartial methodology and our articles or blog posts are not meant to be money advice. It does not constitute a advice to invest in or sell any inventory, and does not acquire account of your targets, or your monetary situation. We goal to deliver you very long-term concentrated evaluation driven by essential facts. Take note that our evaluation may not issue in the latest price-sensitive enterprise announcements or qualitative content. Only Wall St has no place in any stocks talked about.