SIOUX Metropolis — Smaller nonfarm enterprises in 12 Northwest Iowa counties are eligible to utilize for very low-curiosity federal catastrophe financial loans from the U.S. Tiny Business Administration, the SBA introduced Thursday.

The financial loans are intended to offset economic losses for the reason that of reduced revenues induced by drought in the pursuing main counties that began July 5, in accordance to an SBA push launch.

The primary counties are Cherokee and O’Brien neighboring counties involve Buena Vista, Clay, Dickinson, Ida, Lyon, Osceola, Plymouth, Sac, Sioux and Woodbury County.

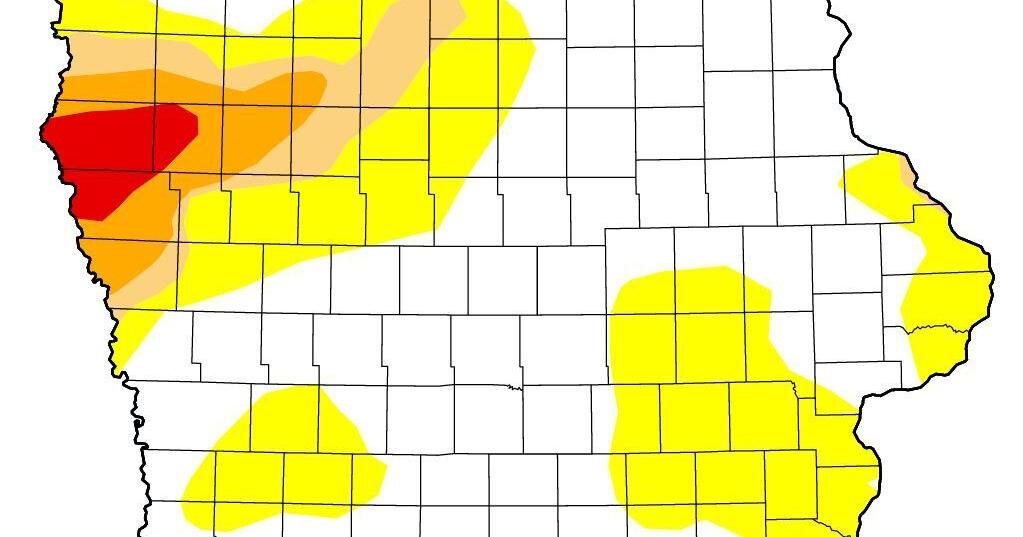

Substantially of Northwest Iowa is presently in a drought to some diploma or another. According to the U.S. Drought Keep track of, most of Plymouth County and substantial spots of Cherokee and Woodbury County are in a condition of intense drought at the second in each individual of these counties, the element not currently rated at excessive drought is in severe drought. Every single of the other counties is rated at possibly serious drought, average drought or abnormally dry, besides for the northern pieces of Osceola, Dickinson and Lyon County.

Folks are also reading…

Small nonfarm corporations, small agricultural cooperatives, small companies engaged in aquaculture and most non-public nonprofit businesses of any measurement might qualify for Financial Injury Disaster Financial loans of up to $2 million to assistance satisfy money obligations and running fees which could have been met had the disaster not occurred.

The loans have an curiosity fee of 2.935 per cent for businesses and 1.875 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} for private nonprofit businesses and have a greatest payoff expression of 30 years. They are readily available to little corporations and most nonprofits that never have the economic wherewithal to offset the impacts of drought devoid of hardship, said Tanya N. Garfield, director of SBA’s Catastrophe Field Functions Center-West

“Eligibility for these loans is primarily based on the monetary influence of the disaster only and not on any actual home destruction,” Garfield said in a statement.

The SBA can make Economic Personal injury Disaster Loans readily available when the U.S. Secretary of Agriculture designates an agricultural disaster. Tom Vilsack, the Secretary of Agriculture, declared a disaster on July 11.

Enterprises generally engaged in farming or ranching are not suitable for SBA catastrophe help, according to an SBA press release. Agricultural enterprises must get in touch with the Farm Companies Company about the U.S. Section of Agriculture aid produced offered by the Secretary’s declaration. Nurseries, on the other hand, are suitable for SBA disaster aid in drought disasters.

Candidates may utilize on the web, obtain supplemental catastrophe guidance information and down load apps at disasterloanassistance.sba.gov. Applicants might also contact SBA’s Shopper Services Centre at (800) 659-2955 or e mail disastercustomerservice@sba.gov for far more data on SBA catastrophe support. For folks who are deaf, difficult of hearing, or have a speech incapacity, please dial 7-1-1 to entry telecommunications relay expert services. Accomplished purposes really should be mailed to U.S. Tiny Enterprise Administration, Processing and Disbursement Heart, 14925 Kingsport Road, Fort Truly worth, TX 76155.

The deadline to apply for financial harm is March 13, 2023.