Some traders rely on dividends for expanding their wealth, and if you might be one of all those dividend sleuths, you may possibly be intrigued to know that The PNC Financial Companies Team, Inc. (NYSE:PNC) is about to go ex-dividend in just three days. The ex-dividend date occurs a person working day before the history day which is the working day on which shareholders need to have to be on the company’s guides in get to receive a dividend. The ex-dividend date is of consequence since any time a stock is purchased or bought, the trade can take at the very least two business enterprise day to settle. Meaning, you will need to have to acquire PNC Economical Expert services Group’s shares just before the 14th of October to get the dividend, which will be paid on the 5th of November.

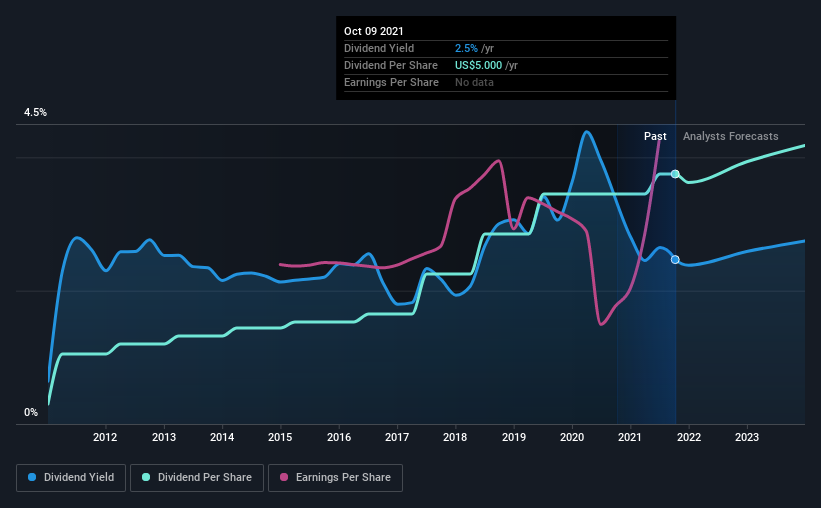

The firm’s upcoming dividend payment will be US$1.25 for each share. Previous yr, in overall, the enterprise dispersed US$5.00 to shareholders. Final year’s whole dividend payments demonstrate that PNC Monetary Companies Team has a trailing generate of 2.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} on the present-day share price tag of $202.76. If you get this small business for its dividend, you ought to have an thought of whether PNC Economical Services Group’s dividend is trustworthy and sustainable. That is why we should really always verify no matter whether the dividend payments surface sustainable, and if the enterprise is developing.

Verify out our most up-to-date analysis for PNC Fiscal Expert services Team

Dividends are commonly paid out of organization earnings, so if a company pays out a lot more than it earned, its dividend is commonly at a larger chance of staying lower. Luckily PNC Monetary Products and services Group’s payout ratio is modest, at just 35{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of earnings.

Providers that pay out out a lot less in dividends than they get paid in gains normally have extra sustainable dividends. The lower the payout ratio, the more wiggle home the small business has in advance of it could be pressured to lower the dividend.

Simply click below to see the firm’s payout ratio, in addition analyst estimates of its upcoming dividends.

Have Earnings And Dividends Been Growing?

Stocks in businesses that crank out sustainable earnings expansion often make the ideal dividend prospective buyers, as it is a lot easier to lift the dividend when earnings are rising. If earnings decrease and the business is forced to slice its dividend, investors could observe the worth of their financial investment go up in smoke. Fortuitously for readers, PNC Financial Expert services Group’s earnings per share have been increasing at 12{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} a yr for the previous five yrs.

The key way most investors will assess a company’s dividend prospective clients is by examining the historical level of dividend growth. PNC Financial Companies Team has sent 29{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} dividend progress per yr on common in excess of the earlier 10 years. Both equally for each-share earnings and dividends have both been rising fast in latest periods, which is terrific to see.

To Sum It Up

Has PNC Money Services Group got what it usually takes to keep its dividend payments? When businesses are escalating speedily and retaining a bulk of the revenue inside the business, it truly is usually a sign that reinvesting earnings creates far more worth than spending dividends to shareholders. This tactic can add significant benefit to shareholders more than the very long phrase – as very long as it truly is carried out with out issuing far too several new shares. We feel this is a pretty eye-catching blend, and would be interested in investigating PNC Economical Solutions Team extra intently.

With that in thoughts, a important aspect of comprehensive stock study is staying aware of any hazards that inventory at present faces. In conditions of expense dangers, we’ve discovered 1 warning indicator with PNC Economical Companies Team and understanding them really should be aspect of your financial investment system.

We would not endorse just buying the 1st dividend stock you see, although. Here’s a listing of exciting dividend shares with a higher than 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} generate and an impending dividend.

This short article by Simply Wall St is common in character. We supply commentary based mostly on historical knowledge and analyst forecasts only working with an unbiased methodology and our content articles are not meant to be money information. It does not constitute a recommendation to acquire or provide any inventory, and does not acquire account of your aims, or your economic problem. We aim to convey you prolonged-expression centered evaluation driven by basic knowledge. Take note that our examination may well not issue in the most recent value-delicate firm bulletins or qualitative substance. Merely Wall St has no posture in any shares pointed out.

Have comments on this posting? Anxious about the material? Get in contact with us immediately. Alternatively, e-mail editorial-staff (at) simplywallst.com.