Flavors of Italy, a Native Hawaiian, woman-owned enterprise, has been issued a $250,000 Hua Kanu personal loan by the Workplace of Hawaiian Affairs’ Mālama Loans system.

Desiree Kanae Loperfido, a Division of Hawaiian Home Lands beneficiary, and her spouse, chef Donato Loperfido, operates the business that imports and distributes alcoholic beverages and specializes in a large assortment of wines and cheese.

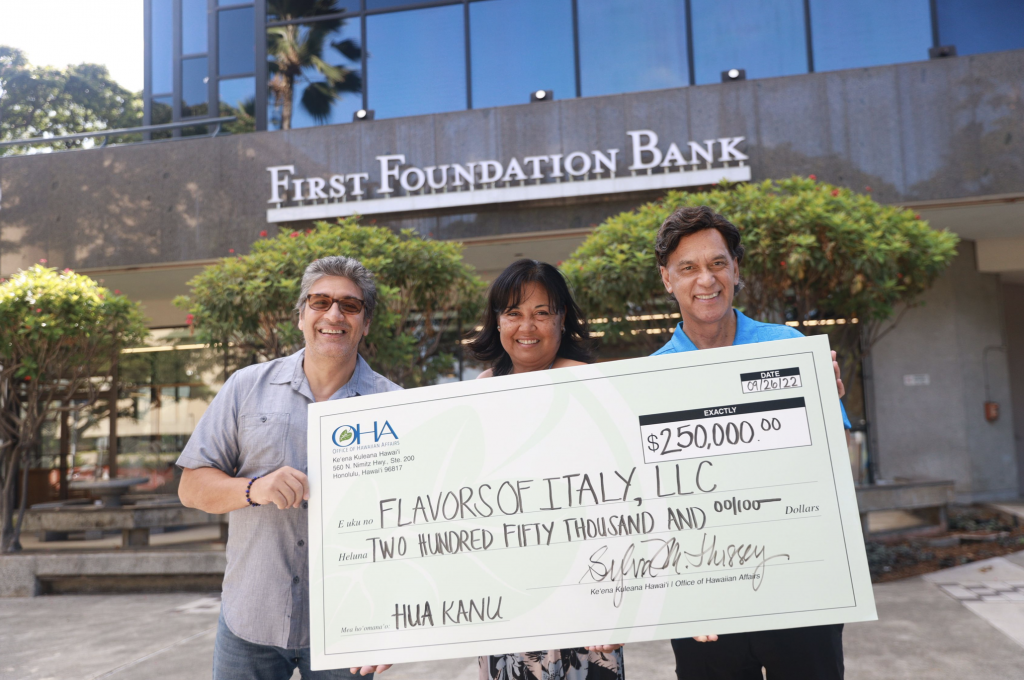

A bank loan signing ceremony was held Sept. 26 at Initial Foundation, OHA’s economic lending spouse, in Kakaʻako.

“What will make Flavors of Italy this sort of a superior applicant for this bank loan is the energy of their business enterprise which has been in procedure considering the fact that 2005,” claimed Aikūʻē Kalima, OHA’s Mālama Financial loans manager. “Desiree and Donato have immediate ties to Italy, which lets the organization to import and distribute solutions competitively.”

Flavors of Italy, positioned in Honolulu, provides it products to local places to eat, resorts these kinds of as the Four Seasons and to grocery stores including Foodland and Entire Foods Marketplace. The firm has grown from a humble start out in 2005 when they imported just just one pallet of merchandise to today the place they at the moment convey in 8 to 10 containers of wine and cheese each individual 12 months.

Desiree Loperfido claimed the company will use the mortgage resources to develop the company by building stock and acquiring further tools. The small business is also predicted to begin producing cheeses this kind of as refreshing mozzarella, getting rid of transportation and shipping and delivery charges, and producing Hawaiʻi extra sustainable.

Loperfido, born and elevated on a Nānākuli homestead, said she attended schooling on how to apply for a Mālama Loan years in the past, and remembered the OHA system when they were on the lookout to build their business.

“I spoke with my spouse, and we made the decision to get to out to OHA and see if they could enable us for the reason that we have to have that additional money to grow our organization,” she explained. “The interest fees are great, and we are incredibly appreciative of what OHA and its Mālama Financial loans application does for the Hawaiian community. We’re grateful for the support, since we genuinely needed it.”

OHA Board Chair Carmen “Hulu” Lindsey said a single of the agency’s strategic goals is to boost the number of company loans to Division of Hawaiian Home Lands beneficiaries who are intrigued in commencing a new small business, or deliver operating cash to present enterprise entrepreneurs.

“We’re attempting to guide these beneficiaries by escalating their fiscal capabilities and making financial self-sufficiency, and this small business loan to Flavors of Italy is a fantastic instance of that function,” Lindsey stated.

OHA’s Hua Kanu Small business Loans offer extremely skilled small business owners seven-yr reduced desire level financial loans ranging from $150,000 to $1 million, while Mālama Small business Loans target startup and small enterprises with financial loans of $2,500 to $149,999.

Mālama Mahi ʻAi Agriculture, Mālama Dwelling Improvement, Mālama Credit card debt Consolidation and Mālama Education are the other OHA courses that comprise the Mālama Financial loans software.

OHA’s Mālama Loans program tap into a federal funding stream available as a result of the Administration for Native Us citizens and would make the federal cash accessible locally to Hawaiians to extend their companies, increase their houses and help pay for academic fees.

Discover far more about OHA loans at oha.org/loans or call 808-594-1924.