12 April 2022

- Credit score criteria tightened for firms owing to perceptions of elevated danger, with even more tightening anticipated

- Bank loan desire from companies continued to improve, driven largely by doing work money needs

- ECB’s monetary policy observed to carry on to guidance lending, but much less so than in previous study rounds

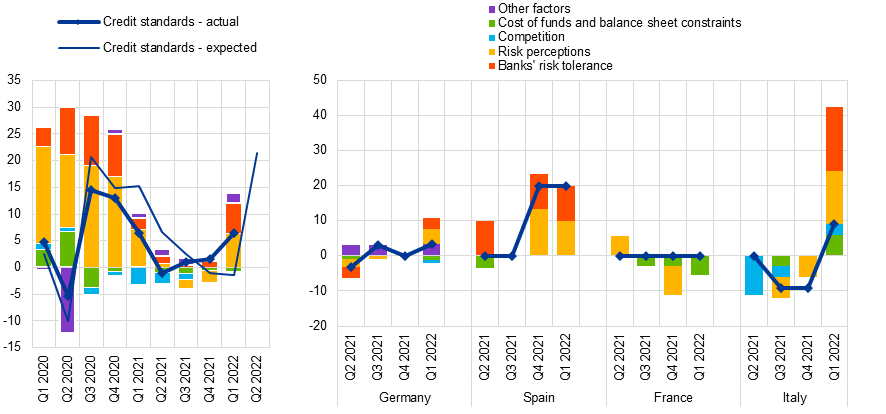

According to the April 2022 euro region financial institution lending survey (BLS), credit criteria – i.e. banks’ inner tips or financial loan acceptance criteria – for loans or credit history strains to enterprises tightened (internet share of financial institutions standing at 6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, see Chart 1) in the initially quarter of 2022. Relating to loans to households for residence buy, euro place financial institutions reported a slight web tightening of credit history criteria (web share of 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}), whilst credit score criteria for customer credit and other lending to households continued to relieve (net share of -5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}). Banking institutions referred to perceptions of improved chance and diminished possibility tolerance, in the context of substantial uncertainty, supply chain disruptions and substantial energy and input selling prices, as elements driving the internet tightening of credit score criteria for corporations. For the second quarter of 2022, banking institutions count on a noticeably more robust internet tightening of credit history criteria for financial loans to companies, probable reflecting the unsure economic influence of the war in Ukraine and the anticipation of significantly less accommodative monetary plan. In addition, banks expect a moderate net tightening of credit score criteria for housing loans and for customer credit rating and other lending to households.

Banks’ total conditions and ailments – i.e. the real terms and conditions agreed in personal loan contracts –tightened moderately for loans to firms and loans to households for residence invest in in the to start with quarter of 2022. For loans to firms, this was predominantly due to a significant widening of margins on riskier financial loans, though margins on typical loans widened much less. For consumer credit and other lending to homes, in general conditions and situations eased marginally on account of narrower loan margins.

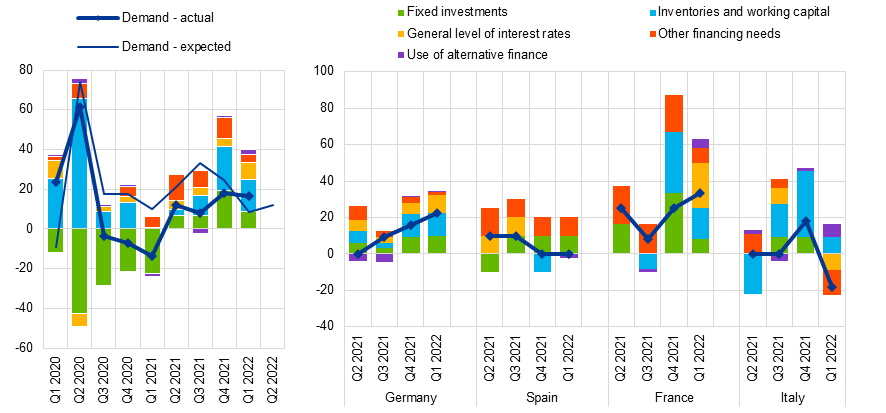

Banks documented, on equilibrium, a ongoing increase in firms’ demand from customers for loans or drawing of credit history strains in the 1st quarter of 2022 (see Chart 2). Personal loan demand from customers was pushed by a sturdy beneficial effect of financing needs of corporations for doing the job cash, reflecting source chain disruptions as very well as precautionary inventories and liquidity holdings. Fastened investment decision ongoing to have a optimistic impact on loan demand from customers, but much less than in the prior quarter. In addition, the low standard level of desire prices as effectively as other funding demands, such as mergers and acquisitions exercise and credit card debt refinancing and restructuring, contributed positively to loan need from companies. Demand for housing financial loans and for buyer credit score and other lending to homes greater additional in web terms in the initial quarter of 2022. The internet raise in housing bank loan demand from customers was mostly pushed by the common stage of fascination fees. Desire for customer credit was supported by paying out on sturdy intake products and – to a lesser extent – by client self-assurance. For the 2nd quarter of 2022, banking companies hope a ongoing net increase in firms’ loan need, but a net decrease in the demand from customers for housing financial loans and broadly unchanged demand for consumer credit score.

In accordance to the banks surveyed, accessibility to wholesale funding deteriorated in the 1st quarter of 2022, reflecting tighter fiscal industry ailments for banking institutions. Financial institutions described that the ECB’s asset invest in programmes and the 3rd collection of targeted extended-expression refinancing functions (TLTRO III) continued to have a good influence on their liquidity place and industry funding problems. They be expecting this impact to turn into lesser in the situation of TLTROs and damaging for the ECB’s asset purchase programmes around the following 6 months. Financial institutions also indicated that the ECB’s asset purchases programmes and the detrimental deposit facility price (DFR) experienced a unfavorable impression on their profitability, largely by using internet desire cash flow. This result was mitigated by the ECB’s two-tier process for remunerating excessive liquidity holdings and by TLTRO III. The ECB’s asset buys, the unfavorable DFR and TLTRO III had a ongoing internet easing influence on lending circumstances and a positive affect on lending volumes, but usually less than earlier claimed. Financial institutions count on the effect of the ECB’s asset purchase programmes to convert into a web tightening for lending situations and a generally damaging effect for bank loan volumes more than the following 6 months. For the detrimental DFR and TLTRO III, the internet easing effect on financial institution lending ailments and the good effects on lending volumes are generally expected to become weaker.

The euro area financial institution lending survey, which is conducted four periods a 12 months, was developed by the Eurosystem in order to enhance its knowing of bank lending conduct in the euro spot. The results reported in the April 2022 study relate to changes observed in the 1st quarter of 2022 and anticipated improvements in the next quarter of 2022, until in any other case indicated. The April 2022 survey round was performed between 7 March and 22 March 2022. A overall of 151 banking companies have been surveyed in this spherical, with a response price of 100{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

For media queries, make sure you contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this study round is accessible on the ECB’s internet site. A duplicate of the questionnaire, a glossary of BLS terms and a BLS user guide with data on the BLS series keys can be found on the very same website web page.

- The euro location and countrywide data sequence are out there on the ECB’s web-site via the Statistical Data Warehouse. Nationwide outcomes, as released by the respective nationwide central banking companies, can be attained by means of the ECB’s internet site.

- For far more comprehensive facts on the financial institution lending study, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro space lender lending survey”, Occasional Paper Collection, No 179, ECB, 2016.

Chart 1

Changes in credit score requirements for loans or credit traces to enterprises, and contributing components

(net percentages of banking institutions reporting a tightening of credit score criteria, and contributing components)

Supply: ECB (BLS).

Notes: Internet percentages are outlined as the change among the sum of the percentages of financial institutions responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banking institutions responding “eased somewhat” and “eased considerably”. The internet percentages for “other factors” refer to even more variables which had been pointed out by financial institutions as possessing contributed to adjustments in credit score expectations.

Chart 2

Improvements in desire for loans or credit history traces to enterprises, and contributing aspects

(net percentages of financial institutions reporting an increase in need, and contributing aspects)

Resource: ECB (BLS).

Notes: Net percentages for the queries on demand from customers for loans are described as the variance in between the sum of the percentages of banking institutions responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”.