Outstanding financial institution financial loans to area homes experienced appear to 1,060.7 trillion won ($982 billion) as of the conclusion of past calendar year, down 200 billion gained from the previous month, in accordance to the BOK.

The December studying in contrast with a 2.9 trillion-received on-thirty day period obtain in November.

It marked the initial on-month decline for any December considering that 2004, when the BOK started compiling connected facts.

For all of 2021, banks’ residence loans elevated 71.8 trillion received, the third-biggest obtain.

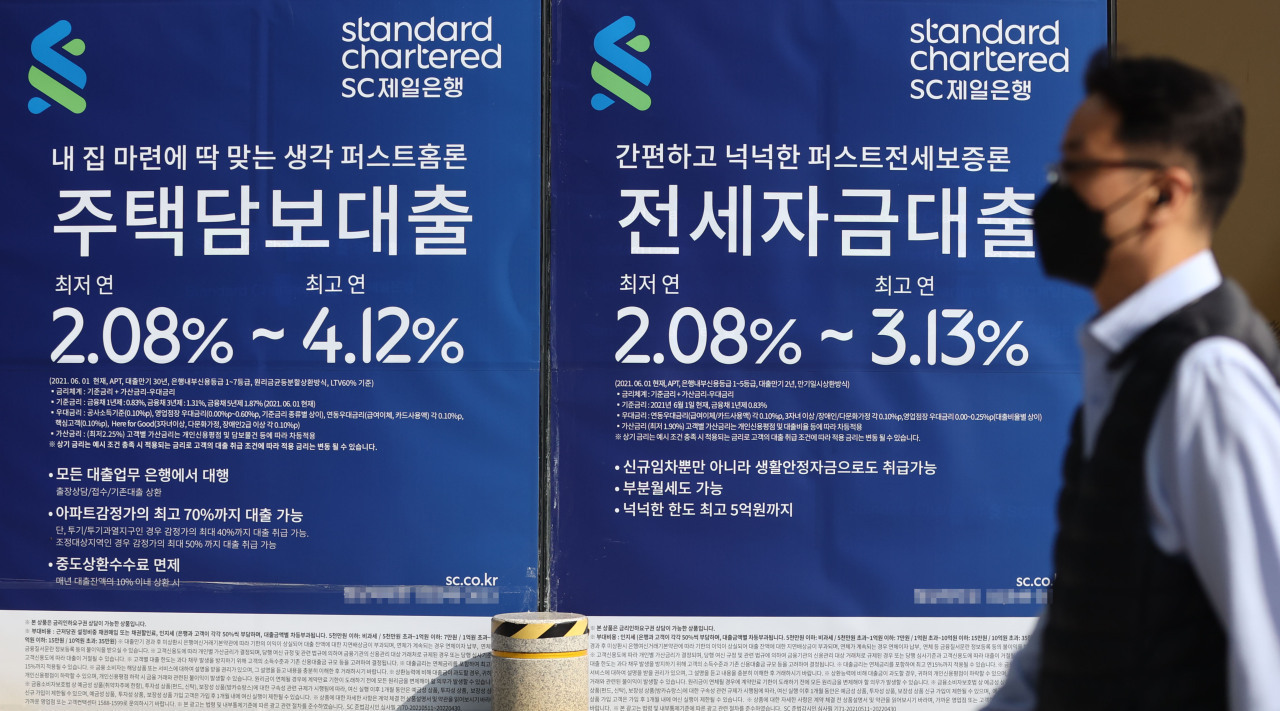

The BOK claimed banks’ family loans fell last month amid hikes in lending prices and lenders’ tight lending regulations.

The country’s central lender lifted the benchmark desire level by a quarter proportion issue to 1 percent in November to curb inflation and family personal debt. It followed a .25 proportion level hike in August.

The information confirmed banks’ house loan loans grew 2 trillion received on-thirty day period to 778.8 trillion gained. It marked the slowest expansion considering that February 2018.

Unsecured and other non-home finance loan loans experienced arrive to 280.7 trillion won as of stop-December, down 2.2 trillion received from the prior thirty day period. It also marked the swiftest on-thirty day period slide for any December given that 2004.

The BOK reported it is too early to say if banks’ household loans could continue on to increase little by little, as need for dwelling-lending financial loans nonetheless remains higher.

Home loans by banking companies and non-banking institutions grew by 200 billion won in December from the former month, in accordance to the Monetary Supervisory Provider. It sharply slowed from a 5.9 trillion gained on-thirty day period obtain in November.

Monetary authorities search for to preserve the on-calendar year expansion of mixture domestic debt in the 4-5 per cent assortment for this 12 months.

Final year, household financial loans grew 7.1 percent.

Residence debt has sharply greater amid history-low desire charges and demand from customers for loans to obtain households spurred by skyrocketing housing price ranges.

Household credit score had occur to a file superior of 1,844.9 trillion won as of finish-September, up 36.7 trillion gained from three months previously, according to different BOK information.

Meanwhile, banks’ loans to businesses fell 2.8 trillion won on-month in December to 1,065.7 trillion gained.

The drop came as organizations repaid portion of their personal debt to increase their yr-finish equilibrium sheets.

Financial institution lending to significant providers fell 1.7 trillion gained on-thirty day period to 179.3 trillion received, though financial loans to lesser companies declined 1 trillion won to 886.4 trillion gained. (Yonhap)