What GAO Located

In response to the COVID-19 pandemic, the Board of Governors of the Federal Reserve Procedure (Federal Reserve) approved 13 crisis lending programs—known as facilities—to guarantee the move of credit rating to many sections of the overall economy. To enhance its oversight of these facilities, the Federal Reserve issued three inside reviews that discovered possibilities from December 2020 as a result of June 2022 to enrich inner procedures and controls, including for collateral and asset management. GAO’s review of Federal Reserve documentation identified that Federal Reserve Financial institutions, which manage the services, addressed most improvement prospects discovered in prior Federal Reserve oversight assessments and are in the process of addressing remaining improvement opportunities. GAO discovered that the Federal Reserve’s plans for ongoing monitoring of the amenities carry on to normally align with federal interior control specifications for ongoing checking of an entity’s inner manage system.

Readily available indicators propose that credit rating marketplace pitfalls in the sectors specific by the facilities have remained lower because the services ceased extending credit history, despite the fact that some vulnerabilities continue to be. For example, corporate bond issuances are bigger than prepandemic stages, and credit history spreads (which mirror borrowing costs) frequently remain low, indicating businesses have reasonably effortless obtain to credit. Nonetheless, key money sector resources that obtain mostly limited-time period company securities remain susceptible, which could make it tough for enterprises to acquire credit history or trigger the resources to market property at decreased charges. Small businesses’ accessibility to credit history has frequently remained favorable, and municipalities’ borrowing expenditures have remained reduced since the amenities in these sectors stopped extending credit. Even though near-phrase threats in the credit history markets supported by the amenities keep on being workable, the outcomes of aspects these as growing fascination charges and significant inflation concentrations could make these markets vulnerable in the in the vicinity of potential.

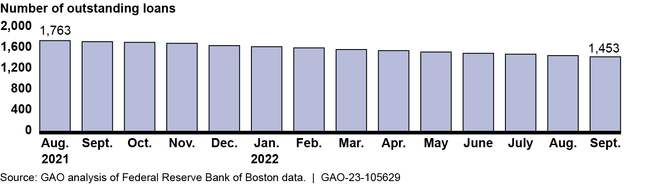

As of September 30, 2022, the Principal Road Lending Software facilities, which supported financial loans built to compact and mid-sized companies and nonprofits, held about $11.2 billion in superb assets. Of the 1,830 financial loans designed by means of the program, 1,453 loans remained exceptional as of the stop of September 2022, the most the latest facts offered (see determine). Given that required interest payments started in August 2021, most borrowers have been creating them on time. GAO’s evaluation of Federal Reserve Financial institution of Boston data found that 365 loans (about 20 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}) were being absolutely repaid as of September 30, 2022, and a lot less than 1 percent experienced resulted in losses.

Main Road Lending System Fantastic Loans, August 2021–September 2022

Why GAO Did This Analyze

On July 30, 2021, the final of the 13 Federal Reserve lending services stopped paying for assets or extending credit. On the other hand, some of these amenities go on to keep substantial amounts of fantastic property and loans. This involves services supported by way of Division of the Treasury funding appropriated below segment 4003(b)(4) of the CARES Act. The Federal Reserve will carry on to keep track of and manage the services right up until these assets and loans are no lengthier outstanding.

The CARES Act bundled a provision for GAO to periodically report on segment 4003 financial loans, mortgage guarantees, and investments. This report examines (1) the Federal Reserve’s oversight and checking of the CARES Act amenities (2) trends in credit history marketplaces that the amenities specific and (3) the position and general performance of Principal Avenue Lending System loans.

GAO reviewed Federal Reserve Financial institution documentation analyzed company and other facts on the services and credit marketplaces, which include data on quick-term and extensive-term corporate credit history industry indicators analyzed knowledge on Primary Avenue Lending Method loan functionality and interviewed Federal Reserve officials.

For far more data, get hold of Michael E. Clements at (202) 512-8678 or clementsm@gao.gov.