Wells Fargo on Nov. 16 released a extensively available compact-dollar financial loan to its clients, producing it the fourth massive financial institution to provide an economical alternate to costly payday loans. With this move, economical establishments that operate nearly 13,000 branches—about 18{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of all bank branches in the U.S.—now supply automated and in close proximity to-instantaneous tiny-greenback financial loans to their shoppers.

This modify unlocks entry to borrowing for several examining account shoppers with very low credit rating scores who could not normally qualify for financial institution credit. Financial institutions have found that these buyers are probably to repay the loans because of their prior partnership with the lender and due to the fact the financial loans are repaid in very affordable installments above quite a few months.

The most volume of these loans is set at $500 or $1,000, depending on the lender, enabling customers to borrow as considerably as they would from a payday financial institution but at a much lessen cost and with powerful safeguards. Payday loans typically carry desire prices above 300{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} and typically have unaffordable lump-sum payments that can consume up a big chunk of borrowers’ typical paychecks. In most circumstances, recurring utilization leads to borrowers carrying highly-priced debt for many months.

Even though banking institutions use various requirements to decide eligibility for small-greenback loans, the 4 major kinds supplying them—Bank of The us, Huntington, U.S. Lender, and Wells Fargo—primarily base their qualifications on the customer’s account historical past with them for example, irrespective of whether the probable borrower has been a customer for a presented selection of months, employs the examining account or debit card frequently, or has immediate deposit for paychecks. All 12 million Us citizens who use payday loans per year have a examining account and an cash flow because all those are the two demands for obtaining a payday personal loan.

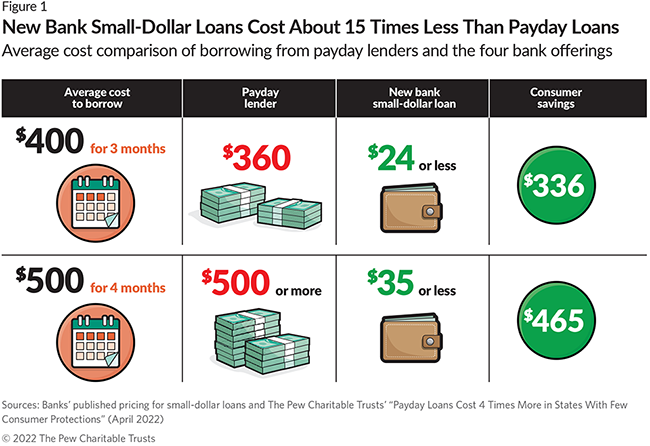

The big financial institutions providing smaller-dollar loans are charging charges that are at least 15 instances reduce than average payday creditors. The loans are repayable around three to four months, which is in line with consumers’ sights of the time necessary to repay little loans. As opposed with usual payday financial loans, which preserve borrowers indebted for 5 months of the yr on typical, customers can help save hundreds of dollars working with the banks’ financial loans instead. For illustration, the common price tag to borrow $400 for three months from a payday loan provider is $360 in the meantime, these banking institutions are charging $24 or much less for that credit rating. In the same way, the typical cost to borrow $500 for 4 months from a payday financial institution is much more than $500 in fees alone whilst the value to borrow that as a result of one particular of these bank applications is, at most, $35.

Preceding research has identified that utilizing payday loans can place consumers at elevated risk of dropping their checking accounts, suggesting that debtors of banks’ compact financial loans can experience gains further than preserving hundreds of bucks in costs. And mainly because the ordinary payday personal loan borrower earns about $30,000 per year—less than $1,200 for each biweekly paycheck—the total discounts would be consequential.

When Pew surveyed payday personal loan borrowers, 8 in 10 stated they would change to borrowing from their bank if it commenced featuring modest financial loans and they were being likely to be authorised. Their major standards for choosing in which to borrow from integrated how quickly the funds would be accessible, how specified they would be to be accredited, and how straightforward it would be to utilize. The financial institutions all have easy, rapid on-line or cell programs and put the mortgage proceeds in customers’ accounts inside of minutes. Which is far faster and a lot easier than the approach of any payday lender. This speed and ease advise sturdy shopper uptake of lender tiny loans.

Examining account customers who have turned to payday and other higher-expense creditors due to the fact their banking institutions did not give tiny loans now have an selection that is far extra very affordable than any that has been greatly obtainable. These new compact financial loans are now an solution in part due to the fact of considerate, nicely-developed assistance from the Federal Deposit Insurance plan Corporation (FDIC), Federal Reserve Board of Governors, Business office of the Comptroller of the Forex, and Nationwide Credit history Union Administration that welcomed automation in this kind of lending and gave financial institutions the regulatory certainty they needed to produce these goods.

So considerably, only Bank of America, Huntington, U.S. Bank, and Wells Fargo have stepped up to provide harmless, tiny installment financial loans or traces of credit to their consumers who most require it and who would not ordinarily qualify for financial institution financial loans. Several other establishments have introduced that they are producing new tiny-financial loan products and solutions. To achieve thousands and thousands of borrowers and assist them help save billions of pounds on a yearly basis, as opposed with what they would owe payday loan companies, much more financial institutions will need to prioritize monetary inclusion. To do that, they should be a part of these four in supplying comparable credit to their clients who most require aid.

Alex Horowitz is a principal officer and Linlin Liang is a senior affiliate with The Pew Charitable Trusts’ shopper finance project.