DenisTangneyJr/E+ by way of Getty Photographs

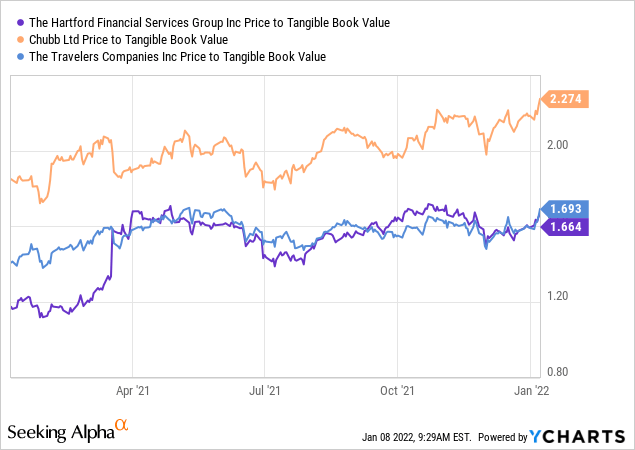

Hartford Money Providers (NYSE:HIG), a diversified money organization presenting professional insurance policies, personal insurance coverage, team added benefits, and mutual funds across the US, not too long ago held its virtual trader working day featuring optimistic commentary on the wellness and prospective buyers of the small business in excess of the medium to for a longer time-term. In individual, the P&C (“house & casualty”) insurance fundamental put together ratio and ROE steerage were being shiny places, reflecting anticipations for recent favorable developments to go on into the upcoming many years. But, HIG trades under P&C friends as buyers keep on to perspective it as a ‘show me’ story, probably only providing credit score for effects when delivered. But about time, I feel the fairly low P/B value in comparison to its powerful ROE and ebook worth advancement must end result in a re-rating.

Powerful Setup for Commercial Heading into 2022

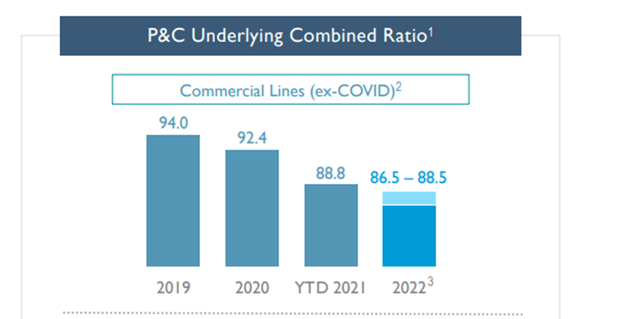

HIG reaffirmed the in close proximity to-phrase advice laid out with its prior earnings report, with business traces NWP (“net published rates”) development guided at 4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in fiscal 2022 with an underlying mixed ratio of 86.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 88.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} (vs. 88.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} YTD). Though the flat steering might disappoint some investors, management did show it is working ahead of program with commercial traces growth coming in at 11{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} this year and envisioned to hit 4.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in fiscal 2022, implying a good 7-7.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} CAGR. And when HIG refrained from updating its margin assistance (further than the 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}pts of underlying advancement expected in 2022), administration commentary signaled pricing would not slide below loss in the around time period.

Source: Hartford Financial Services Presentation Slides

Apparently, the function also made available a exceptional glimpse beneath the hood at HIG’s industrial enterprise, offering crucial insight into enhancements the firm has designed in recent decades. Most spectacular was the profitability of the new Spectrum policy, which has created an 85{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} underlying put together ratio in fiscal 2021. When the advantage from mild non-cat property losses in FQ3 ’21 probable boosted the ratio considerably, the fact that HIG’s new organization line is by now improving margins is a crucial optimistic. With the Navigators acquisition outperforming targets as effectively, HIG looks established to more create out its progress capabilities in specialty going ahead.

Beneficial ROE Steering Outweighs Investor Working day Disappointments

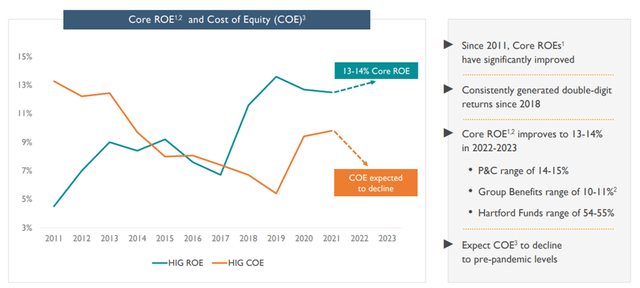

Hartford has also guided to a core ROE of 13{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 14{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in fiscal 2022 (modestly higher than the 12.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} averaged over the 2018-2020 interval), comprising P&C (14{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 15{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}), Group Gains (10{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 11{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}) and Hartford Resources (54{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 55{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}). The underlying ROE could establish even stronger, nonetheless, considering the Team ROE is lessen than P&C, which management attributed to a increased combine of intangibles in the section. As these, on a tangible basis, Group would have contributed (not established dilutive) to the in general ROE. I watch the up to date targets as achievable in mild of the potent momentum on the main P&C side and the probable for share repurchases in advance. When there may perhaps have been some disappointment that HIG did not explore designs to glimpse for options for the Mutual Money small business, I feel the essential positives from the event more than outweighed the modest disappointment below and of not increasing targets. Instead, I consider a lot of of the offsetting elements for HIG remain unappreciated, which includes its comprehensive new products and solutions throughout virtually all companies and its improving expense stages.

Resource: Hartford Economical Companies Presentation Slides

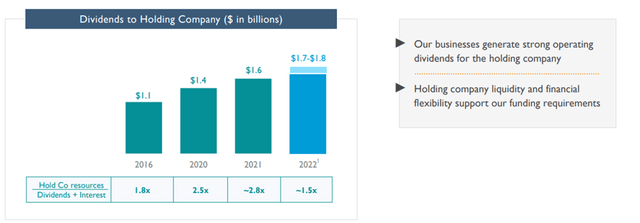

Favorable Money Allocation Update

Most likely the most salient update from the trader working day presentation was that HIG now has all the solutions it demands to reach rewarding development and industry-main ROEs. This means lots of excess cash will be available for use for the two shareholder return (dividends and repurchases) and foreseeable future advancement forward, despite the fact that M&A continues to be a lower precedence. On the dividend front, HIG is guiding toward hold co dividends of $1.7-1.8 billion in fiscal 2022 (up from the $1.6 billion guided for fiscal 2021), with considerably of the raise coming from its P&C subsidiaries. Furthermore, HIG is also projecting a identical stage of repurchases in fiscal 2023 relative to the annual rate in fiscal 2021/2022, implying one more $1.5 billion dependent on the YTD run charge. I see further more upside to the repurchase run-amount, nonetheless, if HIG normalizes its remittance capability from present-day lower degrees – for context, the P&C division remits 75{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of statutory earnings in comparison to 90{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} by its peers. With lots of capability at the holdco as well, looking at HIG prefunded $600 million in financial debt, the balance sheet overall flexibility could also assistance an accelerated funds return in advance.

Supply: Hartford Economic Products and services Presentation Slides

Remaining Just take

The vital takeaway from its new investor day was the reality that Hartford’s ongoing transformation into a primary P&C, group, and mutual fund advanced seems to be running in advance of timetable. Yet, traders nonetheless do not appear to be supplying HIG substantially credit for the stable underwriting and development initiatives or the modern operational advancements, with its 3 crucial businesses all poised for margin enlargement in advance. In the meantime, shares look significantly undervalued – HIG trades beneath P&C peers Chubb (NYSE:CB) and Vacationers (NYSE:TRV) despite becoming on observe for a powerful 13-14{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} ROE. More than time, ROE and book price expansion really should push the valuation, leaving a lot of scope for outperformance ahead.