NongHyup Financial institution, just one of the five big business banking companies right here, normalized lending of its overall domestic loan products, which include mortgages on Monday. It has also made the decision to elevate its strains of credit history from the previous 20 million won ($16,700) to 100 million gained.

NongHyup experienced suspended lending of its household and crucial house loan merchandise in June past calendar year on government tension.

The nation’s third net-only lender Toss Bank introduced in October experienced to suspend its lending products and services 9 times right after its institution, but resumed its new loan expert services on Jan. 1. The on line bank had to suspend its lending services the economic authorities declined to increase the firm’s lending limit right after it exhausted 500 billion-gained quota.

Toss Financial institution is the nation’s 3rd internet-only bank just after the start of the nation’s 1st and second on the net banking companies Kakao Lender and Kbank in 2017.

NongHyup’s industry rival Woori Bank has determined to revive its primary charge financial loans, which are offered to the banks’ most creditworthy buyers from Feb. 3. KB Kookmin Financial institution has added extra prime amount bank loan options on its portfolio.

Mainly because a bank’s best clients have minor likelihood of defaulting on a loan, the lender can demand lower premiums than it does to additional risky debtors.

Much more banks are anticipated to loosen up, but borrowers are predicted to encounter stricter lending specifications this 12 months, in accordance to new bulletins built by financial authorities.

Commencing this month, debtors with above a full 200 million-won worthy of of complete loans that require to repay additional than 40 percent of their once-a-year revenue in principal and desire will be barred from additional lending. From July the sum of complete financial loans are established to be lowered to 100 million gained, enforcing even stricter principles for debtors, in phrases of the personal debt support ratio, which measures how a lot a borrower has to spend in principal and curiosity in proportion to his or her once-a-year profits.

In December, the policymaking Financial Providers Commission said in December that it has resolved to use stricter guidelines for jeonse financial loans. Jeonse is a housing lease process special to Korea whereby tenants pay out a refundable lump-sum deposit as an alternative of regular hire on a two-yr agreement. The financial loans are rather straightforward for debtors to get, since they are issued right to the house owner, alternatively than the borrower, and secured towards the assets.

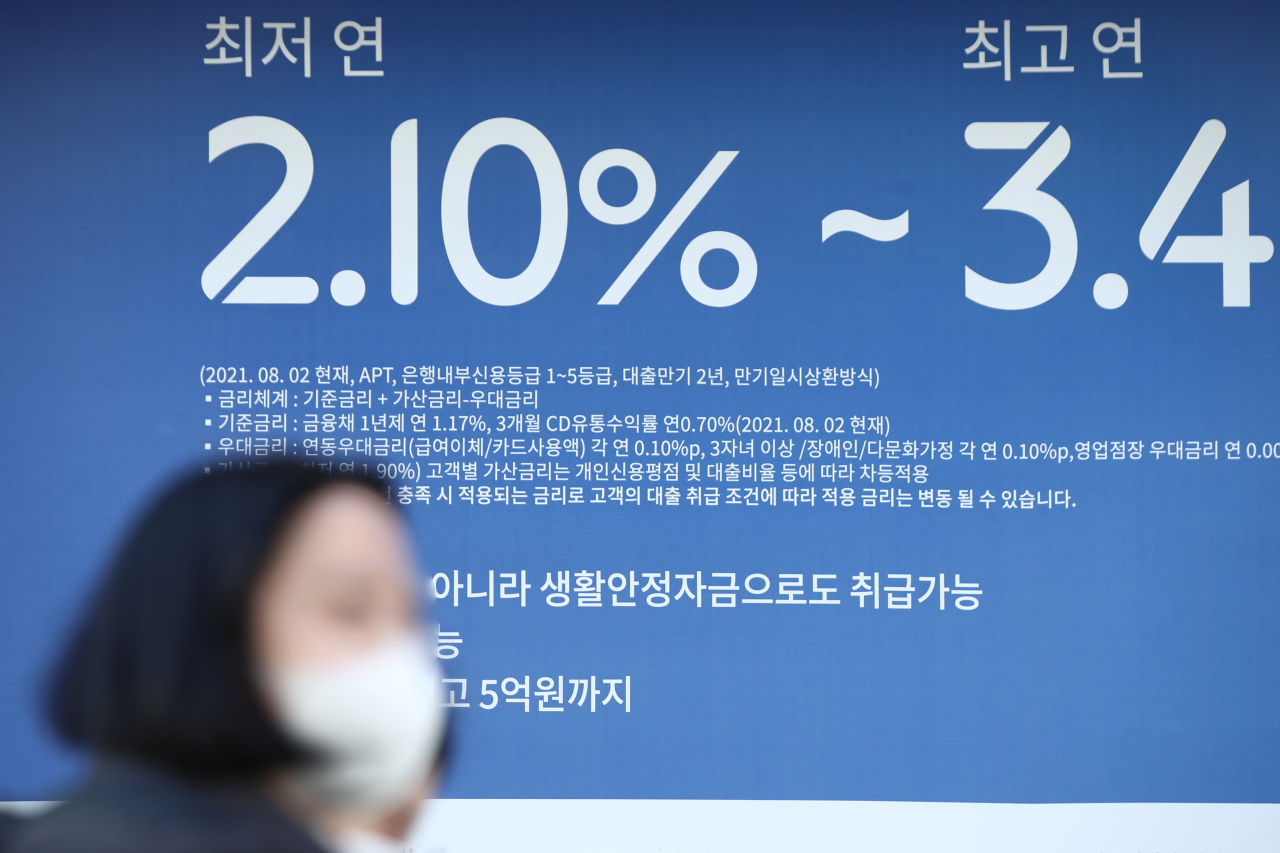

On top rated of it, the Bank of Korea’s determination to increase its benchmark fascination amount to 1 p.c in November 2021 alongside experts’ forecasts of at the very least two rate hikes scheduled for this year is very likely to add more volatility to personal loan interests.

Noting the elevated volatilities, experts have been recommending safer and reasonably possibility-absolutely free financial loan products and solutions for shoppers.

“I advise debtors change their current loans to fastened-fee merchandise or search for fixed-level financial loans when taking out a new one,” said Hwang Se-woon, a senior researcher at the Korea Money Marketplace Institute.

South Korean banks’ financial loans to households have been escalating at an increasingly slower rate in latest months, with the monetary authorities’ purchase to financial institutions to adopt stricter lending regulations previous year getting effect. The overall benefit of loans extended to homes in December acquired only 364.9 billion gained to 709.5 trillion received. This compares with 2.3 trillion won and 3.4 trillion received gains in November and December, respectively.

Whole financial loans extended to homes have been gaining by a monthly normal of 11 trillion from January to December final 12 months.

By Jung Min-kyung (mkjung@heraldcorp.com)