In a different conference with the Nationwide Board of Profits (NBR), the IMF officers asked to know the explanations for so substantially tax exemption in Bangladesh

Infographic: TBS

“>

Infographic: TBS

The Worldwide Monetary Fund (IMF) has asked for data about the initiatives undertaken by the Fiscal Institutions Division and the Bangladesh Bank to recuperate defaulted financial loans, declaring a large sum of non-accomplishing financial loans poses an acute possibility for the country’s banking sector.

On top of that, the world loan company has proposed rapidly amending several laws to establish superior governance in the banking sector as nicely as to be certain economical sector reform and entire autonomy of the central bank.

A traveling to IMF mission expressed its problem above defaulted financial loans in conferences with Money Institutions Division Secretary Sheikh Mohammad Salim Ullah and officers of many departments of the central bank on Sunday as component of a method to grant a $4.5 billion mortgage Bangladesh has sought to deal with its overseas trade reserve crisis, officials anxious claimed.

In a separate meeting with the National Board of Earnings (NBR), the IMF officials asked to know the causes for so considerably tax exemption in Bangladesh.

It also said the country’s tariff amount is substantially larger than that of its peers and asked for data about the NBR’s plan to convey it down.

In the conferences with the central financial institution officials and the Economical Institutions Division, the Washington-dependent loan company also questioned for information and facts on losses induced by loans specified by point out-owned banking institutions to the Bangladesh Petroleum Company and about Bangladesh’s designs to rehabilitate ailing industries.

The Fiscal Institutions Division secretary declined to remark on the discussion with the IMF.

Having said that, some officials at the Fiscal Establishments Division who had been current at the conference, reported the IMF termed the condition-owned lenders’ huge defaulted financial loans a important hazard for the banking sector.

Considering that the Economic Establishments Division is involved in the administration of point out-owned banking institutions, the IMF needs to know what steps the federal government is taking to recuperate the defaulted financial loans. The multilateral financial institution has questioned for getting demanding motion to get better the defaulted financial loans quick.

The Financial Institutions Division, through a presentation, advised the IMF that Covid-19 has created a vulnerable circumstance amid state-owned financial institutions given that March 2020. Banking institutions have played a critical part in normalising the overall economy all through the pandemic predicament.

Additionally, condition-have industrial financial institutions lead a good deal to going forward governing administration initiatives specially by furnishing financial loans to the precedence sectors at decreased interest fees and involving in different social protection net things to do with out imposing any demand.

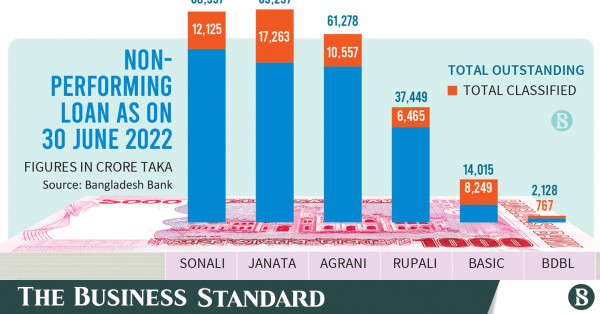

According to data from the Bangladesh Bank, at the end of final June, the overall volume of defaulted financial loans in the banking sector stood at Tk1.25 lakh crore. Amongst them, the amount of defaulted financial loans of condition-owned Sonali, Janata, Agrani, Rupali, Standard and Bangladesh advancement banking companies is much more than Tk55,000 crore.

Expressing shock at the higher quantity of defaulted financial loans even with extending the personal loan moratorium interval and offering an possibility to reschedule defaulted loans, the IMF said, the failure of banking companies to recuperate defaulted financial loans is developing an acute danger for the sector.

Among the the state-owned financial institutions, a single-fourth of Janata Bank’s whole outstanding has defaulted. The default price of Sonali, Agrani and Rupali financial institutions is about one-fifth of their full fantastic.

Standard Lender, which collapsed thanks to bank loan cons, accounted for more than 50 percent of its full exceptional and BDBL’s non-performing financial loans accounted for 36{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of its superb.

The point out-owned banking institutions make independent agreements with the Monetary Institutions Division every single yr to recuperate defaulted financial loans, but they are not able to show success in recovering defaulted loans as for every the target. This calendar year is no exception.

Not only defaulted financial loans, but the failure of banking companies to collect composed-off loans has also come up in the discussion with the IMF. Though 5 state-owned banks goal to get better Tk1,670 crore of penned-off loans this 12 months, only Tk201 crore has been gathered at the conclude of past June.

Amongst the point out-owned banking companies, Janata, Agrani, Rupali and Simple financial institutions are experiencing a major capital crunch due to large non-executing financial loans. The funds deficit of the 4 banking institutions is a lot more than Tk11,000 crore. Foreign financial institutions do not want to settle for letters of credit score (LCs) from these banking institutions due to a lack of cash. Banking institutions have to pay out excess commission for this.

Officers of the Money Establishments Division stated even though the IMF on numerous occasions experienced before provided value to the complete autonomy of the Bangladesh Financial institution, this time the worldwide loan provider is giving extra worth to it. Mainly because, considering the fact that 2018, vital decisions in the banking sector, including repairing the desire charge of financial loans and deposits, personal loan moratorium, restructuring and rescheduling of defaulted loans, have been imposed by the finance ministry.

The IMF mission also held different conferences on Sunday with Bangladesh Bank’s Banking Regulation Plan Division, Section of Off-Site Supervision, Stats Office and the Chief Economist Device.

In this regard, central bank spokesperson GM Abul Kalam Azad claimed, there have been conversations with the IMF with numerous departments the place it expressed problem about the extra defaulted loans of condition-owned banking companies in unique.

“At the conferences, the central lender explained it is frequently signing once-a-year memorandums of being familiar with with banks to minimize non-undertaking financial loans. Aside from, there will be a assembly with the central bank’s major officials on 9 November, wherever they will emphasize the techniques taken by the Bangladesh Lender to bring the defaulted financial loans to usual stages,” he included.

Azad, also an govt director of the central lender, claimed the IMF has also questioned about the floating trade fee.

“It has been stated from our aspect that a single market fee will be established in the future two to three months,” he included.

When the IMF asked about mortgage rescheduling and retaining provisions, he claimed, the central financial institution replied that just lately a round has been issued to hand the rescheduling facility around to banks’ boards to perform a extra appropriate function in loan restoration. The IMF has said that it will search at the circular afterwards.

Why so considerably tax exemption: IMF

At the meeting with senior NBR officials, the IMF delegation also required to know the revenue board’s plans for increasing earnings assortment.

The NBR highlighted the rationale of tax exemption and the ongoing things to do to minimize it. In addition, the strategy to minimize the tariff rate was also informed, meeting resources explained.

Seeking anonymity, a senior NBR formal instructed TBS, “It is legitimate that Bangladesh’s tariff fee is higher. The protection tariff fee in Bangladesh is continue to 28-29{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. We have the determination to lower it. We have conveyed that to the delegation.”

Other than, some tax exemptions have to be presented for the financial fact of the country.

NBR users Masud Sadiq, Zakia Sultana and Shams Uddin Ahmed from Customs, VAT and Earnings Tax Departments guide the conference on behalf of the earnings board.

Following the conference, the delegation held a closed-door conference with NBR Chairman Abu Hena Md Rahmatul Muneem.

The chairman could not be arrived at for remarks about the written content of the discussion.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RZHACFYRK5KQVGETI7A724U56E.jpg)