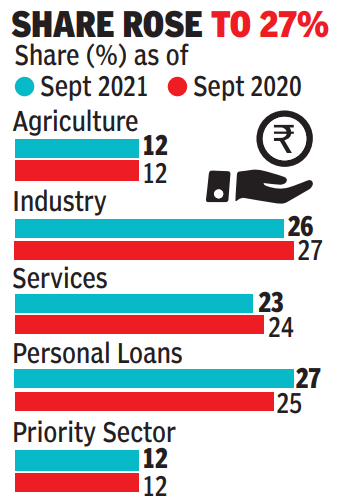

According to info launched by the Reserve Lender of India, financial institution credit score superb on the last Friday of September was Rs 109.5 lakh crore. Of this, the share of loans to business dropped to 26{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} (Rs 28.3 lakh crore) from 27{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} a calendar year before. Particular financial loans, which had been a quarter of all lender loans in September 2020, enhanced to 27{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} (Rs 29.2 lakh crore) by end-September 2021.

The fall in bank credit rating to the market section was mostly thanks to organizations in core industries deleveraging. Loans to iron and metal industries dropped by Rs 39,249 crore and financial loans to chemical substances (which includes fertilisers, medicines and petrochemicals) shrunk by Rs 10,146 crore in the six months finished September. The several sectors which noticed growth in credit rating ended up streets, ports and energy. Even so, even this was not enough to demonstrate optimistic credit history advancement in the infrastructure section.

Over-all credit rating excellent to huge sector shrunk by 5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in the 1st six months of the fiscal. This has pulled down industrial loan growth to 2.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} inspite of credit score to small and medium organizations mounting.

In the individual section, banks additional Rs 20,096 crore of dwelling loans to their portfolio in the final six months. They also amplified their vehicle financial loan and gold mortgage reserve by Rs 3,000 crore each and every. Other personal financial loans were up by Rs 45,000 crore. Overall financial loans outstanding in the personalized bank loan section grew by Rs 73,000 crore in the six months ended September 2021. This has expanded the private loan portfolio to Rs 29.18 lakh crore.

The facts seems to show that financial institutions have wrested sector share from finance corporations in the credit score market. Usually, NBFCs borrow from banking companies and debt marketplaces and lend. Financial institution credit rating to NBFCs, which is the premier element in loans to services sector, shrunk by Rs 61,124 crore in the past six months. This has resulted in the share of credit rating to NBFCs dropping from 9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} (Rs 9.4 lakh crore) on conclusion March 2021 to 8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} (Rs 8.8 lakh crore) as of end September 2021. This has resulted in superb lender credit history to the services sector declining by 3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} considering that March 2021.

According to bankers, the decline in financial institution credit score to big corporations could be attributed to their deleveraging coupled with shifting to the financial debt market place where by less expensive income is obtainable by means of business paper. Some enterprises are looking at better income realisations and do not really feel the need to borrow.

In the NBFC segment, the classification of a significant borrower as a non-performing asset by banks could have added to the drop in the phase. The property financial loan portfolio shows extra regularity and does not sometimes shrink like other segments because residence loans are lengthy time period and refreshing disbursements have a compounding effects on the dimension of the portfolio.