Internet financial loans at Ireland’s premier financial institutions are poised to return to or even exceed 2019 stages as financial exercise proceeds to get well from the consequences of the COVID-19 pandemic and financial loans they obtained a short while ago are because of to arrive on their equilibrium sheets in 2022.

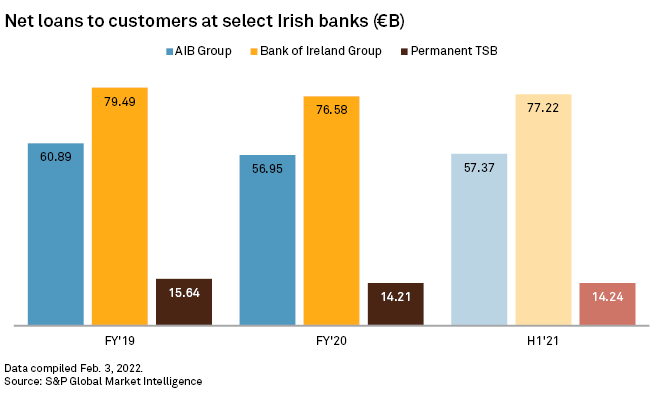

Internet loans to prospects at Lender of Eire Team PLC, AIB Group PLC and Lasting TSB Group Holdings PLC totaled roughly €148.83 billion in the initially 50 percent of 2021, when compared to €147.74 billion in full 12 months 2020 and €156.02 billion in whole 12 months 2019, S&P Global Marketplace Intelligence information exhibits.

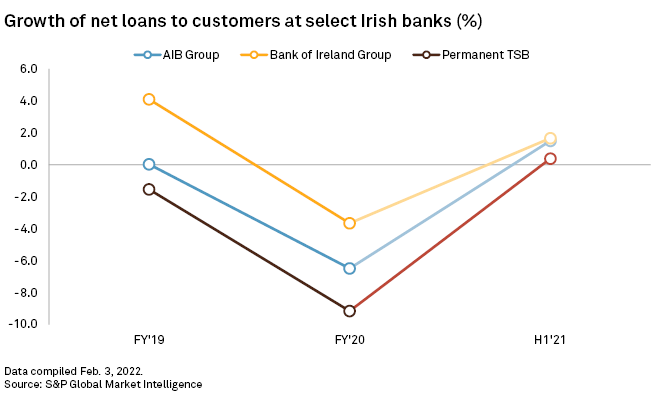

Bank of Eire, the country’s biggest loan company by complete belongings, saw internet loans to buyers increase to €77.22 billion at the close of June 2021 from €76.58 billion in entire calendar year 2020 and €79.49 billion in complete 12 months 2019. In a third-quarter 2021 investing update, Lender of Ireland explained new lending on a continuous currency foundation improved 7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} calendar year about yr in the 9 months to September, although purchaser personal loan volumes were steady at €76.7 billion.

The bank is also set to see a product expansion in its financial loan reserve in complete year 2022 from its acquisition of a portfolio of mortgage property from KBC Lender Ireland PLC, Goodbody reported in a Jan. 25 report. The loan company signed a about €5. billion deal with the KBC Team NV unit in October 2021 involving €9.2 billion of financial loans and €4.4 billion of deposits.

The financial loan progress outlook will also be favorable to AIB Team — Ireland’s 2nd-greatest bank by belongings — in 2022, bolstered by robust organic and natural progress in new lending in the Republic of Eire, mortgages, company and small and medium-sized enterprises, and home, Goodbody said.

As of the finish of June 2021, AIB’s net financial loans to prospects stood at €57.37 billion, in contrast to €56.95 billion in complete yr 2020 and €60.89 billion in whole yr 2019, Sector Intelligence facts reveals. The loan provider explained in its 3rd-quarter 2021 trading update that new lending amounted to €7.2 billion for the nine months to September, symbolizing a 7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} growth versus the equal prior-12 months period with a pickup in momentum in the third quarter to €2.7 billion, when compared to €2.2 billion in the 2nd quarter. The development is predicted to proceed in the fourth quarter as new lending in the next 50 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} is on class to outperform the initial 50 {797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

The Irish house loan market place also ongoing to accomplish strongly in the 3rd quarter of 2021, resulting in a 17{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} year-in excess of-12 months improve in Republic of Ireland new property finance loan lending for the 9 months finished Sept. 30, 2021.

AIB’s acquisition of roughly €4.2 billion of corporate and commercial financial loans from Ulster Financial institution Eire DAC, which is pending approval from Ireland’s opposition regulator, is also projected to contribute to its mortgage book expansion, which Goodbody estimates will get started to appear on to AIB’s stability sheet from later on in 2022.

Everlasting TSB Team Holdings, which agreed in December 2021 to receive specified features of Ulster Bank’s retail, SME and asset finance enterprise in Eire, also reported solid advancement in mortgage originations in the 9 months ended Sept. 30, 2021, with new lending of €1.4 billion, up 50{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} 12 months above year.

PTSB stated when it introduced the offer that the assets staying obtained will maximize its mortgage loan e-book by about 40{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} from its 2020-finish amount and its branch community by about 30{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. PTSB’s organization lending will also triple in dimensions relative to its amount at the finish of 2020 when incorporating the micro-SME loans and the founded asset finance enterprise getting obtained. Completion of the first step in the transaction is predicted to acquire place in the fourth quarter of 2022.

Greater net fascination money

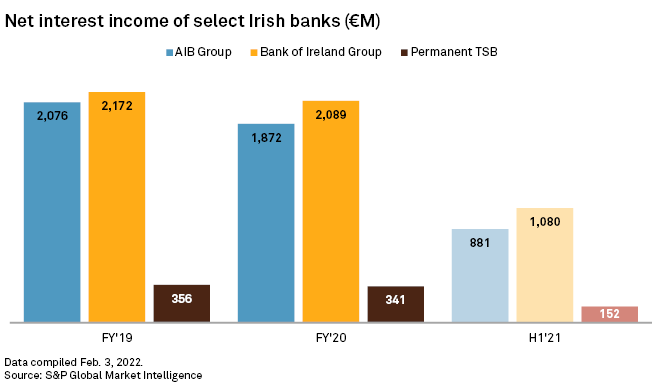

Lender of Ireland’s net curiosity earnings, or NII, was 2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} better in the nine months ended Sept. 30, 2021, as opposed to the identical period in 2020, the bank stated, and Goodbody expects the lender to advantage materially from its acquisition of Irish stockbroking organization J & E Davy. Davy’s consolidation is forecast to strengthen the group’s other working revenue line in 2022, assuming the transaction completes July 1 and as business profits and service fees and commissions recuperate, in accordance to Goodbody.

AIB’s NII is also projected to develop in 2022 on the back of loan advancement and web curiosity margin enhancement, in accordance to Goodbody. For comprehensive calendar year 2021, the loan company expects to see a reasonable drop in NII

Long term TSB Team, which claimed losses in complete 12 months 2020 and the very first half of 2021, is envisioned to continue to report losses in the around term, Goodbody claimed. Nevertheless, the lender’s organization is on an improving upon trajectory and profitability is projected to get better on the back again of its offer with Ulster Lender, it extra.

Financial institution of Ireland and AIB are scheduled to report their entire calendar year 2021 effects on Feb. 28 and March 3, respectively, though PTSB is set to release its outcomes March 2.