LONDON, Oct 28 (Reuters) – NatWest’s (NWG.L) shares fell as much as 9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} on Friday after the British financial institution warned of mounting expenditures, and as its third-quarter effects were being strike by a deteriorating United kingdom financial outlook that prompted an enhance in undesirable debt provisions.

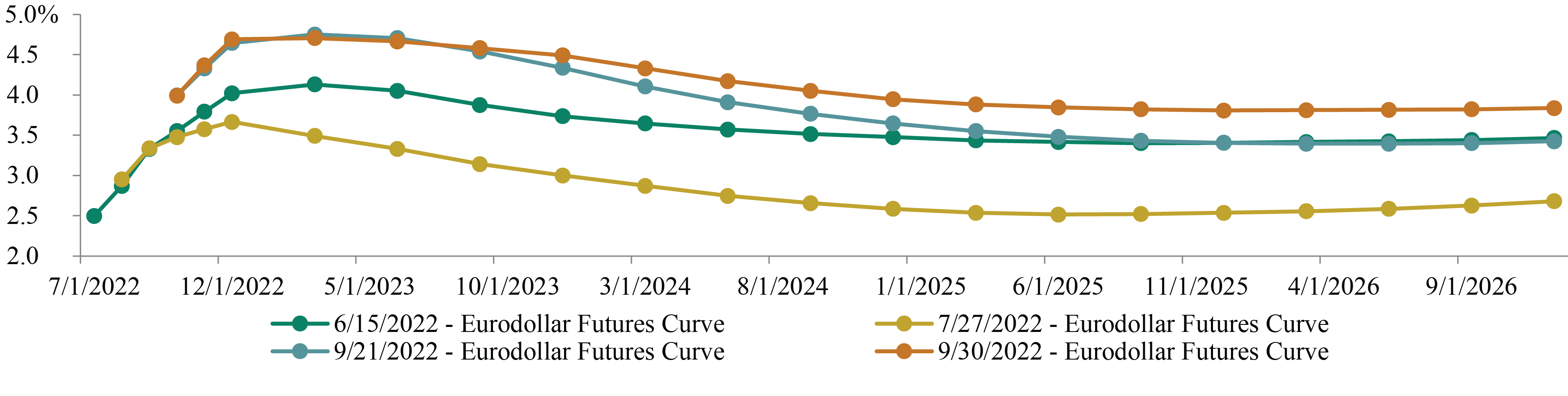

Britain’s economy is dealing with recession at a time when the Lender of England is raising desire rates to control double-digit inflation, squeezing the funds of households and corporations.

NatWest set aside an additional 247 million pounds to replicate the gloomy outlook and reported its charges upcoming 12 months would no for a longer period be steady, in a indication of how soaring inflation is impacting bank funds.

The financial institution was also strike by a 652 million euro ($650 million) reduction in its Ulster Financial institution company in Ireland – which it is in the process of exiting. NatWest stated this was predominantly due to a revaluation of its loans.

Pre-tax revenue came in at 1.1 billion lbs ($1.27 billion) for July-September, a bit below analyst forecasts and unchanged on the prior calendar year.

The lender’s shares ended up very last down 8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, in opposition to a benchmark FTSE index down 1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} (.FTSE).

“Even though the financial institution is in a affordable position for now, we are anticipating an arduous downturn in the financial system by the center of following yr, which will rock the boat,” claimed Sophie Lund-Yates, analyst at Hargreaves Lansdown.

Analysts at JPMorgan stated in a take note that NatWest’s warning on expenditures could also lead to downward revisions for its profitability.

NatWest is the previous of Britain’s “Massive 4” banks to report results this 7 days. Lloyds, Barclays and HSBC before all described sound revenue but unsettled investors with better bad mortgage prices.

The lender reported its terrible financial loan provisions reflected its additional detrimental look at of its present economic scenarios, and it now expects property prices to drop 7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} future calendar year. Rival Lloyds adopted a equally bearish perspective on Thursday, predicting an 8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} fall.

NatWest CEO Alison Rose said the financial institution experienced not nevertheless observed improved signs of monetary distress from clients, but mentioned the lender was closely checking the scenario.

On prices, Rose explained to reporters the bank’s improved assistance partly reflected the want to increase fork out for staff members to enable them cope with inflation.

Property finance loan MAYHEM

Britain’s new key minister Rishi Sunak has pledged to restore investor self-confidence in the country, right after predecessor Liz Truss’s procedures induced chaos in money marketplaces.

The contagion hit home finance loan markets, primary lenders to withdraw around 1,700 merchandise in the house of a 7 days before reintroducing them at larger costs.

Market place conditions have considering that calmed down, but loan companies have been gradual to go on the benefits to clients.

Rose explained to reporters NatWest lower some mounted charges on Friday, introducing: “It is really significant that we make guaranteed we go people as a result of.”

NatWest reduce prices on quite a few products for present clients by up to .6 percentage factors, a spokesperson stated. Facts provider Moneyfacts mentioned as the modifications did not have an effect on new shoppers it would not impact its compiled normal premiums.

Banking institutions are wary that Sunak might slap added taxes on the sector, as he seeks to plug a hole in the country’s finances.

“Financial institutions centered in the Uk currently pay back a substantial quantity of tax… It is really significant that the money services sector remains aggressive and investible,” Rose explained.

Point out-backed NatWest returned to vast majority private ownership previously this year, extra than a 10 years on from its 45 billion pound taxpayer bailout in the world financial crisis.

Banking companies in typical are benefiting from bigger premiums as they profit from the difference in what they demand on lending and fork out out on deposits. But increased interest costs are a double-edged sword as they also squeeze debtors and increase the risk of personal loan defaults.

Larger rates served to strengthen the bank’s income by a fifth to 3.2 billion lbs.

NatWest explained it nevertheless expects to arrive at its return on fairness focus on – a important measure of profitability – of 14-16{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in 2023, adding that mounting money would help make up for better expenditures.

($1 = .8654 lbs)

($1 = 1.0030 euros)

Reporting by Iain Withers and Lawrence White, Enhancing by Jane Merriman

Our Requirements: The Thomson Reuters Have faith in Rules.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4ZPCLGW6FNMEZARDIFARVVHOMQ.jpg)