The Signal and the Noise

“The fundamentals of the U.S. economy have clearly weakened in 2022, as reduced fiscal largesse, tightening monetary policy, and rising prices have weighed on consumption. But these negative trends have been building for some time. What has

shifted more dramatically of late is how investors interpret these fundamentals. Such interpretations are liable to remain volatile as long as the macroeconomic picture remains murky.”

– Performing Credit Quarterly 2Q2022: Shifting Gears

Negative macroeconomic trends – including persistent global inflation, tightening monetary policy, a surging U.S. dollar, and slowing consumption – have weighed on financial markets in 2022. But what has caused much of the volatility in asset

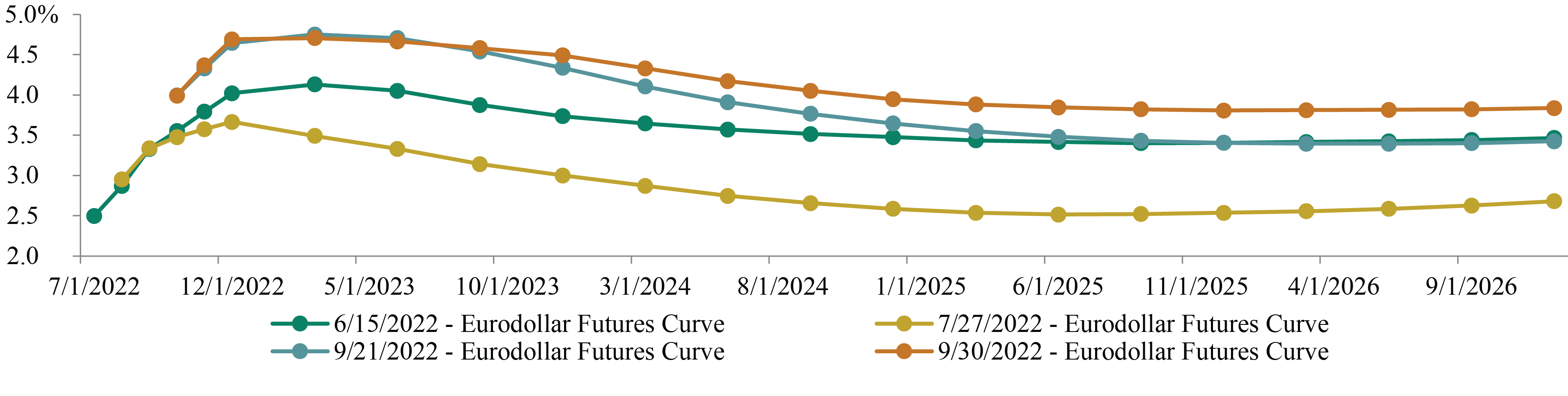

prices has been investors’ fickle expectations regarding these trends. Consider the market rally that began in mid-June. The primary cause was a significant drop in Treasury yields that, counterintuitively, began after the Federal Reserve hiked

the fed funds rate by 75 basis points, reiterating its commitment to fighting inflation. Investors appeared to believe that the Fed’s actions would slow the economy enough to tame inflation, but not enough to cause a significant recession or

meaningfully reduce corporate earnings. By the end of July, the futures market had lowered the anticipated peak fed funds rate by approximately 50 bps and begun to price in a drop in short-term interest rates beginning in early 2023. (See Figure 1.)

But by the time the Fed met in September, investors had already changed their minds: The expected terminal rate had climbed by more than 100 bps, and the anticipated start of the rate-cutting cycle had been pushed into late 2023.

What brought about this U-turn? In the weeks surrounding the Jackson Hole Economic Policy Symposium in late August, Fed Chair Jay Powell and other officials reiterated the central bank’s commitment to fighting inflation. In other words, very little

about the macroeconomic environment had actually changed, but investors’ interpretations of it had changed dramatically, as had asset prices.

Since the end of the quarter, we’ve continued to see significant moves in financial markets, often based on modest changes in economic data and massive swings in investor sentiment. We’ve also seen unexpected crises emerge. (For instance,

in August, how many investors had “turmoil in the UK gilt market” designated as a key risk?) As Howard Marks recently wrote in his memo The Illusion of Knowledge,

few, if any, investors have the ability to consistently and profitably predict macroeconomic trends. But investors’ attempts to do just that are currently driving markets, which means we should expect many twists and turns in the road ahead.

Value-focused investors may thrive in this environment, but only if they have the capital and conviction needed to withstand the volatility as well as the ability to find signals – and invest wisely – despite all the macro noise.

Figure 1: Interest Rate Expectations Have Shifted Dramatically in Recent Months

Source: Bloomberg

Signal #1: “Junk Loans” are raising alarm bells

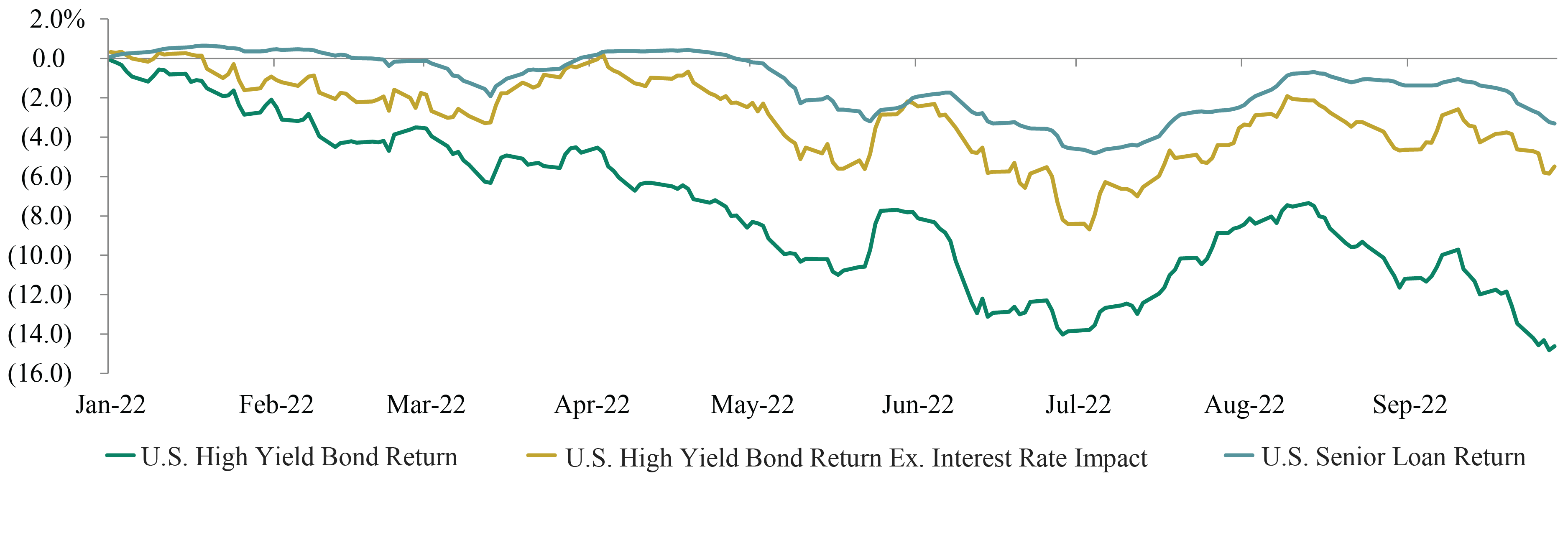

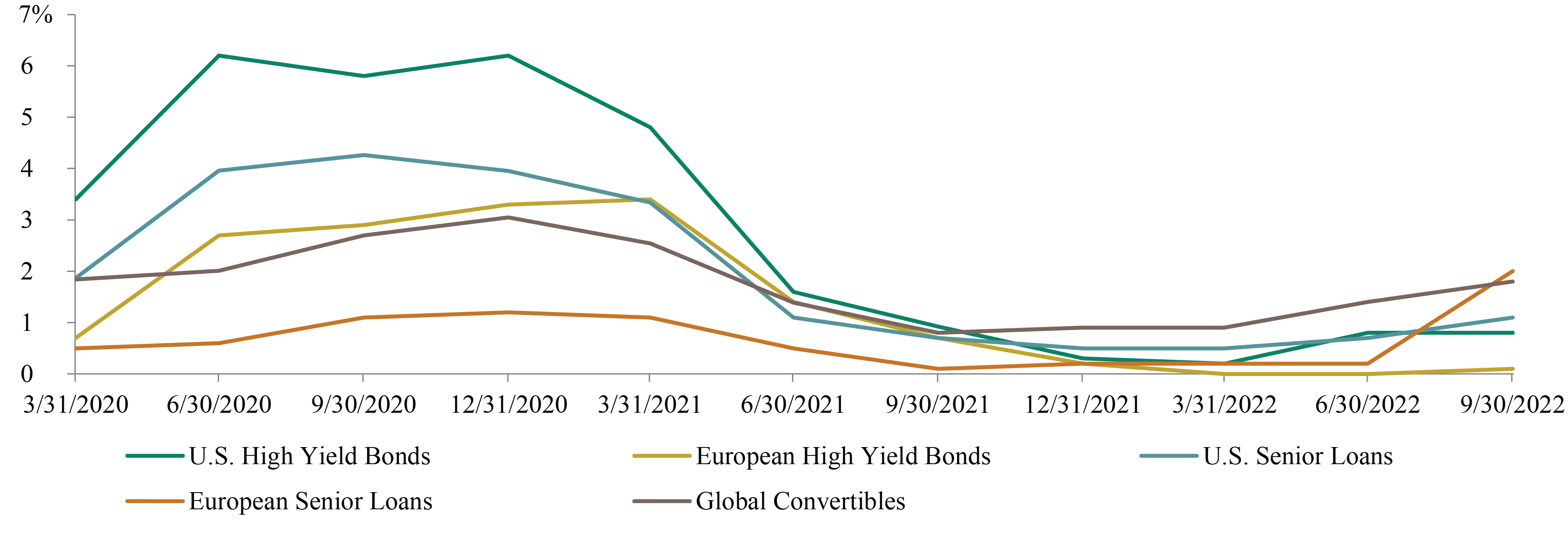

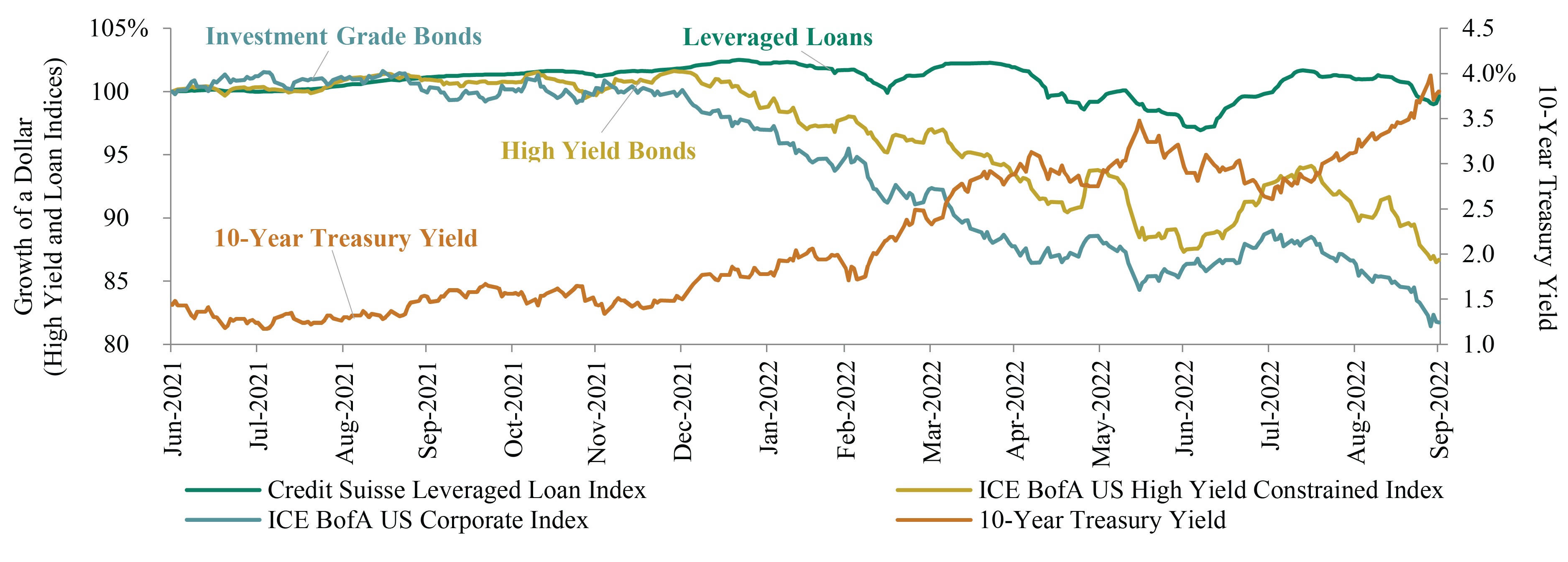

Rising interest rates have dominated the credit market story in 2022. Consider the relative performance of fixed- and floating-rate assets. While fixed-rate assets are negatively impacted by rising Treasury yields, most leveraged loans have floating rates,

so their prices aren’t weighed down in this environment. Instead, loans generate more income as short-term interest rates rise. In fact, for most of 2022, the projected income from loans has exceeded the average yield on high yield bonds –

an uncommon occurrence that has resulted from the dramatic increase in the reference rates for loans since January.1

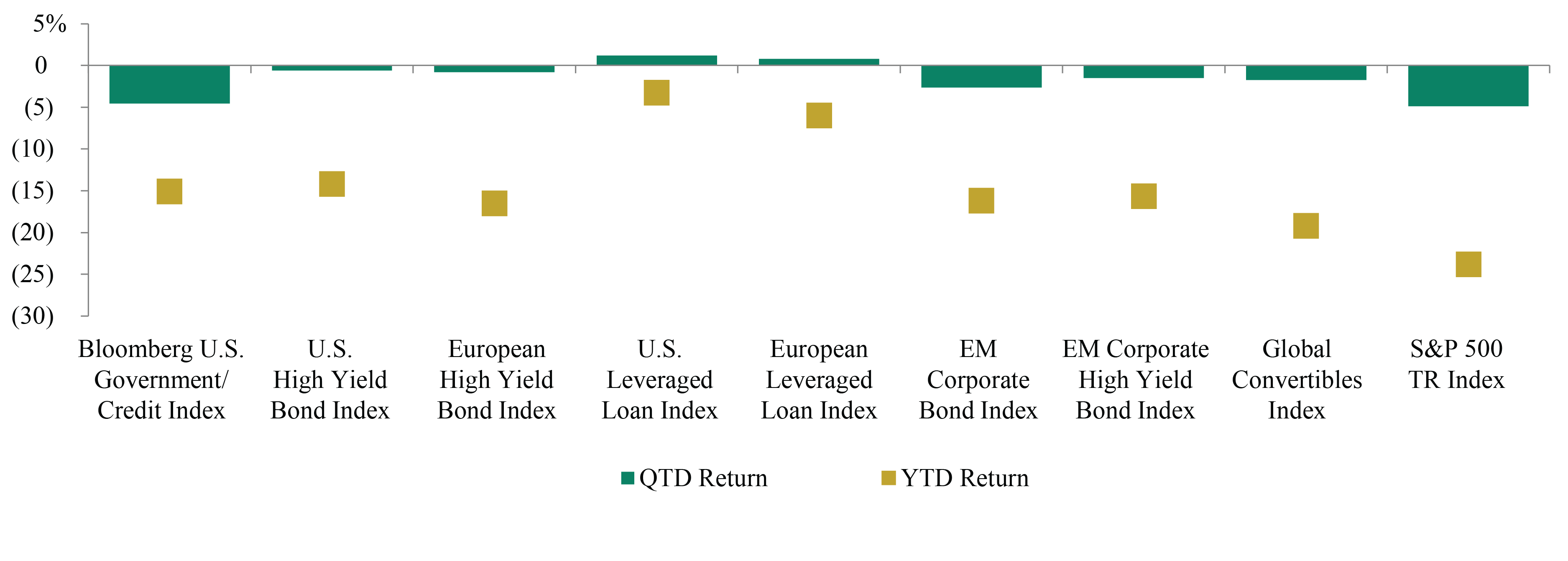

It’s therefore unsurprising that U.S. leveraged loans, which recorded a 3.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} loss in the first nine months of 2022, have meaningfully outperformed both U.S. investment grade and U.S. high yield bonds, which generated losses of 18.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} and 14.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, respectively.2 Importantly, if one strips out the impact of rising interest rates, the outperformance of loans shrinks dramatically. (See Figure 2.)

Figure 2: Relative Performance in Fixed Income Markets Has Been Driven by Rising Interest Rates

Source: ICE BofA US High Yield Index and Credit Suisse Leveraged Loan Index, as of September 30, 2022

But as we noted earlier in the year, floating rates are a double-edged

sword. Rising interest rates initially benefit investors in floating-rate loans because these holders receive larger coupons, but this trend obviously doesn’t help borrowers, who face higher interest costs (unless they hedged this risk). Yet if a borrower struggles to service its floating-rate debt, the company’s problem can quickly become the loan investor’s problem.

We believe some investors may find themselves in this difficult position if current market expectations for the timing and speed of interest rate cuts prove to be overly optimistic. Companies are facing the prospect of higher borrowing costs at a time

when input costs are rising at the fastest pace in decades and the global economy is slowing. While many companies were able to pass through cost increases to customers in the first half of 2022, this capacity is now likely low – if not nonexistent

– at many businesses, especially those that are smaller or in cyclical industries.

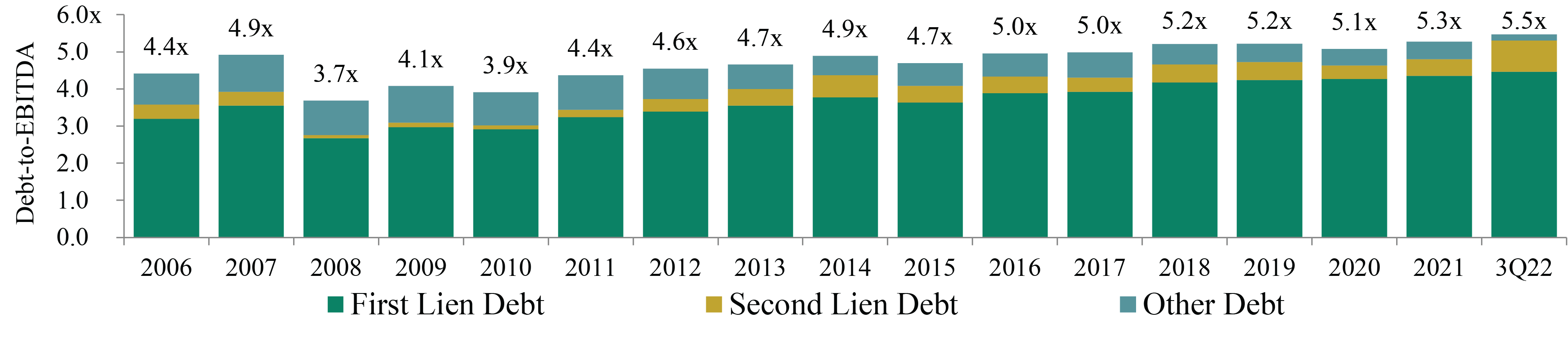

This risk is particularly noteworthy given that many companies with loans outstanding are carrying significant debt loads. The average debt-to-EBITDA ratio in new U.S. loan transactions hit a record-high 5.5x in 1Q2022, above the 4.9x recorded just before

the Global Financial Crisis. (See Figure 3.) Importantly, companies involved in these transactions were often more highly levered than they appeared on paper, as many used aggressive EBITDA adjustments (e.g., for synergies, cost cuts, etc.) when making

these leverage calculations. It’s likely that many of these assumptions haven’t been borne out, due to the aforementioned negative economic trends. If the U.S. and other major economies continue to slow, the denominator in these companies’

leverage ratios will likely keep shrinking, further boosting leverage levels and the likelihood of credit rating downgrades.

Figure 3: Leverage in New Loan Transactions Has Reached a Record High

Source: S&P Leveraged Commentary & Data

Additionally, many of these loans have few investor protections, as covenant-lite loans have become the norm in recent years. In fact, over 90{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of loans issued in 2021 and early 2022 were classified as covenant-lite due to the limited restrictions on

borrowers’ activities.3 This trend has not only enabled companies to amass tremendous amounts of debt but has also allowed them to borrow against weak collateral and take other imprudent actions, such as paying out dividends to equity

holders with cash that could have been better used paying down debt. While the ubiquity of covenant-lite loans could provide borrowers with flexibility during a downturn – as companies obviously can’t default on covenants that don’t

exist – this situation may simply be postponing the inevitable and could cause recovery values to be lower than average when defaults do occur.

We’re already beginning to see the impact of these negative trends on borrowers’ fundamentals and in market prices. In the second quarter, roughly two-thirds of sectors in the leveraged loan market experienced year-over-year margin erosion

– and this figure has likely risen in the third quarter.4 Consequently, downgrades in the loan market have been accelerating: The upgrade/downgrade ratio in August fell to the lowest level since June 2020.5 Meanwhile, the

universe of distressed U.S. loans (i.e., those trading below 80 cents on the dollar) has risen markedly in recent months. The par value reached $102.5 billion at the end of September, after spiking by $43.7 billion, the largest monthly increase since

March 2020.6

Technology and healthcare are the most exposed sectors, representing 23{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} and 19{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, respectively, of the distressed total.7 Technology is also one of the sectors most vulnerable in a rising-interest-rate environment, due to technology companies’

heavy reliance on floating-rate debt and the low average use of interest rate hedges.8 To make matters more challenging, many technology companies that borrowed through the leveraged loan market have generated little if any earnings in

the last twelve months.

As we’ve noted in previous editions of the Performing Credit Quarterly, borrowers may be able to handle elevated interest expenses in the short term. Near-term default risk is fairly low in the U.S. and Europe, as companies have limited

maturities in the next two years and often still have relatively high levels of cash on their balance sheets. While default rates have started to rise, they’ve been doing so from low levels. At quarter-end, the trailing-12-month default rate

for U.S. and European loans were 1.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} and 2.0{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, respectively, below their long-term historical averages.9

But the longer the fed funds rate remains significantly above the 10-year average – which was very low by historical standards – the more likely it is that the cracks in loan fundamentals that we’re seeing could widen and eventually lead to greater instability and, potentially, a few collapses.

Signal #2: Loans are benefiting from supportive technicals

Despite the deterioration in the medium-term outlook for loans, we still believe that the asset class is unlikely to experience dramatic price declines in the short term.

That’s because loan prices should continue to benefit from supportive technicals (i.e., factors related to how the market works, not the fundamentals of the issuers).

First, the supply of new loans has been very limited in 2022. Gross issuance in the U.S. loan market totaled only $205 billion in the year through September, a roughly 68{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} decline YoY.10 The situation is similar in the European loan market,

as the war in Ukraine and related concerns about energy security and the region’s economic health have caused primary markets to stall.

Despite the turbulent macroeconomic backdrop, demand to invest in loans has remained fairly robust, primarily because both the U.S. and European loan markets have a massive, stable buyer: collateralized loan obligations. (See Figure 4.) Steady appetite

from CLOs – which hold almost 60{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of loans in the U.S.11 – is one of the main reasons that volatility in the loan market is typically much less pronounced than that in the high yield bond market. CLOs, unlike holders of many

other asset classes, are almost never forced to offload assets.

Figure 4: CLOs Are the Primary Holders of U.S. Loans

Source: S&P Leveraged Commentary & Data, percentage of senior loan market, as of September 30, 2022

The creation of CLOs in 2022 has decelerated from the rapid pace in 2021, though the slowdown in loan issuance has been much more severe. Looking forward, CLO creation may remain subdued due to the challenging macroeconomic environment, and CLO warehouses

may be increasingly less willing to buy new low-rated loans, due to the risk of downgrades. (CLO structures are designed to limit exposure to loans in the lowest credit rating tier, so when holdings of these securities exceed a specific threshold,

cash flows to a CLO’s equity tranche are typically halted.) This may make it more challenging for some highly levered borrowers to take on new loans. But the issuance of CLOs is unlikely to truly stall as long as it remains profitable for managers

to create these securities. Thus, in the near term, supportive technicals may continue to put upward pressure on loan prices, masking the fundamental weakness that is growing in the asset class.

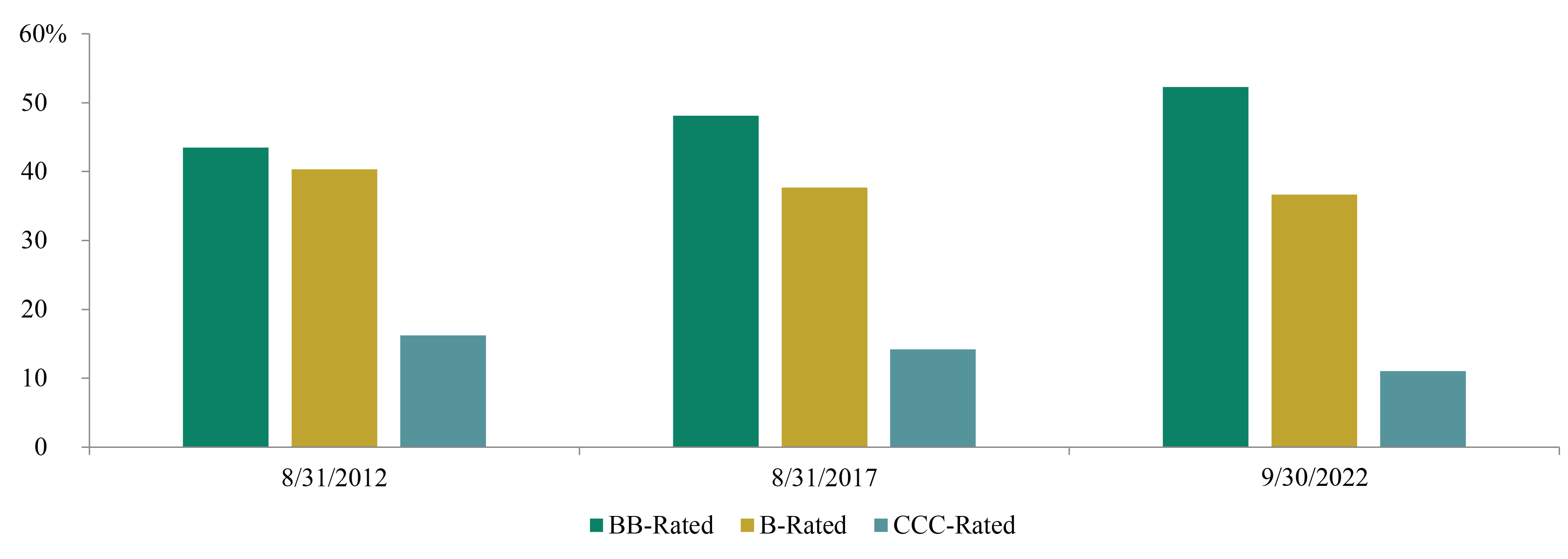

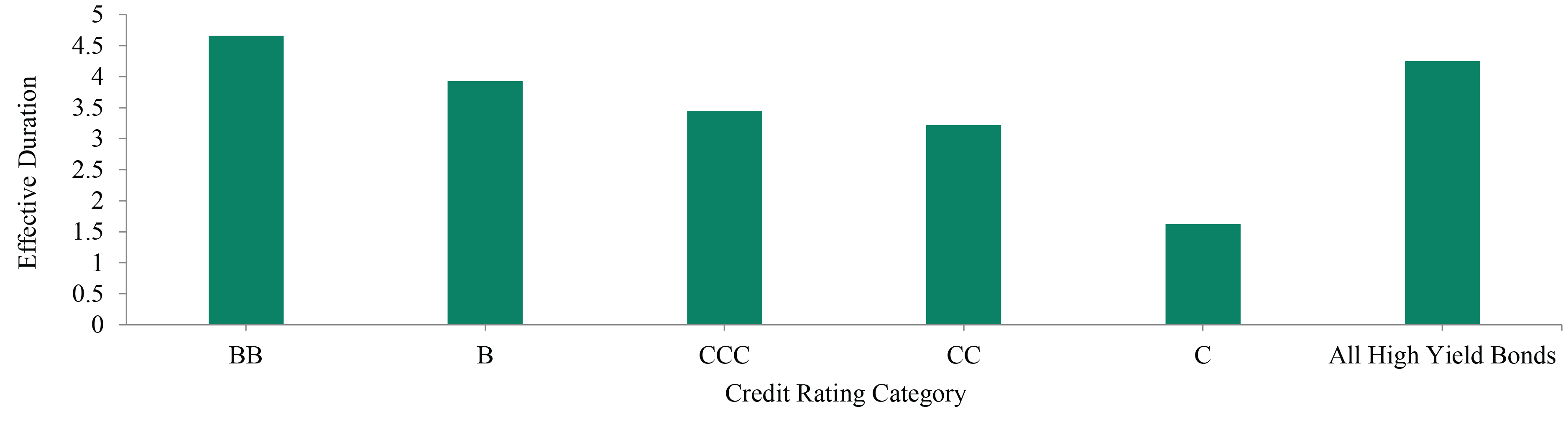

Signal #3: High yield bonds may become increasingly attractive due to their quality and price

If global economies continue to weaken, high yield bonds may become more attractive than loans due to their higher average quality and lower dollar price as well as borrowers’ stable interest costs. While credit fundamentals in the high yield bond

market will likely decline if negative economic trends accelerate, these fundamentals are coming down from a fairly high level. That’s because quality in the high yield bond market has improved significantly in the last ten years. More than

52{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of the market is now rated BB (the level just below investment grade), ten percentage points higher than in 2012. Additionally, the lowest rating category (CCC and below) now represents only 11{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of the market, five percentage points less than

in 2012.12 (See Figure 5.) For comparison, less than one-quarter of loans are rated BB, while the vast majority are rated B, meaning a larger percentage are at risk of being downgraded into the lowest rating tier.13

Figure 5: Quality Has Improved in the U.S. High Yield Bond Market

Source: ICE BofA US High Yield Constrained Index, as of September 30, 2022

High yield bond issuers also benefit from having stable borrowing costs, which should help them weather a significant economic downturn better than companies that are mostly reliant on floating-rate financing. Many issuers were able to lock in ultra-low

interest rates by taking advantage of the generous capital markets in 2020 and 2021. This should be particularly beneficial for the highest-quality issuers, as they have the longest duration in the asset class and thus will enjoy low, stable borrowing

costs for the lengthiest period of time. (See Figure 6.)

Figure 6: Higher-Quality Bonds Have the Longest Duration

Source: ICE BofA US High Yield Constrained Index, as of September 30, 2022

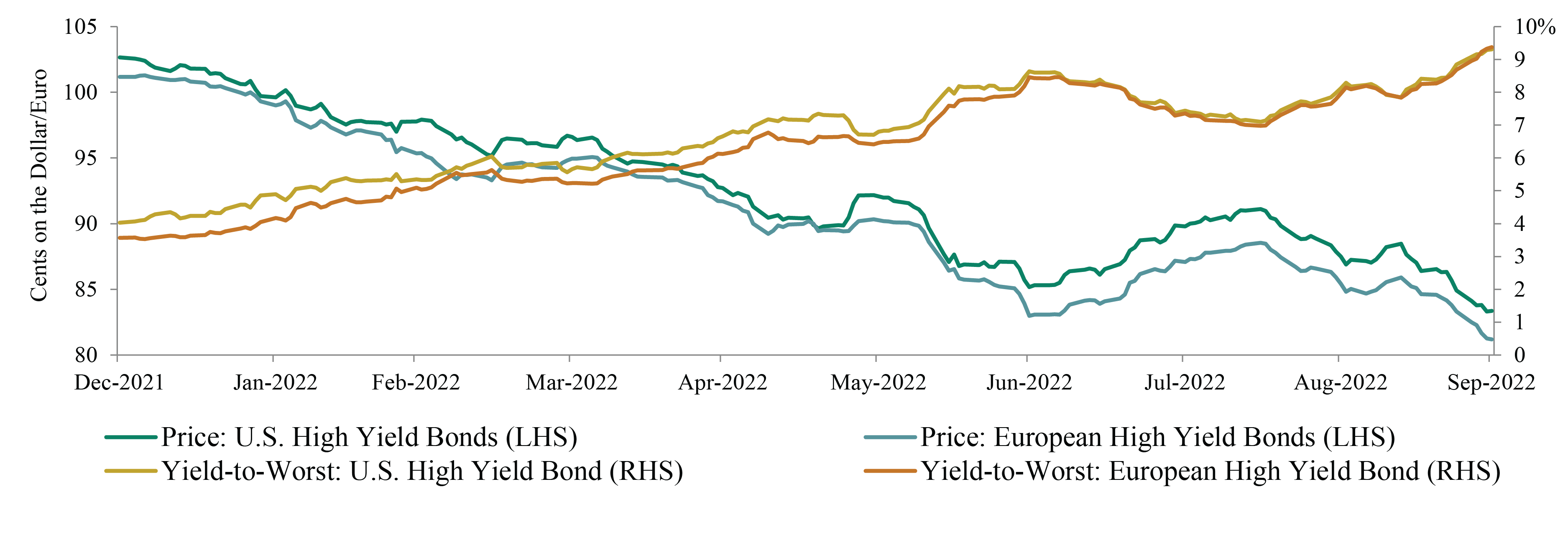

Finally, the low dollar price of high yield bonds may increasingly attract meaningful investor attention, even if other asset classes, such as loans, offer higher yields. At the end of September, the average price in the U.S. high yield bond market was

around 83 cents on the dollar, more than eight cents lower than the average in the U.S. loan market.14 It’s noteworthy that bonds are trading at this low price even though average spreads are still hovering near 500 bps.15 If yield spreads move closer to the recessionary norm, the average dollar price in the market will fall to an extremely low level by historical standards, increasing investors’ already-substantial total return potential. Moreover, such spread-widening

would likely only occur if the economy were to continue slowing. And falling GDP growth typically tempers interest rate risk, which makes longer-duration asset classes more appealing.

Moving forward, we believe these combined characteristics – minimal credit risk, limited near-term debt maturities, stable borrowing costs, and a low dollar price – will make the BB-rated segment of the high yield bond market appealing to investors. As we articulated earlier, fixed-rate assets have performed poorly in 2022 because duration has been the main protagonist in this year’s credit market drama. But we believe this situation may change if the U.S. economy continues to slow and

concerns about credit risk begin to take center stage.

The Limits to Negativism

Credit markets have experienced one of the most challenging nine-month periods on record. And as we noted above, more dangers likely lie ahead. Policymakers and investors are grappling with economic conditions neither has seen in decades, which is creating

volatility – but also some of the most attractive opportunities we’ve seen in years. While caution is necessary when navigating such unsteady terrain, we also believe that the time to turn aggressive may soon be approaching.

Assessing Relative Value

performance of select indices

As of September 30, 2022

Sources: Bloomberg Barclays, Credit Suisse, FTSE, ICE BofA, JP Morgan, S&P Global, Thomson Reuters16

default rates by asset class

Sources: Bank of America, Credit Suisse, JP Morgan

Note: Data represents the trailing-12-month default rate; doesn’t include distressed exchanges

Strategy Focus

high yield bonds

Market Conditions: 3Q2022

u.s. high yield bonds

Return: -0.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}17

Issuance: $18.9bn18

LTM Default Rate: 0.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}19

-

Recession fears and hawkish actions by the Federal Reserve weighed on fixed-rate assets in 3Q2022: After rebounding early in the quarter, high yield bonds posted losses for two consecutive months. Approximately 85{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of U.S.

high yield bonds offered yields above 7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} at quarter-end, compared to roughly 6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} at the beginning of the year.20 -

Yield spreads remain elevated: Although spreads contracted by roughly 40 bps during the quarter, they were wider than 500 bps at quarter-end, which is typically an indicator of growing stress in the market.21

european high yield bonds

Return: -0.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}22

Issuance: €2.3bn23

LTM Default Rate: 0.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}24

-

The asset class’s performance was highly volatile during the quarter: In July, European high yield bonds recorded their highest monthly return in two years. But losses in the following two months erased this gain.25

-

Performance varied significantly by sector: Real estate rallied meaningfully during 3Q2022, following an extremely poor 1H2022. Retail underperformed, reflecting the ongoing cost-of-living crisis in the region.

Outlook

Opportunities

-

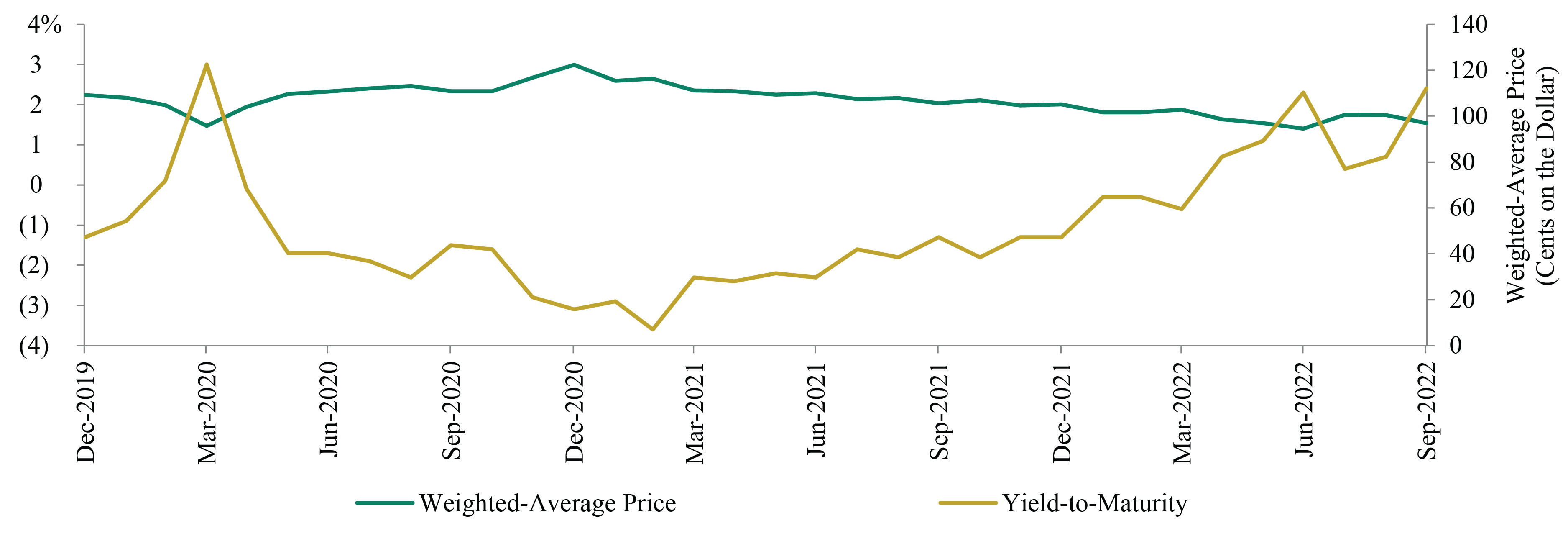

Yields increased during the period, but default risk remains low: In 3Q2022, yields rose in the U.S. and European high yield bond markets by 70 bps and 90 bps, respectively.26 (See Figure 7.) While analysts anticipate

that default rates in these markets will rise moving forward, they expect default rates will remain well below their long-term historical averages.27 Issuers’ fundamentals are fairly healthy despite the slowdown in economic

growth, and near-term maturities are minimal following the wave of refinancings in 2020–21. -

Covenant-lite loans are providing highly leveraged U.S. companies with flexibility: In recent years, high yield bond issuers have had ample access to loans with few restrictions or requirements. While such loans may have enabled

imprudent borrowing, access to this relatively unrestricted source of capital may make bond/loan issuers less likely to default on their bonds in the near term.

Risks

-

Tightening monetary policy could harm heavily indebted companies: Low-rated corporate issuers might struggle to roll over debt if rising interest rates and quantitative tightening slow the economy and cause financial conditions

to become restrictive. This could result in higher-than-expected default rates. -

Elevated inflation could impair issuers’ fundamentals: Companies may be unable to pass along price increases to customers. Reduced earnings could negatively impact leverage ratios and potentially lead to credit rating

downgrades. -

Credit risk appears to be higher in Europe: We believe the likelihood of a significant near-term recession is higher in Europe than in the U.S., given the former’s energy security concerns and proximity to the war in

Ukraine.

Figure 7: High Yield Bonds Are Offering Potentially Attractive Yields and a Low Average Price

Source: ICE BofA Non-Financial Developed Markets High Yield Constrained Index and ICE BofA Global High Yield European Issuers Non-Financial Excluding Russia Index

senior loans

Market Conditions: 3Q2022

u.s. senior loans

Return: 1.2{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}28

Issuance: $24.0bn29

LTM Default Rate: 1.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}30

-

U.S. loans rallied in 3Q2022, as new issuance slowed: During the period, loans outperformed most other asset classes and experienced far less volatility. (See Figure 8.) However, performance in the loan market could be more

volatile than usual moving forward, as tremendous uncertainty remains concerning both inflation and growth in major economies. -

Retail investors reduced their exposure to the asset class: Loan mutual funds and loan ETFs recorded outflows five consecutive months of outflows through September. Outflows in 3Q2022 totaled $13.2bn.31

-

Default rates are beginning to rise: The trailing-12-month default rate for U.S. loans increased to 1.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} at quarter-end, but it remains well below the long-term historical average.32

european senior loans

Return: 0.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}33

Issuance: €17.0bn34

LTM Default Rate: 2.0{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}35

-

European loans were resilient in a challenging environment: Investors favored assets perceived to be safer, including BB-rated loans and those in less-cyclical sectors.

-

Relative outperformance versus European high yield bonds continued: Loans benefited from having floating rates, as investors priced in higher interest rate expectations.

-

Credit risk was punished: CCC-rated loans underperformed the broad market, primarily because of the extremely poor performance of a small subset of loans.

Outlook

Opportunities

-

Rising interest rates may support relative performance: The Federal Reserve, the European Central Bank, and the Bank of England are all likely to continue tightening monetary policy in the near term, which may make U.S. and

European floating-rate loans more attractive relative to fixed-rate assets. -

Loans’ core buyer base is stable: Volatility in loans is usually lower than in other asset classes because (a) CLOs – the primary holders – have limited selling pressure and (b) the cash settlement period

for loans is lengthy, so the asset class tends to attract long-term institutional investors.

Risks

-

Rising interest rates could prove challenging for highly indebted borrowers: The reference rates used in many loan contracts have risen significantly, so borrowers that didn’t hedge their interest rate risk could struggle

to service their debt. -

Tightening central bank policy and geopolitical concerns could impede economic growth and increase defaults: While near-term default risk remains muted, the risk over the medium term is growing – especially for floating-rate

loans – highlighting the importance of disciplined credit selection in this environment. -

High inflation could harm companies’ fundamentals: Borrowers may struggle to pass along cost inflation to customers, a trend that could negatively impact companies’ earnings and leverage ratios. European borrowers

may be especially vulnerable, as energy prices are likely to remain high. -

Loan quality has declined in recent years: Issuer-friendly loans may have encouraged imprudent borrowing, which could prove problematic in an economic downturn. Loan-only issuers could be the most vulnerable, as their average

credit rating is lower than that of bond-and-loan issuers.36

Figure 8: Loans Have Experienced Less Volatility Than Fixed-Rate Debt

Source: Credit Suisse, Bank of America, U.S. Department of the Treasury

emerging markets debt

Market Conditions: 3Q2022

EM Corporate High Yield Bond Return: -1.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}37

-

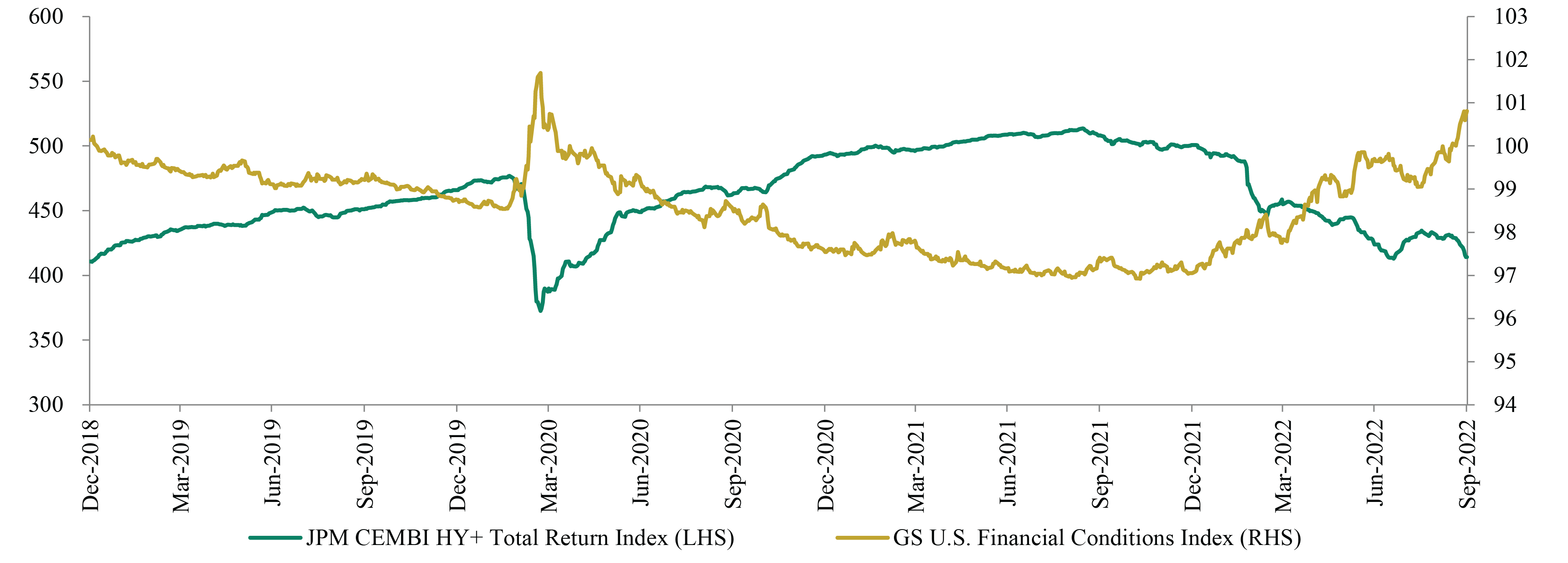

Macroeconomic and geopolitical issues remained significant headwinds: The EM corporate debt index recorded a 16{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} YTD loss through September 30, while the EM sovereign debt index posted a record-high 24{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} YTD loss.38 Tightening financial conditions in the U.S. have weighed heavily on the asset class. (See Figure 9.) Additionally, capital flight accelerated during the quarter due to ongoing concerns, including the strong U.S. dollar, the war in Ukraine,

slowing growth in China, elevated global inflation, and weakness in Western European economies. -

Outflows from EM debt funds increased, offsetting the positive impact of slowing new issuance: During 3Q2022, primary market activity decelerated to the slowest pace in a decade. Consequently, EM investors collectively received

a YTD net return of capital totaling $177 billion.39 However, outflows from EM debt funds, which accelerated in September, offset this tailwind. YTD outflows totaled approximately 10{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of the market’s AUM at quarter-end.40 -

EM debt default rates continue to vary meaningfully between regions: The EM high yield bond corporate default rate in 2022 reached 10.3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in early October,41 driven by defaults in Russia and in the Chinese property

sector. Default rates in Latin America and the Middle East & Africa remained fairly low. However, some African countries are struggling with their high debt burdens. This includes Nigeria, which recently announced that it’s exploring

liability management options.

Outlook

Opportunities

-

Broad market weakness and negative sentiment may create compelling buying opportunities: A record-high percentage of investors are bearish about the short-term outlook for EM economies.42 Consequently, outflows

from EM debt funds have increased. This has caused a significant amount of EM debt to trade at dislocated prices, even when the issuers are fundamentally sound. -

Active management could be beneficial in this challenging environment: Extensive credit analysis may enable investors to identify securities that offer attractive risk-adjusted return potential. EM capital markets are effectively

closed to all except blue-chip issuers. Companies that can generate consistent cash flow may be well positioned in an environment where access to U.S. dollar financing is limited.

Risks

-

Credit investors’ risk aversion may worsen already-difficult market conditions: If the global economy slows, outflows from EM debt retail funds may accelerate, and primary market activity could decelerate further, increasing

already-elevated refinancing risks. -

Developed market central banks may continue to tighten monetary policy: If financial conditions continue to tighten, EM countries and companies may struggle to roll over and service debt denominated in U.S. dollars.

-

Headwinds impacting EM economies could intensify: The war in Ukraine, the zero-Covid policy in China, rising populism in Latin America, and macroeconomic instability in Turkey could all erode investor confidence in EM credit.

Figure 9: Declining U.S. Financial Conditions Have Historically Weighed on EM Debt Performance

Source: Bloomberg, as of September 30, 2022

Note: The Goldman Sachs U.S. Financial Conditions Index gauges the overall looseness (lower number) or tightness (higher number) of financial conditions in the U.S.

global convertibles

Market Conditions: 3Q2022

Return: -1.7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}43

Issuance: $14.8bn44

LTM Default Rate: 1.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}45

-

The asset class’s performance continued to weaken in 3Q2022: Most global equity markets declined during the period, which caused convertible bond prices to fall. Investor concerns mounted about rising interest rates,

persistent global inflation, and the increasing risk of a global recession. -

Growth-oriented equities underperformed: The convertibles market has significant exposure to high-multiple, high-growth issuers, which have recorded significant losses in 2022 due to rising interest rates and slowing economic

growth. -

Convertible bonds provided downside protection relative to equities: Although convertible bond performance was negative during the quarter, the asset class outperformed the global equity market.46

-

Primary market activity accelerated in 3Q2022: New issuance of convertibles globally totaled $14.8bn across 28 new deals during the period.47

Outlook

Opportunities

-

Yields on convertibles have reached the highest level since 1Q2020: The average yield-to-maturity was 2.4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} at quarter-end, reflecting a YTD increase of 370 bps.48 (See Figure 10.)

-

The convertibles universe remains broad and diverse: While primary market activity has been limited for most of 2022, robust issuance in the previous two years has provided an expansive opportunity set to investors who are

seeking to locate value under challenging market conditions. -

Market weakness could create attractive buying opportunities: Value-oriented investors may be able to identify bargains in this environment, as an increasing number of convertibles are trading below par. (See Figure 10).49

Risks

-

Numerous trends threaten to slow economic growth globally and push down equity prices: These include elevated inflation, declining consumer sentiment, tightening global monetary policy, the war in Ukraine, and the reduction

in fiscal support in most major economies. -

High-multiple equities remain vulnerable: Convertibles are highly exposed to growth-oriented stocks, which may continue to weaken if U.S. interest rates keep rising.

Figure 10: The Convertibles Market Is Offering Positive Yields and an Average Price Below Par

Source: Refinitiv

structured credit

Market Conditions: 3Q2022

Corporate

BB-Rated CLO Return: -2.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}50

BBB-Rated CLO Return: -1.4{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}51

U.S. CLO Issuance: $28.4bn52

European CLO Issuance: €6.5bn53

-

Primary market activity slowed in 3Q2022: Issuance in the U.S. totaled $28.4bn in the period, which is well below the 2Q2022 level. Issuance through the first three quarters totaled $100.2bn, significantly lower than the $132.0bn

recorded in the same period in 2021. Primary market activity in Europe has been similarly muted, though it increased in September. €6.5bn of CLOs priced during the quarter compared to €4.2bn in 2Q2022.54 -

The challenging macroeconomic background weighed on the asset class: Slowing global economic growth, tightening monetary policy, declining risk tolerance among investors, and low trading volumes negatively impacted prices.

But corporate structured credit significantly outperformed primarily fixed-rate asset classes.55

Real Estate

BBB-Rated CMBS Return: -3.8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}56

-

Primary market activity has slowed: Year-to-date issuance of commercial mortgage-backed securities totaled $91.3bn at quarter-end, lower than the $97.5bn recorded in the same period in 2021.57

-

Yield spreads have continued to widen: Rising interest rates and, relatedly, rising mortgage rates weighed on commercial and residential real-estate-backed securities. Real estate debt was also negatively impacted by the slowdown

in economic activity.

Outlook

Opportunities

-

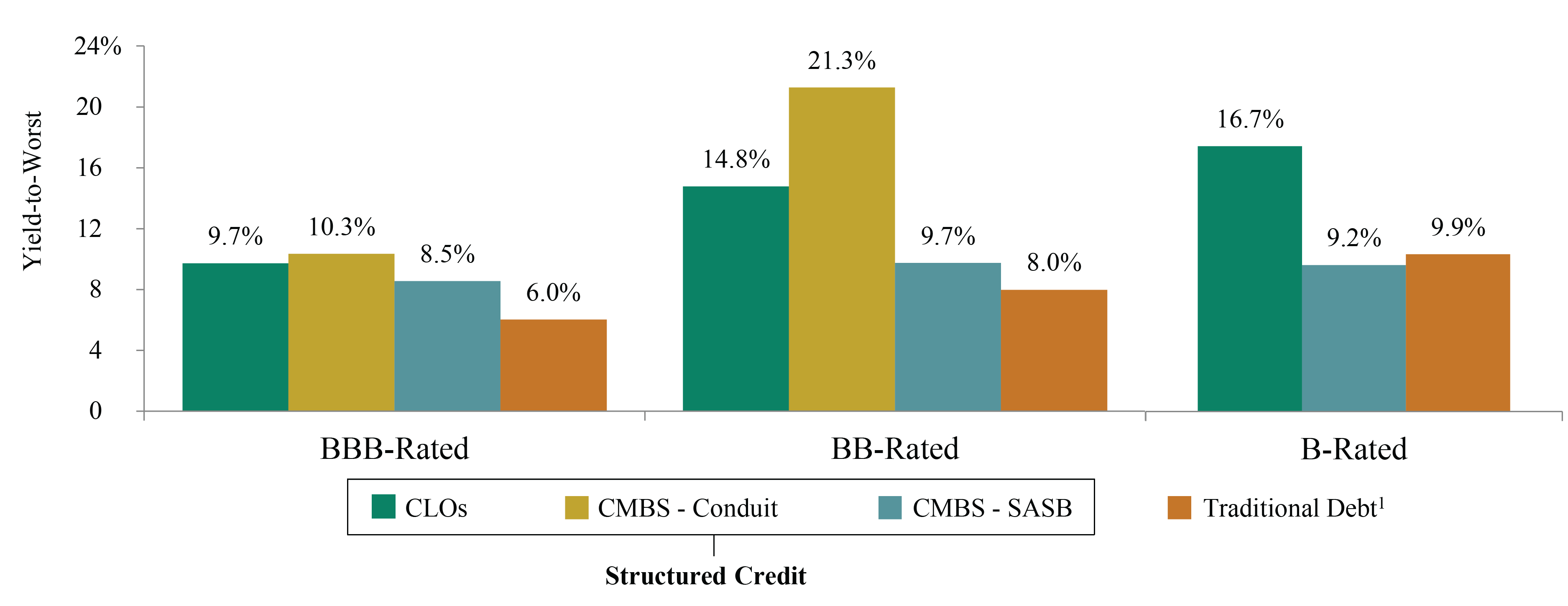

BB-rated CLO debt tranches have many sources of potential value: These instruments have attractive structural and credit enhancements as well as low sensitivity to interest rate increases. Structured credit continues to offer

higher average yields than traditional credit asset classes. (See Figure 11.) -

Asset-backed securities in certain categories may provide meaningful compensation for risk: Yield spreads for select BBB- and BB-rated auto loan and credit ABS may offer attractive value.

-

Weakness in real-estate-backed securities could create compelling opportunities for disciplined investors: The risk/return profiles for SASB CMBS and non-qualified mortgage-backed securities have become increasingly attractive.

However, we think disciplined credit analysis is extremely important in this challenging environment.

Risks

-

CLOs have historically performed poorly during bouts of equity market weakness: Performance could continue to be negatively affected by numerous factors, including the conflict in Ukraine and related energy security concerns

in Europe, rising inflation, tightening monetary policy, slowing global growth, and the decline in investor risk appetite. -

Widening yield spreads could limit primary market activity in real-estate-backed securities: Issuers may be unwilling to offer the yields demanded by investors, limiting the opportunity set.

Figure 11: Structured Credit Offers Higher Yields Than Most Traditional Debt

Source: Bloomberg Barclays Index Services, FTSE Global Markets, Credit Suisse, JP Morgan, as September 30, 2022

private credit

Market Conditions: 3Q2022

-

Private credit has benefited from investor demand for floating-rate debt: Rising interest rates have made private debt with floating rates appealing to investors, as coupons have increased and the debt’s interest rate

risk is low. Floating-rate direct loans have historically performed well in rising-interest-rate environments. -

The volume and quality of sponsor-backed deals varies considerably by size: Deal flow for smaller businesses (i.e., those with EBITDA of $10-30mm) has remained robust, and terms have become slightly more lender-friendly. In

2022, yield spreads have increased by 25-50bps, and leverage levels have fallen.58 Deal activity for larger companies (i.e., EBITDA ≥ $50mm) has declined significantly, due to (a) the slowdown in fundraising, (b) investors’

desire to reduce exposure to individual companies, and (c) direct lenders’ decreased access to credit facilities. -

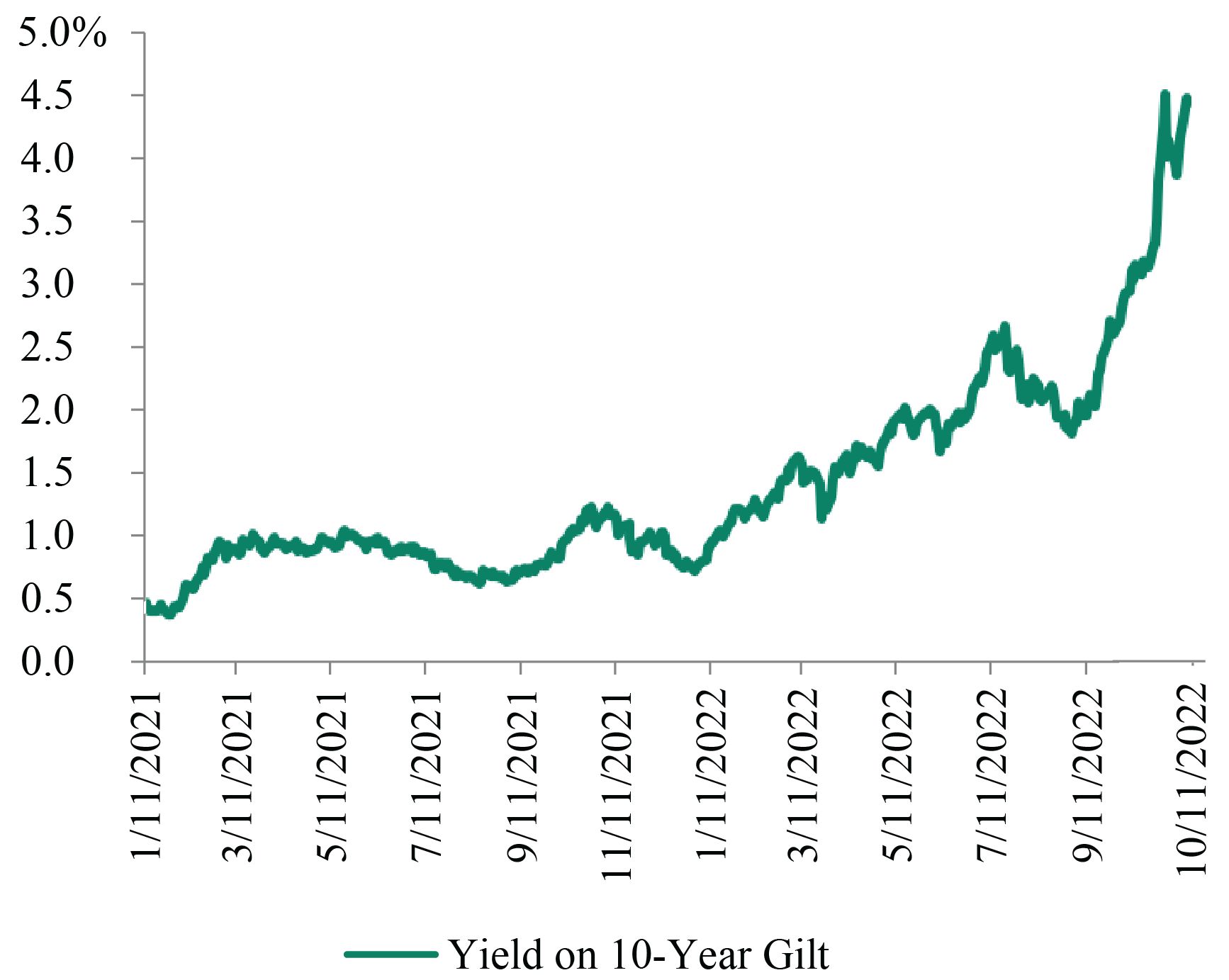

UK markets are suffering due to negative economic trends and policy mistakes: The UK’s annual inflation rate hit 10.1{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in September.59 The disconnect between fiscal and monetary policy has caused significant

turmoil in UK markets. The Bank of England has intervened to ensure markets continue to function properly, but it has indicated that it will soon halt its emergency bond purchases, so volatility has persisted. (See Figure 12.)

Outlook

Opportunities

-

Hung bridge loans are morphing into private deals: Banks are seeking to reduce risk on their balance sheets and are thus disposing of many of these loans in the private market at attractive prices.

-

Compelling rescue lending opportunities are increasing: The opportunity set could expand further if markets continue to weaken.

-

Opportunities in the non-sponsored market (NSM) remain attractive: Average pricing and terms are superior to those in the sponsor-backed market (SBM). Yield spreads in the NSM have widened by as much as 200 bps in 2022, more

than the 50-100 bps observed in the SBM.60 -

Volatility in UK markets could put upward pressure on yields: The turbulence has caused lenders to tighten terms and increase pricing, especially in the real estate sector.

-

European banks may continue to lose market share: In recent years, European borrowers have increasingly turned to direct lenders and other non-bank capital providers, as traditional bank lending has declined due to regulatory

changes. While banks may increase market share temporarily as other capital providers seek to reduce risk during this tumultuous period, we anticipate that the shift toward alternative financing will continue over the long term.

Risks

-

Credit fundamentals in several sectors are deteriorating: Consumer-facing companies are especially vulnerable, as it has become challenging to pass through price increases to customers. Cyclical industries are experiencing

the most significant margin erosion. -

Recession risk is increasing: If the U.S. economy contracts, private equity sponsors may not inject capital into struggling companies like they did in 2020–21. Sponsors may have already met their investment caps or believe

they won’t earn a sufficient return. -

Tightening monetary policy could negatively impact the lending environment: Higher interest rates may discourage new borrowing and make it challenging for current borrowers to roll over their debt. This situation could make

defaults more likely.

Figure 12: The Yield on the 10-Year UK Gilt Has Spiked in Recent Months

Source: Bloomberg, as of October 11, 2022

Investment Grade Credit

Market Conditions: 3Q2022

Return: -5.0{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}61

Issuance: $274bn62

-

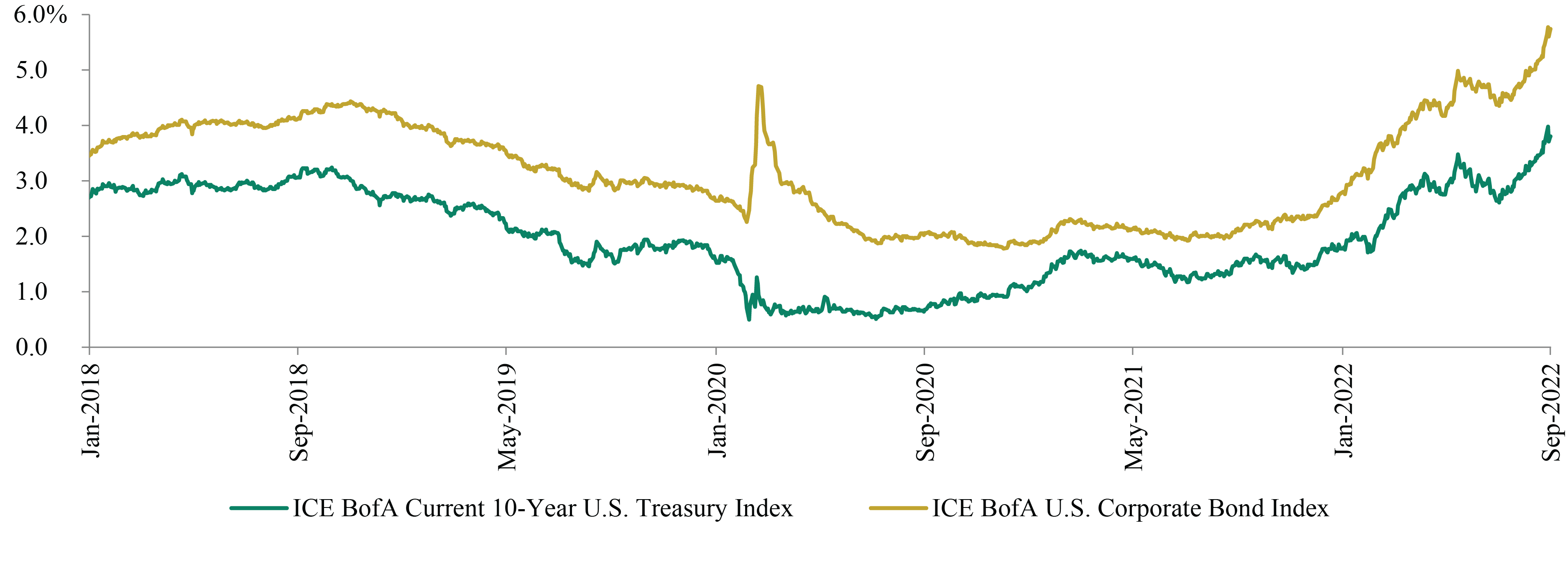

Tightening U.S. monetary policy negatively impacted investment grade credit in 3Q2022: U.S. Treasury yields moved higher during the quarter, as the Federal Reserve continued to hike interest rates to combat elevated inflation.

The yield on the 10-year Treasury note rose by 83 bps during the period.63 -

In September, Treasurys recorded their worst month in 19 years: Markets priced in additional interest rate hikes after the August inflation figure came in higher than expected. Treasury yields spiked late in the quarter after

the British government’s plan for massive tax cuts caused a surge in UK government bond yields. The move in Treasury yields during the quarter was driven by an increase in real rates, as breakeven inflation expectations have continued

to fall. -

Higher-quality credits have been resilient: Yield spreads of A-rated credits have widened less significantly than those of lower-rated credits. At quarter-end, the average price of A-rated bonds was near 88 cents on the dollar,

and the yield-to-maturity was roughly 5.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.64

Outlook

Opportunities

-

Yields on investment grade corporate debt have risen to attractive levels: The asset class’s average yield rose by roughly 100 bps during the period to reach 5.7{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} at quarter-end.65 (See Figure 13.)

-

Rising recession risk may make investment grade debt attractive on a relative basis: Investment grade debt is likely to outperform high yield bonds if widening yield spreads, not rising Treasury yields, are the primary drivers

of performance in the credit markets. -

Defensive sectors could potentially offer attractive value if the macro backdrop deteriorates: Sectors such as financials and cyclicals typically outperform during economic downturns.

Risks

-

Inflation may remain elevated, putting pressure on the Fed to continue hiking interest rates: Tighter monetary policy and slowing economic activity should temper inflation, but endogenous factors (such as the lag in accounting

for rental housing price increases) and exogenous factors (such as geopolitical risk) could put upward pressure on inflation. -

Rising input costs and slowing economic growth could weigh on corporate earnings: Issuers’ fundamentals remain fairly robust, but margin compression could negatively impact credit metrics, resulting in credit rating

downgrades and mark-to-market weakness.

Figure 13: Yields on Investment Grade Bonds Have Spiked as U.S. Treasury Yields Have Risen

Source: ICE BofA

about oaktree’s performing credit platform

Oaktree Capital Management is a leading global alternative investment management firm with expertise in credit strategies. Our Performing Credit platform encompasses a broad array of credit strategy groups that invest in public and private corporate credit

instruments across the liquidity spectrum. The Performing Credit platform, headed by Armen Panossian, has $54.2 billion in AUM and approximately 190 investment professionals.66

Endnotes

1 Based on the realization of the forward curve, as of September 30, 2022.

2 Credit Suisse, JPMorgan, FTSE.

3 S&P Leveraged Commentary & Data.

4 JP Morgan.

5 Citi, as of September 13, 2022.

6 JP Morgan.

7 JP Morgan.

8 Based on a Bank of America study representing $1.5 trillion of debt, as of August 29, 2022.

9 JP Morgan and Credit Suisse, as of September 30, 2022.

10 JP Morgan.

11 S&P Leveraged Commentary & Data, as of September 30, 2022.

12 ICE BofA, as of September 30, 2022.

13 Credit Suisse, as of September 30, 2022.

14 FTSE High Yield Cash Pay Capped Index, Credit Suisse Leveraged Loan Index, as of September 30, 2022.

15 FTSE High Yield Cash Pay Capped Index, as of October 24, 2022.

16 The indices used in the graph are Bloomberg Government/Credit Index, Credit Suisse Leveraged Loan Index, Credit Suisse Western European Leveraged Loan Index (EUR hedged), FTSE High-Yield Cash-Pay Capped Index, ICE BofA Global Non-Financial HY European Issuers ex-Russia Index (EUR Hedged), Refinitiv Global Focus Convertible Index (USD Hedged), JP Morgan CEMBI Broad Diversified Index (Local), JP Morgan Corporate Broad CEMBI Diversified High Yield Index (Local), S&P 500 Total Return Index, and FTSE All-World Total Return Index (Local).

17 FTSE High Yield Cash Pay Capped Index.

18 JP Morgan.

19 JP Morgan.

20 ICE BofA US High Yield Constrained Index.

21 FTSE High Yield Cash Pay Capped Index.

22 ICE BofA Global Non-Financial High Yield European Issuer, Excluding Russia Index (EUR hedged).

23 S&P Global Leveraged Commentary & Data.

24 Credit Suisse.

25 ICE BofA Global Non-Financial High Yield European Issuer Excluding Russia Index.

26 FTSE High Yield Cash Pay Capped Index, ICE BofA Global Non-Financial High Yield European Issuer Excluding Russia Index.

27 JP Morgan.

28 Credit Suisse Leveraged Loan Index.

29 JP Morgan; gross issuance includes refinancings and resets.

30 JP Morgan.

31 JP Morgan.

32 JP Morgan.

33 Credit Suisse Western Europe Leveraged Loan Index (EUR-hedged).

34 S&P Global Leveraged Commentary & Data; gross issuance.

35 Credit Suisse.

36 JP Morgan, as of September 30, 2022.

37 JP Morgan Corporate Broad CEMBI Diversified High Yield Index. The Emerging markets debt section focuses on dollar-denominated debt issued by companies in emerging market countries.

38 JP Morgan.

39 JP Morgan.

40 BofA Global Research.

41 JP Morgan.

42 HSBC; 41{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of EM investors are bearish about the near-term outlook for emerging markets, as of September 27, 2022.

43 Refinitiv Global Focus Convertible Index.

44 Bank of America; gross issuance.

45 Bank of America.

46 Refinitiv Global Focus Convertible Index, FTSE All World Total Return Index.

47 Bank of America.

48 Refinitiv Global Focus Convertible Index; yield-to-maturity is currency-hedged.

49 Refinitiv Global Focus Convertible Index.

50 JP Morgan CLOIE BB Index.

51 JP Morgan CLOIE BBB Index.

52 JP Morgan; new issue only, so doesn’t include refinancings and resets.

53 JP Morgan; new issue only, so doesn’t include refinancings and resets.

54 JP Morgan.

55 JP Morgan CLOIE BBB Index, JP Morgan CLOIE BB Index.

56 Barclays CMBS 2.0 BBB Index.

57 Barclays.

58 Derived from Oaktree estimates, as of September 30, 2022.

59 The Office of National Statistics.

60 Derived from Oaktree estimates, as of September 30, 2022.

61 JP Morgan.

62 SIFMA.

63 U.S. Department of the Treasury.

64 ICE BofA Single-A U.S. Corporate Index.

65 ICE BofA US Corporate Index.

66 The AUM figure is as of June 30, 2022 and excludes Oaktree’s proportionate amount of DoubleLine Capital AUM resulting from its 20{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} minority interest therein. The total number of professionals includes the portfolio managers and research analysts across Oaktree’s performing credit strategies.

Notes and Disclaimers

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments.

Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker dealer,

investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

This document, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of

Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”). By accepting this document, you agree that you will comply with these restrictions and acknowledge that your compliance is a material inducement to Oaktree providing

this document to you.

This document contains information and views as of the date indicated and such information and views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation,

and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree believes that such information is accurate and that the sources from which it

has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Moreover, independent

third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.

© 2022 Oaktree Capital Management, L.P.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/4ZPCLGW6FNMEZARDIFARVVHOMQ.jpg)