25 Oct 2022

- Credit benchmarks tightened considerably for homes and firms

- Personal loan desire from companies enhanced, pushed by substantial enter prices and inventories constructing

- Bank loan desire from homes lowered in a context of bigger fascination prices and decrease self-confidence

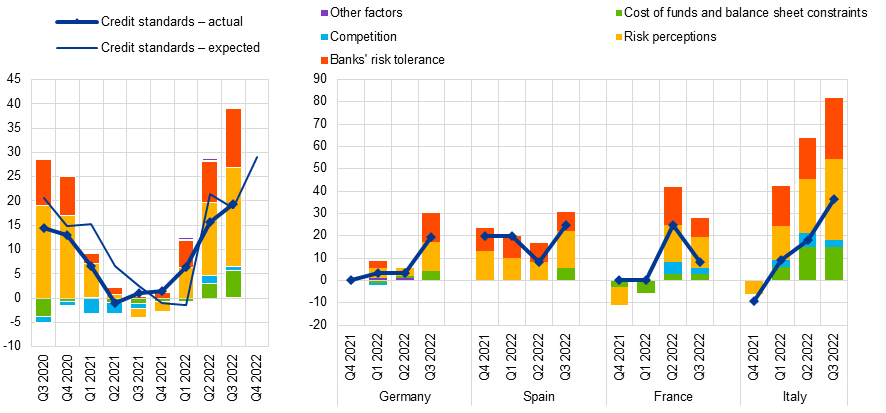

In accordance to the Oct 2022 euro spot lender lending survey (BLS), credit history requirements – i.e. banks’ interior recommendations or bank loan acceptance conditions – for loans or credit score strains to enterprises tightened additional (web percentage of banks standing at 19{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}) in the third quarter of 2022 (see Chart 1). With regard to loans to households for residence buy, euro place financial institutions documented a sturdy net tightening of credit rating standards (net share of 32{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}) and a lesser, but nevertheless pronounced, net tightening for customer credit history and other lending to households (internet percentage of 21{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}). In the context of economic slowdown and intensifying recession fears, the dangers associated to the economic outlook, as nicely as market or agency-particular cases and banks’ declining possibility tolerance all experienced a appreciable tightening impression on credit history criteria for loans to companies. With the ongoing normalisation of monetary coverage, banks’ expense of resources and harmony sheet scenario also experienced a tightening affect on credit criteria for loans to euro place companies, which was larger sized than in the previous survey round. In the fourth quarter of 2022 euro region financial institutions be expecting a drastically more powerful net tightening of credit rating specifications on loans to corporations. In addition, euro place banking companies be expecting credit score standards to proceed to tighten for both of those housing financial loans and shopper credit rating.

Banks’ over-all phrases and situations – i.e. the genuine phrases and disorders agreed in mortgage contracts –tightened for loans to firms and loans to homes in the third quarter of 2022. For financial loans to companies, each loan margins and other terms and ailments had a tightening effect. For home invest in financial loans and client credit score, irrespective of the internet tightening of phrases and circumstances, loan margins (with margins outlined as the distribute over appropriate market reference rates) narrowed, reflecting in section that industry reference rates have greater more rapidly than interest costs on financial loans to homes.

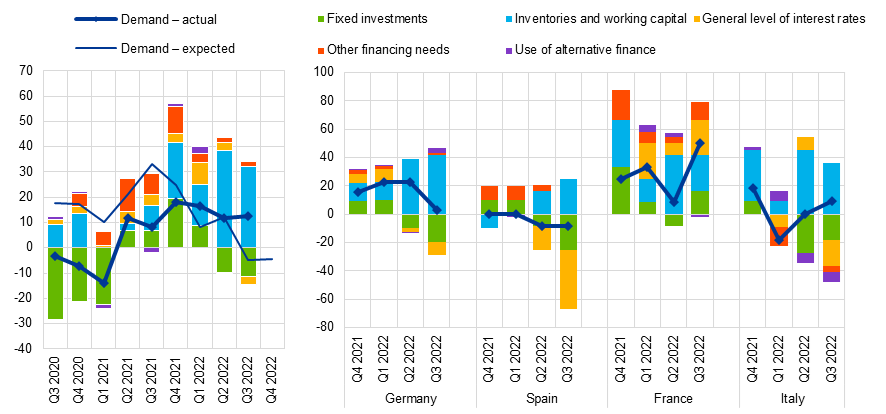

Banking companies reported, on stability, an raise in desire from corporations for loans or drawing of credit score lines in the third quarter of 2022 (see Chart 2). Financial loan demand continued to be driven by firms’ financing demands for performing cash and inventories, in the context of inflated creation prices, growing inventories thanks to the slowdown in need and precautionary behaviour in opposition to the background of provide bottlenecks. For the second consecutive quarter, fastened investment experienced a dampening affect on firms’ internet demand from customers for financial loans, in line with the expected slowdown in financial investment. In the context of monetary coverage normalisation, banking companies have commenced to point out a unfavorable contribution from the typical stage of curiosity rates to financial loan need. In the third quarter of 2022 web demand from customers for housing financial loans fell significantly, although need for client credit rating and other lending to households also decreased in net terms. The web lower in demand from customers for loans to households was primarily driven by the standard stage of fascination prices and declining consumer confidence. For the fourth quarter of 2022 financial institutions count on a web minimize in firms’ desire for loans. For households, financial institutions hope a even further solid internet lessen in the demand from customers for housing financial loans and a lesser, but still comparatively robust, fall in demand from customers for customer credit history.

In accordance to the banking institutions surveyed, accessibility to retail funding, securitisation and significantly medium-to-extended expression credit card debt securities deteriorated, in net phrases, in the 3rd quarter of 2022. This displays the tightening of financial industry problems for banking institutions as financial policy normalises. Banks reported that the ECB’s asset purchase programmes had a damaging affect on their liquidity position, marketplace funding circumstances and profitability more than the previous six months, in the context of the monetary plan normalisation and the ending of internet asset buys. Above the previous six months, which partly covered the time period in which the ECB’s deposit facility charge was however damaging, euro space banks described in web phrases, that the deposit facility level continued to have a favourable, albeit smaller, effects on lending volumes to firms and households and continued to contribute negatively to bank profitability. Financial institutions in the euro location indicated a lesser favourable effects from TLTRO III on their economic problem and lending volumes, as well as a lower net easing affect on phrases and problems for financial loans to corporations and homes compared with the prior survey round.

The euro region financial institution lending study, which is done four times a 12 months, was formulated by the Eurosystem in get to strengthen its understanding of financial institution lending conduct in the euro area. The results described in the October 2022 survey relate to modifications observed in the 3rd quarter of 2022 and envisioned alterations in the fourth quarter of 2022, except if normally indicated. The October 2022 survey spherical was performed among 16 September and 4 October 2022. A full of 153 financial institutions ended up surveyed in this spherical, with a reaction amount of 100{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

For media queries, be sure to make contact with Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this study spherical is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS person manual with info on the BLS series keys can be located on the very same webpage.

- The euro location and countrywide data series are offered on the ECB’s web site via the Statistical Data Warehouse. Countrywide final results, as published by the respective nationwide central financial institutions, can be received by using the ECB’s web site.

- For far more thorough information and facts on the BLS, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro region financial institution lending survey”, Occasional Paper Collection, No 179, ECB, 2016.

Chart 1

Modifications in credit score expectations for loans or credit strains to enterprises, and contributing aspects

(internet percentages of banking companies reporting a tightening of credit criteria, and contributing aspects)

Supply: ECB (BLS).

Notes: Net percentages are outlined as the variance involving the sum of the percentages of financial institutions responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to additional factors which have been pointed out by banking companies as owning contributed to modifications in credit expectations.

Chart 2

Changes in need for loans or credit history strains to enterprises, and contributing variables

(net percentages of financial institutions reporting an boost in demand, and contributing things)

Supply: ECB (BLS).

Observe: Internet percentages for the concerns on demand for financial loans are outlined as the big difference in between the sum of the percentages of banking institutions responding “increased considerably” and “increased somewhat” and the sum of the percentages of banking companies responding “decreased somewhat” and “decreased considerably”.