|

| Singapore has opened its borders to thoroughly vaccinated website visitors. Resource: iStock |

Singapore’s financial institutions are likely to see speedier bank loan growth and enhanced profitability as Southeast Asian economies open up for enterprise and travel right after two several years.

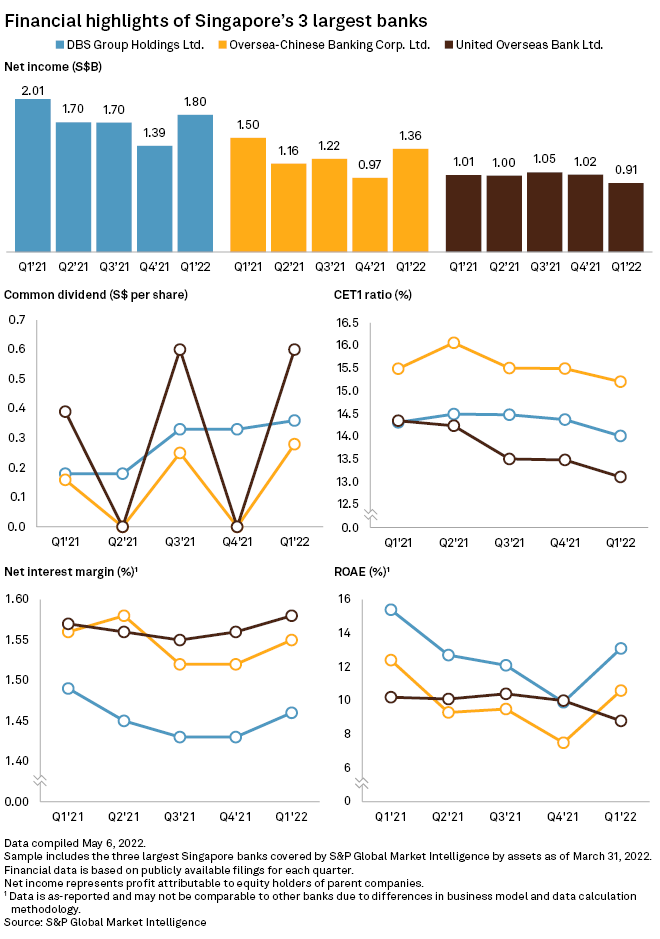

Loans across the 3 Singaporean banking institutions — DBS Team Holdings Ltd., Oversea-Chinese Banking Corp. Ltd., or OCBC, and United Overseas Financial institution Ltd. — rose by 8{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 9{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} calendar year around 12 months in the very first quarter of 2022, according to their lately declared final results. That was a sizeable advancement from a 5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} mortgage progress claimed every single by DBS and UOB in the initially quarter of 2021, while OCBC’s loans had been flat, dragged by the COVID-19 pandemic.

DBS expects a mid-single-digit progress in financial loans this 12 months, and UOB expects a mid- to large-solitary-digit raise.

Loans are expected to expand as Southeast Asian economies open borders, strengthen infrastructure investing and boost manufacturing capacity, reported Thilan Wickramasinghe, head of investigation and head of regional financials at Maybank Kim Eng Singapore. “This must travel mortgage need better,” Wickramasinghe explained.

The 3 Singapore banks are seriously concentrated on Southeast Asia and derive most of their earnings from the region. In 2021, DBS generated around 70{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of its running revenue from Singapore, and South and Southeast Asia, according to S&P World Market Intelligence knowledge. OCBC and UOB derived all around 80{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of their functioning earnings from the metropolis-condition and Southeast Asia.

Regional product

A increase in loan desire, in accordance to Wickramasinghe, “bodes perfectly for the Singapore banking institutions who have been investing in integrated regional styles that could consider edge of cross-border credit rating and banking solutions desire.”

Singapore itself completely reopened its borders to all vaccinated guests from April 1. The government expects the city-state’s overall economy to grow by 3{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} to 5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} in 2022, adhering to a 7.6{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} expansion in 2021, according to the Ministry of Trade and Field. The Financial Authority of Singapore tightened plan ahead of a lot of world friends and established the area greenback on a steeper appreciation path in opposition to a basket of currencies of the nation’s key investing companions. As most world-wide central banking institutions, which include the U.S. Federal Reserve, raise costs to suppress inflation, the outlook for financial institutions could boost.

Financial loan development is predicted to prop up banks’ earnings together with the influence of rising internet fascination margins — a critical metric to banks’ profitability — that have been assisted by climbing curiosity prices. NIMs throughout the three financial institutions have risen by 2 to 3 basis points quarter around quarter, indicating a restoration right after obtaining fallen for 3 many years amid the pandemic-induced slowdown.

Prudent provisions

Singapore banking institutions largely taken care of provisions to trip as a result of marketplace uncertainties and guard from a rise in undesirable loans, in accordance to their 1st-quarter outcomes.

“The provision stages for the banks are prudent with provisioning protection at shut to 100{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, or 1 moments, on nonperforming property,” explained Michael Wu, senior fairness analyst at Morningstar. “Regardless of the expectation of slower development, the all round financial problems ought to however [improve] that is supportive of asset high-quality.”

In addition, the financial institutions have taken care of their “management overlay,” an added sum agreed on by banks to nutritional supplement provision needs from the central lender.

“While risks of damaging credit score price steering revisions keep on being, massive administration overlay buffers minimize the probability of major earnings downgrades,” according to a May possibly 3 notice from CGS-CIMB.

As of May 11, US$1 was equal to S$1.39.