Expanding rate revenue and attainable generate-backs of prior provisions for lousy loans will assistance Singapore’s key financial institutions preserve their earnings momentum through the rest of the calendar year.

Desire margins, even so, are likely to consider longer to recuperate as world central banking companies maintain financial coverage configurations uncomplicated to support financial development.

“We anticipate earnings to broadly be sustained by broad-dependent charge cash flow restoration in [the fourth quarter of 2021],” stated Andrea Choong, a Singapore-dependent equity study analyst at CGS-CIMB Securities. Outside of that, “impairments will likely be the vital swing component on the [banks’] bottom line,” Choong reported.

Choong expects credit score fees to hover all-around the degrees seen in the third quarter, assisted by the substantial normal provision buffers Singapore’s banking companies have created.

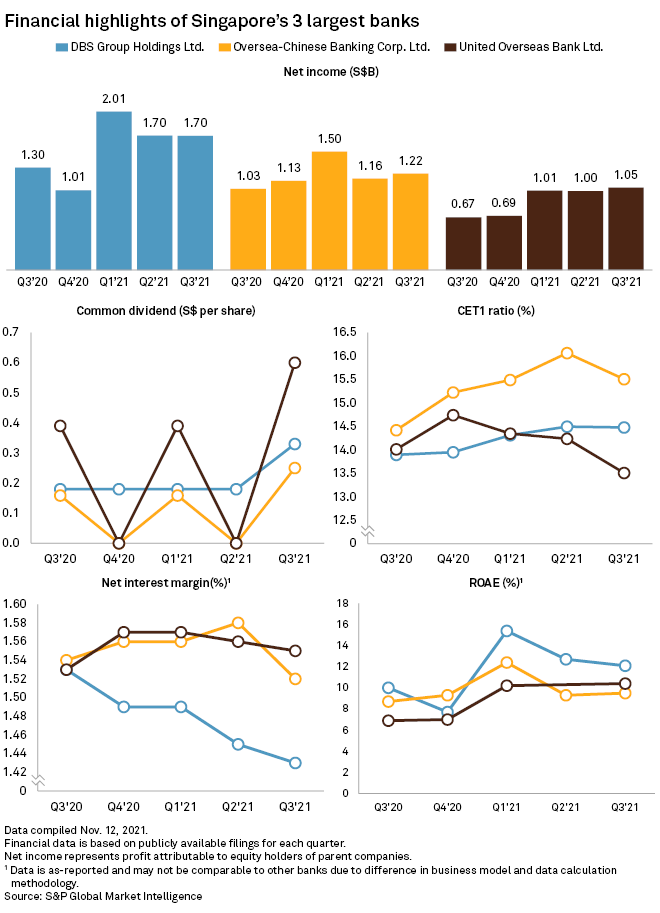

The metropolis-state’s big banking institutions all posted internet revenue gains in the quarter finished Sept. 30. United Overseas Lender Ltd. posted a 57{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} 12 months-more than-year net income expansion in the third quarter, adopted by DBS Group Holdings Ltd. at 31{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} and Oversea-Chinese Banking Corporation Ltd. at 19{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

The improve in web revenue was partly thanks to larger price incomes and reduced credit history allowances. UOB and OCBC both recorded a 14{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} year-around-calendar year enhance in internet fee cash flow for the September quarter, while DBS logged a obtain of 11{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}.

Terrible financial loans secure

Analysts say the loan companies are effectively positioned to satisfy their loan growth targets for 2021 as the economy recovers. Asset good quality remained secure, with all 3 banking companies logging a nonperforming financial loan ratio of 1.5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} for the quarter. Meanwhile, nonperforming asset protection across the three banking institutions has also reduced in comparison with past calendar year, at an typical of 103{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}, a reversal of the provisions entrance-loaded at the commencing of the pandemic.

“We can see that the banking institutions are starting to reverse the significant provisions created in 2020 and it would count on how the economy increases,” reported Glenn Thum, a Singapore-centered research analyst at Phillip Securities Analysis

Singapore has altered to a “dwell with COVID-19” approach, opening up the economic climate and welcoming small business vacation as more than 80{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of its inhabitants is thoroughly vaccinated versus the virus. The island nation is also actively presenting booster photographs to those people above the age of 30 and other substantial-threat teams.

Net desire margins for the 3 banking institutions remained secure in the September quarter amid a very low price environment and competition.

“We assume NIM to be secure, as loans advancement will be capable to offset the decreased web curiosity earnings because of to lower charges,” Thum explained, including that financial institution earnings in the fourth quarter may be moderated by static NIMs as more competitive company loans have resulted in reduced asset yields.

UOB recorded the highest NIM of 1.55{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} at September-close, followed by OCBC with 1.52{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. DBS’s NIM was the lowest among the the a few at 1.43{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. The ratio declined at all banking companies as global central financial institutions guided fascination prices decrease to improve economic activity.

The Monetary Authority of Singapore in Oct tightened its financial plan amid value pressures caused by supply constraints and a restoration in the worldwide financial system, providing its very first adjust considering that 2018.

The MAS amplified the slope of its currency band “slightly” from the prior zero to ensure selling price balance more than the medium expression even though recognizing the pitfalls to financial recovery. In its place of interest fees, the Singapore central lender utilizes forex exchange as its principal monetary coverage tool, guiding the area dollar in an undisclosed forex band relative to friends in the nation’s vital investing partners.

As of Nov. 15, US$1 was equal to S$1.35.