Just five decades back, no substantial banking institutions supplied little installment loans or traces of credit history to examining account clients with lower or no credit history scores but currently thanks in portion to modifications in federal polices to aid buyers, six of the eight most significant financial institutions, calculated by their variety of branches, do. These financial loans are safer and additional reasonably priced for consumers who previously would switch to significant-price payday financial loans or other option economical solutions, these types of as automobile-title financial loans and hire-to-very own agreements.

Regions Lender, Truist, and Wells Fargo commenced providing these shopper-friendly financial loans in late 2022, becoming a member of Financial institution of The usa, Huntington Lender, and U.S. Bank. These 6 massive banking institutions combined work practically 17,000 branches, or 23{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of all financial institution branches in the U.S.

They are presenting financial loans in quantities up to $500, $750, or $1,000 depending on the bank, which are huge ample for prospects to replace substantial-cost non-bank financial loans with very affordable credit rating. Borrowers can entry the money in a number of minutes or less, simply because they are quickly pre-authorized or comprehensive a rapid software and the proceeds are disbursed into their bank account virtually immediately. All the applications give prospects at the very least a few months to repay in equal installments.

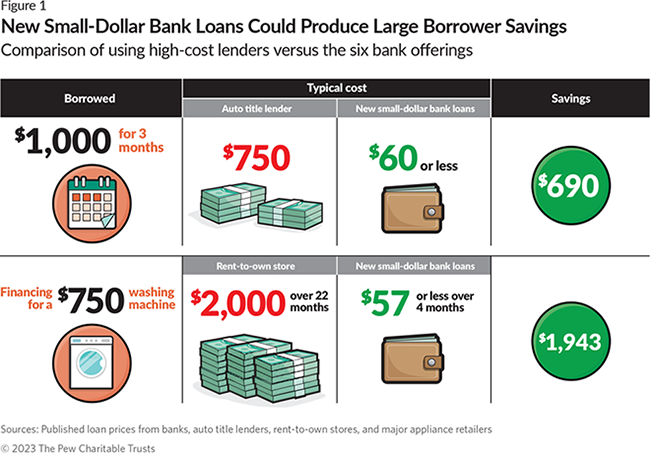

Pew has previously observed these new financial institution-issued financial loans are priced at least 15 times decreased than payday loans, featuring hundreds of dollars in cost savings to a common borrower. But the financial savings could be even larger for those people who use other alternate economical products and services, these as vehicle title financial loans or hire-to-personal agreements. Nineteen states have vehicle title lending, letting state-accredited businesses to make loans secured by a borrower’s vehicle, usually at annual curiosity prices of 200-300{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b}. Pew has discovered that, like those who use payday financial loans, most vehicle title financial loan debtors pay out extra in charges than they originally been given in credit score. Lease-to-have suppliers function in every condition and primarily serve prospects with weak or no credit score scores. Obtaining and funding a computer system, appliance, home furniture, or other product from 1 tends to value about a few to 4 situations as a great deal as purchasing it from a mainstream retailer, so a $500 appliance would ordinarily cost $1,500-$2,000 when factoring in the funding. But the new availability of lender compact-greenback loans provides many consumers a much much less high priced alternative to borrow from their financial institution and use the proceeds to buy these objects from standard retailers.

New Federal Deposit Insurance Corp. (FDIC) knowledge demonstrate that 95{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of American homes hold accounts with financial institutions or credit history unions. That includes all payday loan borrowers, and most prospects who use auto title loans and hire-to-possess. If buyers working with all those or hire-to-personal agreements for widespread buys like appliances or computers switch to borrowing from banks, the personal savings for anyone earning $30,000 annually could exceed 1-2 months of earnings.

The new, available loans could also give relief to consumers who have not earlier turned to high-value credit history. Activities like eviction, auto repossession, and utility disconnection hurt thousands and thousands of Us residents each year, and attaining accessibility to affordable credit score from their financial institution could assistance them avoid that turmoil. The financial loans could also aid all those who regularly overdraft their financial institution accounts and rack up steep fees as a final result, permitting them to save hundreds of pounds every year.

The new financial loans were designed probable in section by the regulatory certainty stemming from careful, ahead-wondering joint assistance in May possibly 2020 from the Office of the Comptroller of the Forex, FDIC, Federal Reserve Board of Governors, and Countrywide Credit score Union Administration. The direction welcomed automation and lower-value, adaptable personal loan underwriting conditions whilst prioritizing affordability and client effectively-staying. Now, the households who want the most help are starting up to get it.

Alex Horowitz is a principal officer and Gabe Kravitz is an officer with The Pew Charitable Trusts’ Client Finance Venture.