KanawatTH/iStock via Getty Photos

By Reema Agarwal, CFA, Director, Floating Fee Debt, Franklin Templeton Mounted Cash flow

The technological and essential picture looks favorable for financial institution financial loans for a quantity of causes, in accordance to Reema Agarwal, Franklin Templeton Mounted Income’s Director of Floating Level Debt. She states existing spreads appear interesting amid what is very likely to be a time period of monetary coverage tightening in excess of the study course of the calendar year, and periods of volatility should really be thought of getting possibilities.

Take note: the movie beneath was recorded in December 2021. References to “next year” so refer to 2022.

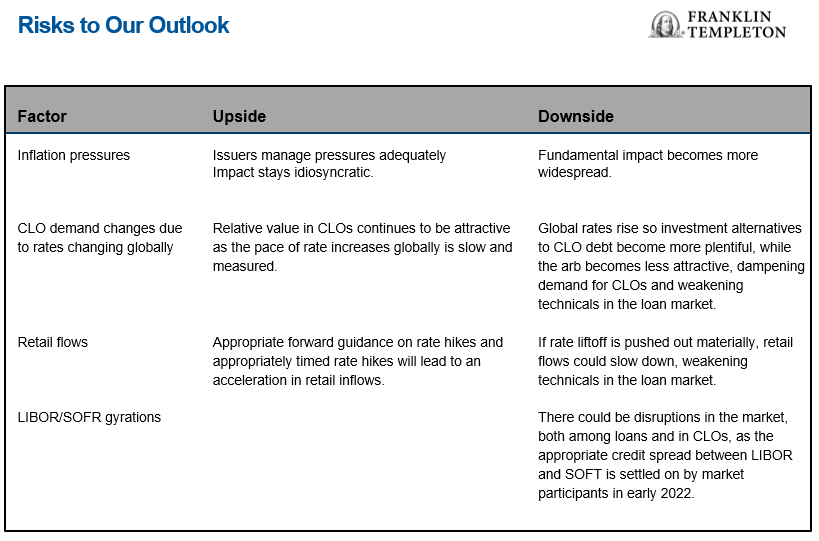

Apart from for a transient pause all-around the COVID-19 Omicron variant discovery, bank loan spreads have ongoing their continual march tighter, more so considering the fact that mid-September, when anticipations all over US Federal Reserve tapering and price hikes begun to raise, which has delivered tailwinds to the floating-level bank mortgage sector. Technological conditions keep on being healthy—record collateralized bank loan obligation (CLO) issuance and retail demand from customers have supported personal loan selling prices. While there could be a lull in bank loan market action in the early section of 2022 as industry participants absorb the implications of the transition from London Interbank Provided Fee (LIBOR) to Secured Overnight Funding Fee (SOFR), we believe CLOs will keep on to be an interesting option for investors, which supports personal loan valuations and gives a floor on mortgage prices. In standard, retail flows have been constantly optimistic in 2021, pushed by an expectation that curiosity rates will increase.1 We believe that present-day bank loan spreads are desirable, and complex conditions remain in favor of a tightening trajectory. We also consider expectations all over the timing of an curiosity fee liftoff will be a key determinant of credit rating marketplace sentiment.

As predicted, the route to comprehensive restoration has been uneven across industries and issuers as economies entirely reopen, based on traits in office vs. distant get the job done, security limits on indoor and outdoor ability in different sectors and supreme demand from customers for things to do and services that have been reopening. Business provide corporations have been sluggish to get well as have sure aerospace issuers and leisure issuers these types of as fitness centers and motion picture theaters. Source chain disruptions and labor and enter price inflation have been headwinds in sure scenarios as properly. Need for chemical compounds, packaging, and developing components has been robust, but margins have been negatively impacted by larger resin and other enter expenses and/or greater container premiums. Many issuers have been capable to thrust by way of value raises to offset a part or all of the better charges, albeit with a lag. Customer, retail, and food items issuers have also faced better input charges and labor inflation, with various qualities to pass on price tag will increase.

On the other hand, some issuers are benefiting. Commodity issuers are evidently benefiting from inflation, and financial loan rates have been lifted most in these sectors in 2021, although we would take note that these industries signify just 5{797b2db22838fb4c5c6528cb4bf0d5060811ff68c73c9b00453f5f3f4ad9306b} of the mortgage current market. We are aware of cyclical upswings that may possibly be winding down for certain sectors that experienced thrived during the pandemic. At the very same time, we are on the lookout for financial loan issuers with small business types that will possible reward the most from lasting modifications in consumption styles/behaviors and operate practices in a article-COVID-19 world.

If we observe volatility on account of supply chain issues and price inflation, transforming expectations on the timing of amount hikes, or opportunity macroeconomic troubles posed by the Omicron variant, on a selective foundation we would think about these kinds of periods as acquiring possibilities, as we believe that company fundamentals are still nutritious.

In basic, we favor B-rated financial loans, specially people with LIBOR floors. As the chance of growing price ranges and fascination costs is bigger than it has been in the very last numerous many years, we sustain our look at that industries with challenged fundamentals could be a lot more adversely affected than other individuals, primarily all those with ongoing supply chain woes. Amid idiosyncratic issuer risk, prudent security selection continues to be paramount, in our look at.

In spite of the possible headwinds that persistent inflationary pressures could deliver, we continue on to believe that that provide chain disruptions and inflation have the prospective to hold off, but not derail, whole recovery. We also do not hope a large chance of large-scale fundamental weak point in the financial loan marketplace more than the subsequent year, in particular to this kind of a diploma that it eclipses the significant technological tailwinds for floating rate property. We keep our constructive outlook for the lender personal loan sector—over the upcoming 12 months, technical ailments should really continue being strong and fundamentals broadly constructive with subdued default rates, towards the backdrop of a soaring interest-price setting.

What Are the Risks?

All investments involve dangers, which include feasible decline of principal. Bond rates usually shift in the opposite route of desire prices. As a result, as costs of bonds in an investment portfolio change to a increase in desire rates, the benefit of the portfolio may drop. Investments in reduced-rated bonds include things like higher threat of default and reduction of principal. Specific hazards are involved with overseas investing, like forex fluctuations, economic instability and political developments. Investments in emerging marketplaces require heightened risks similar to the same elements, in addition to individuals associated with these markets’ scaled-down dimensions and lesser liquidity. Floating-charge loans and personal debt securities tend to be rated below expense quality. Investing in bigger-yielding, decreased-rated, floating-amount loans and personal debt securities entails greater risk of default, which could result in decline of principal—a danger that could be heightened in a slowing financial system. Interest gained on floating-charge loans varies with adjustments in prevailing desire fees. As a result, even though floating-level loans give increased fascination income when desire charges rise, they will also crank out fewer cash flow when desire premiums decline. Changes in the economic power of a bond issuer or in a bond’s credit history ranking may well affect its price.

1. Sources: Franklin Templeton Set Income Investigate, JP Morgan. As of Oct 2021. There is no assurance any estimate, forecast or projection will be understood.

Editor’s Observe: The summary bullets for this article were decided on by Trying to find Alpha editors.